Affidavit of Non Ohio ResidencyDomicile for Taxable Year Tax Ohio Form

What is the affidavit of non Ohio residency domicile for taxable year 2020?

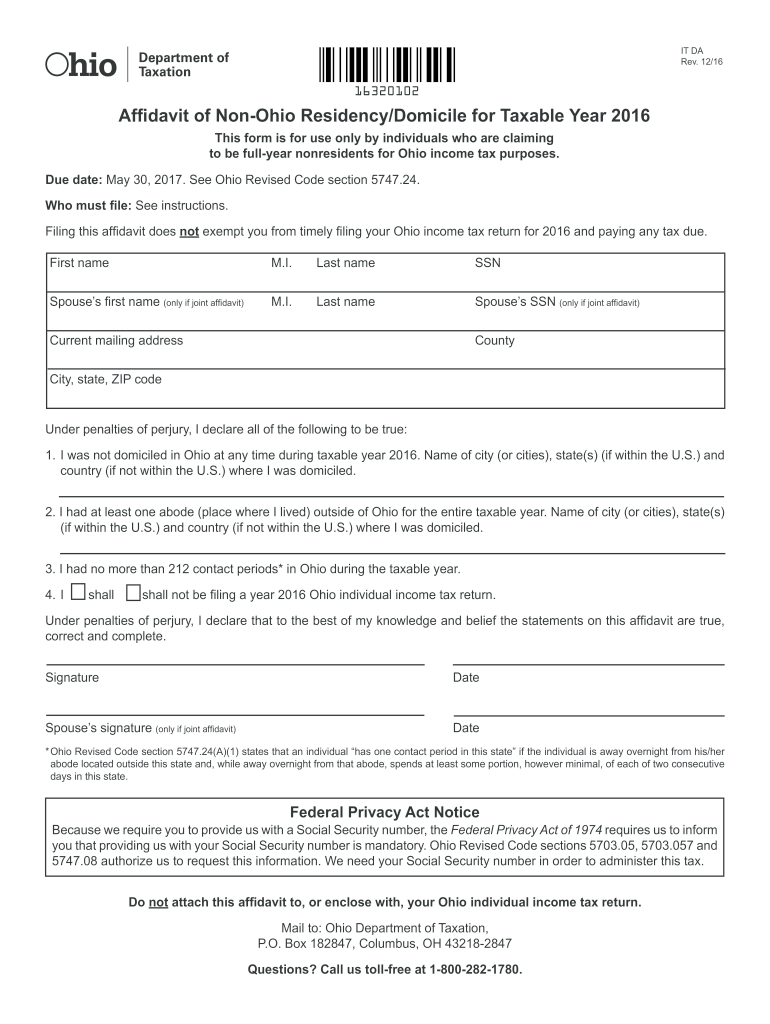

The affidavit of non Ohio residency domicile for taxable year 2020 is a legal document used by individuals who wish to declare their non-residency status in Ohio for tax purposes. This form is essential for those who have lived outside of Ohio and want to ensure they are not subject to Ohio state income taxes. By completing this affidavit, individuals affirm that they did not maintain a permanent residence in Ohio during the specified tax year, which can help in avoiding unnecessary tax liabilities.

Key elements of the affidavit of non Ohio residency domicile for taxable year 2020

This affidavit typically includes several critical components:

- Personal Information: The full name, address, and contact details of the individual submitting the affidavit.

- Residency Declaration: A statement affirming that the individual did not reside in Ohio for the taxable year in question.

- Signature: The individual must sign the affidavit, confirming the accuracy of the information provided.

- Date: The date on which the affidavit is completed and signed.

Steps to complete the affidavit of non Ohio residency domicile for taxable year 2020

Completing the affidavit involves a few straightforward steps:

- Gather necessary personal information, including your current address and any relevant documentation that supports your claim of non-residency.

- Download or access the affidavit form, ensuring you have the correct version for the taxable year 2020.

- Fill out the form accurately, providing all requested information and ensuring clarity.

- Review the completed affidavit for any errors or omissions.

- Sign and date the affidavit to validate your declaration.

Legal use of the affidavit of non Ohio residency domicile for taxable year 2020

This affidavit serves as a legal declaration and can be used to support your tax filings. It is essential for individuals who may be questioned about their residency status by tax authorities. Properly completed, it can help in avoiding penalties and ensuring compliance with Ohio tax laws. It is advisable to keep a copy of the affidavit for personal records and any future reference.

How to obtain the affidavit of non Ohio residency domicile for taxable year 2020

The affidavit can typically be obtained through the Ohio Department of Taxation's website or by contacting their office directly. Many tax professionals also provide access to this form as part of their services. Ensure that you are using the correct version for the year you are filing, as forms may change from year to year.

Filing deadlines / important dates

It is crucial to be aware of the filing deadlines associated with the affidavit of non Ohio residency domicile for taxable year 2020. Generally, this affidavit should be submitted along with your tax return by the standard tax filing deadline, which is typically April 15 of the following year. However, if you are filing for an extension, be sure to check the specific dates that apply to your situation.

Quick guide on how to complete affidavit of non ohio residencydomicile for taxable year 2016 tax ohio

Complete Affidavit Of Non Ohio ResidencyDomicile For Taxable Year Tax Ohio effortlessly on any device

Digital document management has become popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Affidavit Of Non Ohio ResidencyDomicile For Taxable Year Tax Ohio on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign Affidavit Of Non Ohio ResidencyDomicile For Taxable Year Tax Ohio with ease

- Locate Affidavit Of Non Ohio ResidencyDomicile For Taxable Year Tax Ohio and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you would like to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Affidavit Of Non Ohio ResidencyDomicile For Taxable Year Tax Ohio to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the affidavit of non ohio residencydomicile for taxable year 2016 tax ohio

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is an affidavit of non ohio residency domicile for taxable year 2020?

An affidavit of non ohio residency domicile for taxable year 2020 is a legal document that helps establish your residency status for tax purposes. It is essential for individuals who did not reside in Ohio during the specified tax year but need to ensure compliance with tax laws. This document can clarify your tax obligations and potentially reduce your taxable income.

-

How can airSlate SignNow assist with my affidavit of non ohio residency domicile for taxable year 2020?

airSlate SignNow offers a seamless platform to create, send, and eSign your affidavit of non ohio residency domicile for taxable year 2020. Our solution simplifies the document management process, allowing you to expedite the signing process while ensuring that all legal stipulations are met efficiently. It's an ideal choice for maintaining legal compliance and avoiding any tax complications.

-

What is the cost to use airSlate SignNow for preparing my affidavit of non ohio residency domicile for taxable year 2020?

The pricing for airSlate SignNow varies based on your specific needs and usage. We offer flexible subscription plans that are cost-effective for individuals and businesses alike. You can access a range of features for a fixed monthly fee, making it an economical choice for preparing your affidavit of non ohio residency domicile for taxable year 2020.

-

Does airSlate SignNow provide any templates for affidavits?

Yes, airSlate SignNow offers a variety of templates, including those for affidavits of non ohio residency domicile for taxable year 2020. These templates can be customized to fit your specific requirements, helping you save time and ensure that you include all necessary information. This way, you can focus on completing your document accurately and efficiently.

-

Can I integrate airSlate SignNow with other applications for my affidavit needs?

Absolutely! airSlate SignNow integrates with several popular applications and third-party software, enhancing your workflow for your affidavit of non ohio residency domicile for taxable year 2020. Integrations with tools like Google Drive, Salesforce, and more simplify document sharing and collaboration, making it easier to manage your paperwork efficiently.

-

What are the benefits of using airSlate SignNow for my affidavit process?

Using airSlate SignNow for your affidavit of non ohio residency domicile for taxable year 2020 provides numerous benefits, including ease of use, quick turnaround times, and enhanced security for your documents. With our platform, you can easily track the status of your documents and ensure that signatures are completed promptly. These features help streamline your entire affidavit process.

-

Is it safe to eSign my affidavit with airSlate SignNow?

Yes, safety and security are top priorities for airSlate SignNow. Our platform uses advanced encryption and security protocols to protect your personal information and documents while eSigning your affidavit of non ohio residency domicile for taxable year 2020. You can be confident that your sensitive information is secure throughout the entire process.

Get more for Affidavit Of Non Ohio ResidencyDomicile For Taxable Year Tax Ohio

- Car parking allotment letter format word

- Capability statement template for government contractors form

- West coast life insurance beneficiary change form

- Radio talk show script sample pdf form

- Fsco 1204e2 form

- Alpha housing application form

- Form 4506 t ez sp rev 6 short form request for individual tax return transcript spanish version

- Irs gov tax forms 702455461

Find out other Affidavit Of Non Ohio ResidencyDomicile For Taxable Year Tax Ohio

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF