R 1086 Louisiana Department of Revenue Revenue Louisiana 2017

What is the R-1086 Louisiana Department of Revenue Revenue Louisiana?

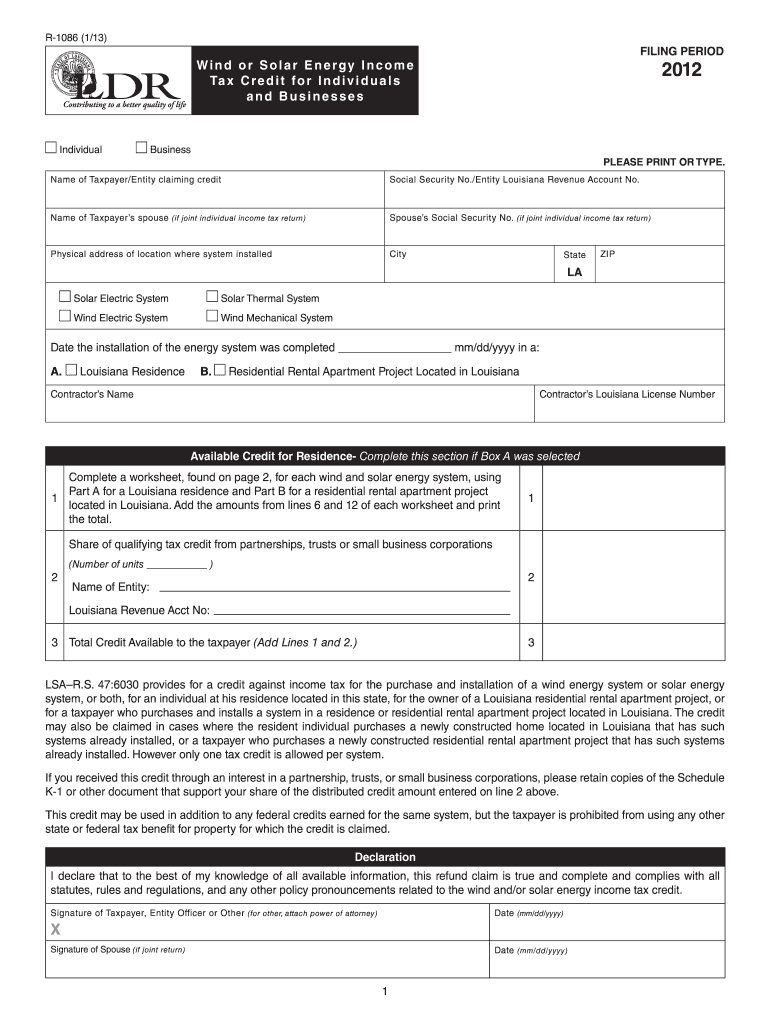

The R-1086 form is a crucial document issued by the Louisiana Department of Revenue. This form is primarily used for reporting specific tax information related to revenue in the state. It serves as a means for individuals and businesses to disclose their financial activities to the state government, ensuring compliance with local tax regulations. Understanding the purpose and requirements of the R-1086 form is essential for maintaining proper tax records and fulfilling legal obligations.

How to use the R-1086 Louisiana Department of Revenue Revenue Louisiana

Using the R-1086 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to your revenue activities. This may include income statements, receipts, and any other relevant financial records. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the instructions provided by the Louisiana Department of Revenue to avoid any errors that could lead to penalties. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference.

Steps to complete the R-1086 Louisiana Department of Revenue Revenue Louisiana

Completing the R-1086 form involves a systematic approach:

- Gather all necessary documents related to your revenue.

- Access the R-1086 form from the Louisiana Department of Revenue website.

- Fill out the form with accurate financial information.

- Review the completed form for any errors or omissions.

- Submit the form electronically or mail it to the appropriate department.

Following these steps will help ensure that your submission is processed smoothly and efficiently.

Legal use of the R-1086 Louisiana Department of Revenue Revenue Louisiana

The R-1086 form is legally binding once it is completed and submitted according to the guidelines established by the Louisiana Department of Revenue. This means that the information provided on the form must be truthful and accurate, as any discrepancies can lead to legal repercussions. It is essential to understand that submitting this form is not just a procedural requirement; it is a legal obligation that carries potential penalties for non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the R-1086 form are critical to ensure compliance with state tax regulations. Typically, the form must be submitted by a specific date each year, which may vary based on the type of revenue being reported. It is advisable to check the Louisiana Department of Revenue's official website for the most current deadlines and any changes that may occur. Missing these deadlines can result in penalties or interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The R-1086 form can be submitted through various methods to accommodate different preferences. Individuals can choose to file online through the Louisiana Department of Revenue's secure portal, which offers a streamlined process. Alternatively, the form can be printed and mailed to the appropriate address. In some cases, in-person submissions may also be accepted at designated offices. Each method has its own advantages, so selecting the one that best fits your needs is important.

Quick guide on how to complete r 1086 louisiana department of revenue revenue louisiana

Effortlessly prepare R 1086 Louisiana Department Of Revenue Revenue Louisiana on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed files, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly and without holdups. Handle R 1086 Louisiana Department Of Revenue Revenue Louisiana on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign R 1086 Louisiana Department Of Revenue Revenue Louisiana with ease

- Locate R 1086 Louisiana Department Of Revenue Revenue Louisiana and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional ink signature.

- Review all the details and click the Done button to finalize your modifications.

- Decide how you wish to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, cumbersome form navigation, or errors necessitating new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and eSign R 1086 Louisiana Department Of Revenue Revenue Louisiana and guarantee outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r 1086 louisiana department of revenue revenue louisiana

Create this form in 5 minutes!

How to create an eSignature for the r 1086 louisiana department of revenue revenue louisiana

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the R 1086 Louisiana Department Of Revenue form, and why is it important?

The R 1086 Louisiana Department Of Revenue form is a crucial document for businesses operating in Louisiana, as it helps report sales and use taxes accurately. Ensuring timely submission of the R 1086 can prevent potential penalties and maintain good standing with the Revenue Louisiana.

-

How can airSlate SignNow assist with processing the R 1086 Louisiana Department Of Revenue form?

airSlate SignNow streamlines the process of completing and eSigning the R 1086 Louisiana Department Of Revenue form, making it easy for businesses to gather necessary signatures and submit compliance documents swiftly. Our platform ensures that all parties can access and sign documents from anywhere, facilitating a seamless workflow.

-

What are the pricing options for using airSlate SignNow for eSigning documents like the R 1086 Louisiana Department Of Revenue?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for businesses that frequently need to handle forms like the R 1086 Louisiana Department Of Revenue. Each plan provides access to features that enhance document management at a cost-effective rate.

-

Are there any special features for managing the R 1086 Louisiana Department Of Revenue form within airSlate SignNow?

Yes, airSlate SignNow includes special features designed to manage the R 1086 Louisiana Department Of Revenue form efficiently, such as document templates, reminders for signing, and cloud storage. These features ensure that you never miss a deadline for submission to Revenue Louisiana.

-

Can airSlate SignNow integrate with other software to manage the R 1086 Louisiana Department Of Revenue form?

Absolutely! airSlate SignNow offers integrations with various popular business applications, allowing you to manage the R 1086 Louisiana Department Of Revenue form seamlessly alongside your existing tools. This ensures a more cohesive workflow and eliminates the need for multiple platforms.

-

What are the benefits of using airSlate SignNow for the R 1086 Louisiana Department Of Revenue form?

Using airSlate SignNow for the R 1086 Louisiana Department Of Revenue form provides signNow benefits, including improved efficiency, reduced paperwork, and enhanced compliance tracking. Additionally, our eSigning solution allows for faster processing, helping you stay current with Revenue Louisiana's requirements.

-

Is airSlate SignNow legally compliant for signing forms like the R 1086 Louisiana Department Of Revenue?

Yes, airSlate SignNow is legally compliant and meets all electronic signature regulations, ensuring your eSigned R 1086 Louisiana Department Of Revenue form is valid and enforceable. Our platform is designed to keep your documents secure while complying with all relevant legal standards.

Get more for R 1086 Louisiana Department Of Revenue Revenue Louisiana

Find out other R 1086 Louisiana Department Of Revenue Revenue Louisiana

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast