F 1120 Form 2020

What is the F 1120 Form

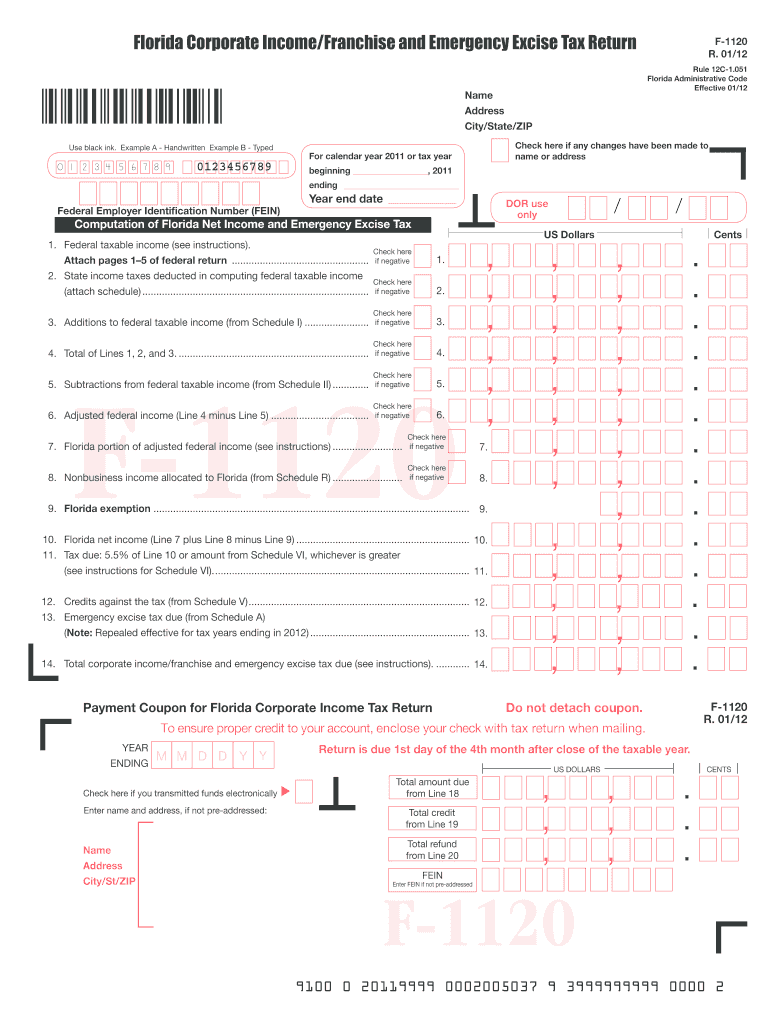

The F 1120 Form is a tax return form used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their federal tax liability. It is typically filed annually with the Internal Revenue Service (IRS) and is a crucial component of corporate tax compliance. Corporations must ensure that all relevant financial information is accurately reflected on this form to avoid penalties and ensure proper tax treatment.

How to use the F 1120 Form

Using the F 1120 Form involves several key steps. First, corporations must gather all necessary financial documents, including income statements, balance sheets, and records of expenses. Next, they should accurately fill out the form, ensuring that all income and deductions are reported correctly. After completing the form, it is advisable to review it for any errors before submission. Corporations can file the F 1120 Form electronically or by mail, depending on their preference and the IRS guidelines.

Steps to complete the F 1120 Form

Completing the F 1120 Form requires a methodical approach. Here are the essential steps:

- Gather financial documents, including income statements and receipts for deductions.

- Fill out the basic information section with the corporation's name, address, and Employer Identification Number (EIN).

- Report total income and any adjustments to income in the appropriate sections.

- Detail deductions, including business expenses, to determine taxable income.

- Calculate the tax liability based on the taxable income and applicable tax rates.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, adhering to IRS deadlines.

Legal use of the F 1120 Form

The legal use of the F 1120 Form is governed by IRS regulations. Corporations must ensure that the form is completed accurately and filed on time to remain compliant with federal tax laws. Failure to comply can result in significant penalties, including fines and interest on unpaid taxes. Additionally, the information provided on the F 1120 Form must be truthful and verifiable, as the IRS may audit corporations to confirm the accuracy of their filings.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the F 1120 Form to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations may also apply for an automatic six-month extension, but this does not extend the time to pay any taxes owed.

Required Documents

To complete the F 1120 Form accurately, corporations need several key documents. These include:

- Financial statements, including income statements and balance sheets.

- Records of all income received during the tax year.

- Documentation for all business expenses and deductions.

- Previous year’s tax return for reference.

- Any applicable schedules or additional forms required by the IRS.

Quick guide on how to complete 2012 f 1120 form

Complete F 1120 Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage F 1120 Form on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign F 1120 Form with ease

- Locate F 1120 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign F 1120 Form and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 f 1120 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 f 1120 form

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the F 1120 Form and why is it important?

The F 1120 Form is a federal tax form used by corporations to report their income, gains, losses, deductions, and also to calculate their tax liability. It is crucial for compliance with IRS regulations and ensuring that corporate taxes are filed correctly to avoid penalties.

-

How does airSlate SignNow facilitate the signing of the F 1120 Form?

airSlate SignNow provides an easy-to-use platform for electronically signing the F 1120 Form, ensuring that the process is quick and legally compliant. With its user-friendly interface, businesses can streamline their document workflows and reduce turnaround times for critical tax filings.

-

What features does airSlate SignNow offer for F 1120 Form management?

airSlate SignNow offers several features for F 1120 Form management, including document templates, secure e-signature capabilities, and automated reminders. These features simplify the preparation and signing process, ensuring that your forms are completed efficiently and accurately.

-

Can I integrate airSlate SignNow with other tax software for the F 1120 Form?

Yes, airSlate SignNow can be easily integrated with various tax software solutions, allowing for seamless data transfer and F 1120 Form preparation. This integration enhances productivity by automating workflows and reducing the likelihood of errors during form submissions.

-

What is the pricing structure for airSlate SignNow's e-signature services?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, enabling cost-effective access to e-signature services for the F 1120 Form. Various subscription tiers allow you to choose the features that best meet your needs without overspending.

-

How does airSlate SignNow ensure the security of the F 1120 Form?

Security is a top priority at airSlate SignNow; all documents, including the F 1120 Form, are encrypted and stored securely. Additionally, the platform complies with industry standards to protect sensitive information, ensuring peace of mind when managing important tax documents.

-

Is it possible to track the status of my F 1120 Form using airSlate SignNow?

Absolutely, airSlate SignNow allows you to track the status of your F 1120 Form in real time. You can receive notifications when the document has been opened or signed, providing transparency and assurance in your document workflow.

Get more for F 1120 Form

Find out other F 1120 Form

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word