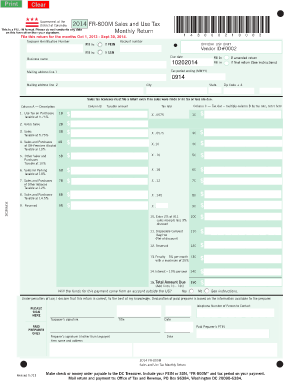

Dc Form Sales Tax 2017

What is the Dc Form Sales Tax

The Dc Form Sales Tax is a document used by businesses in Washington, D.C., to report and pay sales tax on goods and services sold within the district. This form is essential for ensuring compliance with local tax laws and regulations. It captures details such as the total sales amount, taxable sales, and the corresponding tax due. Understanding this form is crucial for business owners to maintain accurate financial records and avoid penalties.

How to use the Dc Form Sales Tax

Using the Dc Form Sales Tax involves several steps to ensure accurate reporting and compliance. First, gather all necessary sales data for the reporting period. This includes total sales, exempt sales, and any adjustments. Next, fill out the form by entering the required information in the designated fields. After completing the form, review it for accuracy before submission. Finally, submit the form to the appropriate tax authority, either online or via mail, depending on your preference.

Steps to complete the Dc Form Sales Tax

Completing the Dc Form Sales Tax requires careful attention to detail. Follow these steps for a smooth process:

- Collect sales records for the reporting period, including invoices and receipts.

- Determine the total sales and the amount subject to sales tax.

- Fill in the form with the total sales amount, taxable sales, and any exemptions.

- Calculate the total tax due based on the current sales tax rate.

- Review the completed form for any errors or omissions.

- Submit the form by the deadline to avoid penalties.

Legal use of the Dc Form Sales Tax

The legal use of the Dc Form Sales Tax is governed by local tax laws. It must be filled out accurately and submitted on time to comply with the District of Columbia's tax regulations. Failure to use the form correctly can result in fines, penalties, or legal action. Businesses are encouraged to keep copies of submitted forms and related documents for their records, as they may be required for audits or inquiries from tax authorities.

Key elements of the Dc Form Sales Tax

Several key elements comprise the Dc Form Sales Tax, which are critical for accurate completion. These include:

- Total Sales Amount: The gross amount of sales made during the reporting period.

- Taxable Sales: The portion of sales that is subject to sales tax.

- Exempt Sales: Sales that qualify for exemption from sales tax.

- Tax Rate: The applicable sales tax rate for the reporting period.

- Total Tax Due: The calculated amount of sales tax owed based on taxable sales.

Form Submission Methods

The Dc Form Sales Tax can be submitted through various methods, ensuring flexibility for businesses. Options include:

- Online Submission: Many businesses opt to submit the form electronically through the District of Columbia's tax portal, which can streamline the process and provide immediate confirmation.

- Mail: Businesses can also choose to print the form and send it via postal mail to the designated tax office.

- In-Person: For those who prefer face-to-face interaction, submitting the form in person at the local tax office is another option.

Quick guide on how to complete dc form sales tax 2014

Effortlessly Prepare Dc Form Sales Tax on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Dc Form Sales Tax on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Dc Form Sales Tax with Ease

- Obtain Dc Form Sales Tax and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Select relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Dc Form Sales Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dc form sales tax 2014

Create this form in 5 minutes!

How to create an eSignature for the dc form sales tax 2014

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is the Dc Form Sales Tax and how is it used?

The Dc Form Sales Tax is a document utilized by businesses in Washington D.C. to report sales and use tax. It allows entities to accurately calculate the taxes owed based on their sales activities and is essential for compliance with local tax laws.

-

How can airSlate SignNow help with Dc Form Sales Tax submission?

airSlate SignNow simplifies the process of submitting your Dc Form Sales Tax by allowing you to eSign and send documents securely. With our user-friendly interface, you can ensure your forms are properly filled out and submitted on time, reducing the risk of errors.

-

What features does airSlate SignNow offer for managing Dc Form Sales Tax?

airSlate SignNow offers a range of features for managing your Dc Form Sales Tax, including templates, automated workflows, and real-time tracking. These tools streamline the entire process, making it easier to manage your tax documents efficiently.

-

Is there a cost associated with using airSlate SignNow for Dc Form Sales Tax?

Yes, there are costs associated with using airSlate SignNow for Dc Form Sales Tax, but our pricing plans are designed to be cost-effective for businesses of all sizes. We offer various tiers to fit your budget while providing essential features for document signing and management.

-

Can I integrate airSlate SignNow with other software for handling Dc Form Sales Tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, facilitating a smooth workflow for managing your Dc Form Sales Tax. This integration helps you synchronize your documents and data, ensuring accuracy and efficiency.

-

What are the benefits of using airSlate SignNow for Dc Form Sales Tax?

The benefits of using airSlate SignNow for your Dc Form Sales Tax include enhanced efficiency, reduced paperwork, and improved compliance. By digitizing your tax forms, you save time and resources while ensuring your submissions are accurate and on time.

-

Is it secure to use airSlate SignNow for sensitive Dc Form Sales Tax information?

Yes, airSlate SignNow prioritizes security and utilizes industry-standard encryption to protect your sensitive Dc Form Sales Tax information. Our platform is designed to ensure that your documents are safe and confidential throughout the signing and submission process.

Get more for Dc Form Sales Tax

Find out other Dc Form Sales Tax

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF