W 9 Idaho Form

What is the W-9 Idaho?

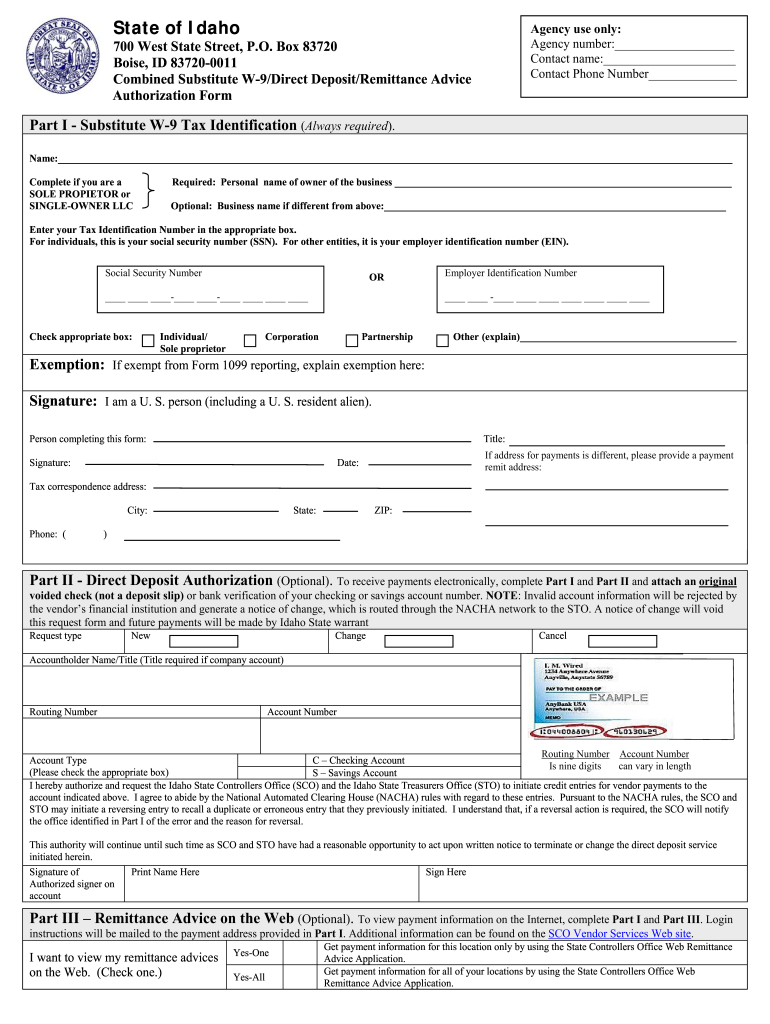

The W-9 Idaho form is a tax document used by individuals and businesses in the state of Idaho to provide their taxpayer identification information to entities that need to report payments made to them. This form is essential for ensuring that the correct tax information is reported to the Internal Revenue Service (IRS). The information collected on the W-9 includes the name, business name (if applicable), address, and taxpayer identification number (TIN), which can be a Social Security number (SSN) or an Employer Identification Number (EIN).

Steps to Complete the W-9 Idaho

Completing the W-9 Idaho form involves several straightforward steps:

- Download the W-9 form from a reliable source.

- Fill in your name and business name, if applicable.

- Provide your address, ensuring it matches IRS records.

- Enter your taxpayer identification number (SSN or EIN).

- Sign and date the form to certify that the information is accurate.

Once completed, the form should be submitted to the requesting entity, not the IRS.

Legal Use of the W-9 Idaho

The W-9 Idaho form serves a critical legal function in tax reporting. It is used by businesses to collect necessary information from independent contractors, freelancers, and other service providers. This information is vital for the issuance of Forms 1099, which report income paid to non-employees. Proper completion and submission of the W-9 ensure compliance with IRS regulations, minimizing the risk of penalties for both the individual providing the information and the entity requesting it.

IRS Guidelines

The IRS has established specific guidelines for the use of the W-9 form. These include:

- Providing accurate taxpayer identification information.

- Ensuring the form is signed and dated to confirm the information is correct.

- Submitting the W-9 to the entity requesting it, not to the IRS directly.

Following these guidelines helps maintain compliance and ensures that the information reported to the IRS is accurate.

Who Issues the Form

The W-9 Idaho form is typically issued by the entity that requires the taxpayer identification information. This can include businesses, financial institutions, or government agencies that need to report payments made to individuals or other businesses. It is important for the requester to provide the W-9 form to the payee, ensuring that the payee can accurately complete and return it.

Penalties for Non-Compliance

Failure to complete or submit the W-9 Idaho form can result in significant penalties. If a business does not obtain a W-9 from a contractor, it may be subject to backup withholding, where the IRS requires the business to withhold a portion of payments made to the contractor. Additionally, inaccuracies or failure to provide the form can lead to fines and complications during tax filing. Therefore, it is crucial for both parties to ensure that the W-9 is completed accurately and submitted timely.

Quick guide on how to complete w 9 idaho 6020682

Complete W 9 Idaho effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle W 9 Idaho on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign W 9 Idaho without breaking a sweat

- Locate W 9 Idaho and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form: via email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign W 9 Idaho and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 9 idaho 6020682

Create this form in 5 minutes!

How to create an eSignature for the w 9 idaho 6020682

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is a W9 deposit form and why is it important?

The W9 deposit form is a crucial document that provides a business with your taxpayer identification information for tax purposes. Completing this form ensures that any payments made to you are reported accurately to the IRS. By using an electronic W9 deposit form, you can streamline the process and enhance compliance.

-

How can airSlate SignNow help with the W9 deposit form?

airSlate SignNow simplifies the process of filling out and signing the W9 deposit form electronically. This service allows you to send, eSign, and manage the document efficiently. With its user-friendly interface, users can easily fill out all required fields, ensuring accuracy and prompt completion.

-

What features does airSlate SignNow offer for managing W9 deposit forms?

airSlate SignNow offers features like secure eSigning, document templates, and real-time tracking for W9 deposit forms. Additionally, you can integrate with multiple applications to streamline your workflow. These features enhance efficiency and keep your documents organized.

-

Is there a cost associated with using airSlate SignNow for W9 deposit forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including the management of W9 deposit forms. Our pricing is designed to be cost-effective, ensuring you get value from the features provided. You can choose a plan that best suits your document signing needs.

-

Can I collaborate with my team on a W9 deposit form using airSlate SignNow?

Absolutely! airSlate SignNow allows for easy collaboration with your team on various documents, including the W9 deposit form. You can share documents, collect signatures, and track changes in real-time, which boosts teamwork and enhances productivity.

-

Does airSlate SignNow integrate with other tools for processing W9 deposit forms?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, making it easier to manage your W9 deposit forms. Whether you use CRM systems or accounting software, the integration capabilities allow for a smoother workflow and better data management.

-

Is it safe to use airSlate SignNow for my W9 deposit form?

Yes, airSlate SignNow employs advanced security measures to protect your data while handling W9 deposit forms. We utilize encryption, two-factor authentication, and secure storage to ensure that your information remains confidential and safe from unauthorized access.

Get more for W 9 Idaho

- Ohio waiver application pdf form

- Cara cek saldo asuransi astra life form

- Skin assessment form

- Artistry products catalogue form

- San bernardino family court forms

- Tipps application form in tamil pdf download

- Ignou control number 13 digit form

- Sample child support enforcement order qdro garnishment of monthly pension payments form

Find out other W 9 Idaho

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form