Per Capita & Occupational Assessment Taxes FAQBerkheimer 2019

What is the Per Capita & Occupational Assessment Taxes FAQBerkheimer

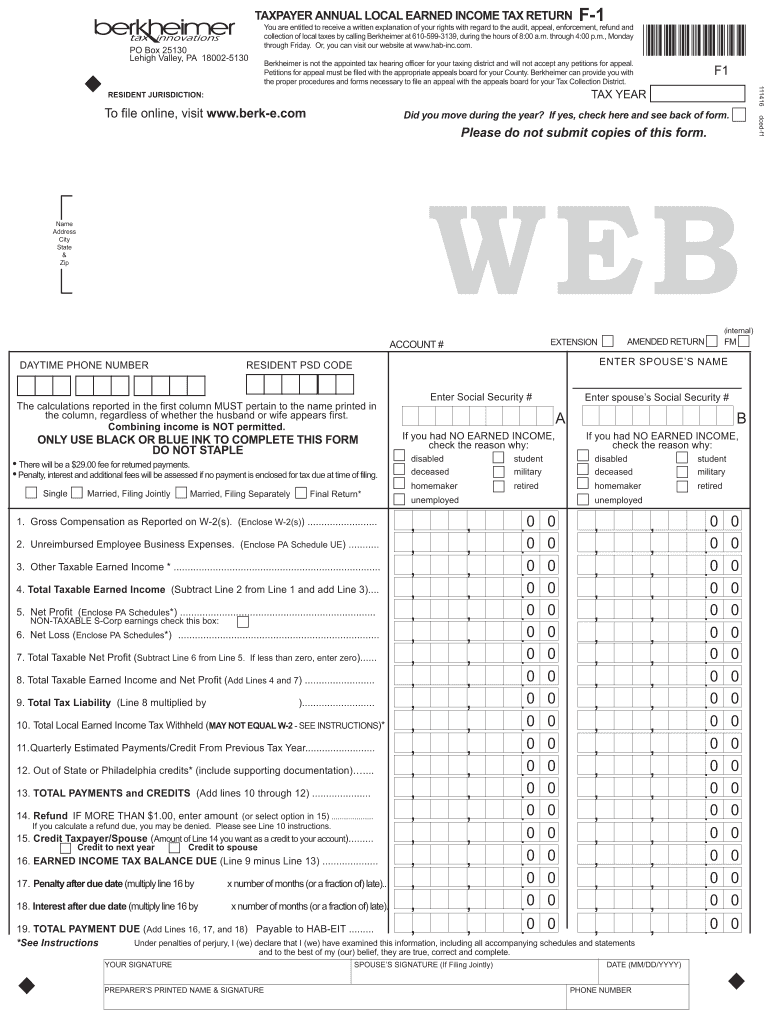

The Per Capita & Occupational Assessment Taxes FAQBerkheimer form is a document used primarily in the United States to assess local taxes on individuals based on their income and employment status. This form is essential for local governments to collect taxes that support community services and infrastructure. It typically includes information about the taxpayer's residency, employment, and income levels. Understanding this form is crucial for compliance with local tax regulations.

Steps to Complete the Per Capita & Occupational Assessment Taxes FAQBerkheimer

Completing the Per Capita & Occupational Assessment Taxes FAQBerkheimer form involves several key steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Collect employment details, such as your employer's name and address.

- Fill in income information, which may include wages, bonuses, and other sources of income.

- Review the form for accuracy and completeness to avoid delays in processing.

- Submit the form according to your local jurisdiction’s guidelines, whether online, by mail, or in person.

Legal Use of the Per Capita & Occupational Assessment Taxes FAQBerkheimer

The Per Capita & Occupational Assessment Taxes FAQBerkheimer form must be filled out and submitted in accordance with local tax laws. This ensures that the information provided is legally binding and can be used for tax assessment purposes. Using a reliable eSignature platform can enhance the legal validity of the form by providing a digital certificate and ensuring compliance with eSignature laws such as ESIGN and UETA.

Who Issues the Form

The Per Capita & Occupational Assessment Taxes FAQBerkheimer form is typically issued by local government authorities or tax assessment offices. These entities are responsible for collecting the necessary information to assess and levy taxes on residents and workers within their jurisdiction. It is important to check with your local tax office for the specific issuing authority and any updates to the form.

Filing Deadlines / Important Dates

Filing deadlines for the Per Capita & Occupational Assessment Taxes FAQBerkheimer form can vary by jurisdiction. Generally, it is advisable to submit the form by the end of the first quarter of the tax year to avoid penalties. Local tax offices often provide specific dates, so it is essential to stay informed about any changes or updates to filing deadlines.

Required Documents

To complete the Per Capita & Occupational Assessment Taxes FAQBerkheimer form, you may need to provide various documents, including:

- Proof of residency, such as a utility bill or lease agreement.

- Employment verification, which may include pay stubs or a letter from your employer.

- Any previous tax returns that may be relevant to your current assessment.

Quick guide on how to complete per capita ampamp occupational assessment taxes faqberkheimer

Effortlessly Prepare Per Capita & Occupational Assessment Taxes FAQBerkheimer on Any Gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, allowing you to acquire the correct format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without holdups. Handle Per Capita & Occupational Assessment Taxes FAQBerkheimer on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Per Capita & Occupational Assessment Taxes FAQBerkheimer with minimal effort

- Find Per Capita & Occupational Assessment Taxes FAQBerkheimer and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and then click the Done button to store your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Alter and eSign Per Capita & Occupational Assessment Taxes FAQBerkheimer and guarantee excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct per capita ampamp occupational assessment taxes faqberkheimer

Create this form in 5 minutes!

How to create an eSignature for the per capita ampamp occupational assessment taxes faqberkheimer

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What are Per Capita & Occupational Assessment Taxes FAQBerkheimer?

Per Capita & Occupational Assessment Taxes FAQBerkheimer refers to a set of inquiries related to specific tax assessments, helping users understand their obligations. This FAQ covers details about how these taxes are assessed, the associated rates, and relevant regulations. It serves as a vital resource for taxpayers wanting clarity on their financial responsibilities.

-

How can airSlate SignNow help with Per Capita & Occupational Assessment Taxes FAQBerkheimer?

airSlate SignNow can streamline the process of managing documents related to Per Capita & Occupational Assessment Taxes FAQBerkheimer. Our platform allows businesses to send, eSign, and store essential tax documents securely. This efficiency reduces the time spent on tax-related paperwork, allowing you to focus on compliance.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and automated workflows to assist with tax documents. These tools are particularly useful for managing Per Capita & Occupational Assessment Taxes FAQBerkheimer, simplifying document handling. This allows users to maintain accurate records effortlessly.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, while airSlate SignNow offers affordable pricing options, it's essential to select the plan that best fits your needs for handling Per Capita & Occupational Assessment Taxes FAQBerkheimer. We provide different tiers depending on the number of users and features required. Investing in our solution can lead to signNow time and cost savings.

-

How does airSlate SignNow ensure the security of sensitive tax information?

Security is a top priority at airSlate SignNow, especially for sensitive tax information related to Per Capita & Occupational Assessment Taxes FAQBerkheimer. We utilize advanced encryption, multi-factor authentication, and strict access controls to protect your documents against unauthorized access. Compliance with industry standards further assures users of their data's safety.

-

Can airSlate SignNow integrate with other financial software for tax management?

Absolutely, airSlate SignNow offers integrations with various financial and accounting software, which can enhance your workflow involving Per Capita & Occupational Assessment Taxes FAQBerkheimer. These integrations allow for easy syncing of data and documents, ensuring your tax management processes are streamlined and efficient. This connected approach facilitates better financial oversight.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, including Per Capita & Occupational Assessment Taxes FAQBerkheimer, offers numerous benefits such as reduced paper usage, increased speed of document processing, and improved accuracy. The ability to eSign documents remotely enhances convenience, making tax management less burdensome. These advantages contribute to a smoother overall experience.

Get more for Per Capita & Occupational Assessment Taxes FAQBerkheimer

Find out other Per Capita & Occupational Assessment Taxes FAQBerkheimer

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online