R 1086 118 2017-2026

What is the R-1086 Form?

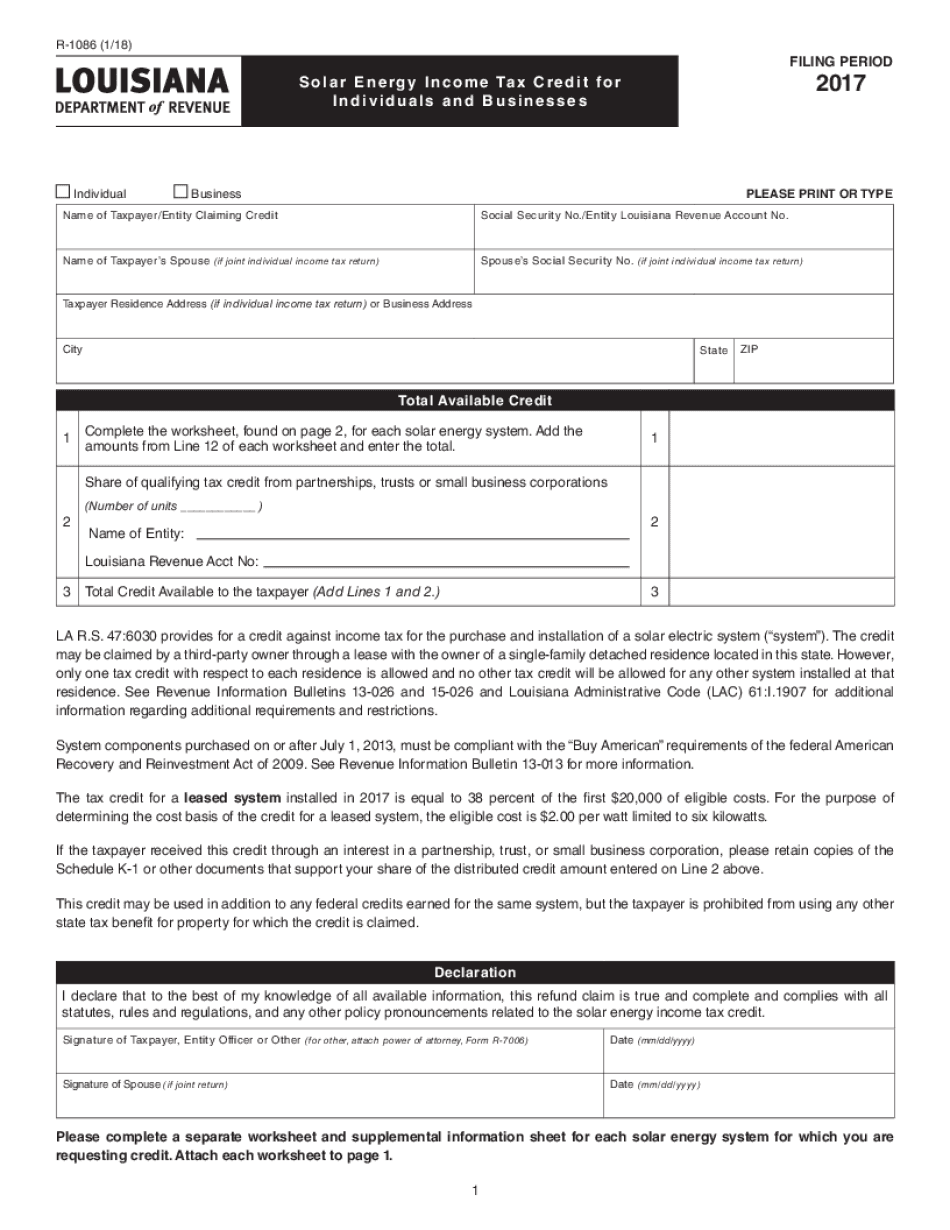

The R-1086 form, also known as the Louisiana Solar Energy Tax Credit application, is a crucial document for individuals and businesses seeking to claim tax credits for solar energy investments in Louisiana. This form allows taxpayers to report their solar energy system installations and apply for the corresponding tax credits. The R-1086 is essential for ensuring that taxpayers receive the financial benefits associated with their solar energy initiatives, promoting the use of renewable energy sources in the state.

Eligibility Criteria for the R-1086 Form

To qualify for the Louisiana solar tax credit, applicants must meet specific eligibility criteria. These include:

- The solar energy system must be installed on a residential or commercial property located in Louisiana.

- The system must be certified by the manufacturer and meet the state's performance standards.

- Applicants must provide proof of purchase and installation, including invoices and receipts.

- The installation must be completed within the specified time frame to qualify for the tax credit.

Steps to Complete the R-1086 Form

Completing the R-1086 form involves several important steps to ensure accuracy and compliance. Here is a simplified process:

- Gather all necessary documentation, including proof of installation and purchase receipts.

- Fill out the R-1086 form with accurate information, including personal details and specifics about the solar energy system.

- Double-check all entries for accuracy to avoid delays in processing.

- Submit the completed form along with required documentation to the Louisiana Department of Revenue.

Required Documents for the R-1086 Form

When submitting the R-1086 form, applicants must include several key documents to support their claim. These documents typically include:

- Proof of purchase and installation, such as invoices and contracts.

- Certification documents from the solar energy system manufacturer.

- Any additional documentation required by the Louisiana Department of Revenue.

Form Submission Methods for the R-1086

The R-1086 form can be submitted through various methods, providing flexibility for applicants. These methods include:

- Online submission through the Louisiana Department of Revenue's website.

- Mailing the completed form and supporting documents to the designated address.

- In-person submission at local Department of Revenue offices, if applicable.

IRS Guidelines and Compliance

While the R-1086 form is specific to Louisiana, it is important for applicants to be aware of IRS guidelines regarding solar energy tax credits. Compliance with federal tax regulations ensures that taxpayers can maximize their benefits while avoiding penalties. Applicants should familiarize themselves with IRS publications related to renewable energy tax credits to ensure they meet all necessary requirements.

Quick guide on how to complete r 1086 118

Complete R 1086 118 with ease on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without any holdups. Manage R 1086 118 on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-centered task today.

How to modify and eSign R 1086 118 effortlessly

- Obtain R 1086 118 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to save your adjustments.

- Decide how you wish to send your form, either by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Modify and eSign R 1086 118 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r 1086 118

Create this form in 5 minutes!

How to create an eSignature for the r 1086 118

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the Louisiana solar tax credit?

The Louisiana solar tax credit allows homeowners and businesses to receive a tax credit for a percentage of their solar energy system costs. This incentive makes going solar more affordable by signNowly reducing the overall installation expenses associated with solar projects.

-

How much is the Louisiana solar tax credit worth?

The Louisiana solar tax credit currently offers a rebate of 26% on the total cost of a solar energy system. This generous incentive is designed to encourage the adoption of renewable energy and can lead to substantial savings for residents and business owners in Louisiana.

-

Who is eligible for the Louisiana solar tax credit?

Homeowners and businesses that install solar energy systems are eligible for the Louisiana solar tax credit. If the solar system is affixed to a property and generates solar power, it qualifies for this tax credit, making it an attractive option for anyone looking to invest in solar energy.

-

How can I claim the Louisiana solar tax credit?

To claim the Louisiana solar tax credit, you must file the appropriate forms with your state tax return, typically including the federal IRS Form 5695 for residential systems. It's important to keep all receipts and documentation related to the installation to ensure a smooth claims process.

-

Do I need to hire a specific contractor to qualify for the Louisiana solar tax credit?

While you don't have to use a specific contractor to qualify for the Louisiana solar tax credit, it's essential to work with a licensed and experienced installer. Using a qualified installer ensures that your solar system is installed properly and meets all necessary codes and regulations.

-

Can the Louisiana solar tax credit be transferred if I sell my home?

Yes, if you sell your home, the new homeowners can often inherit your eligibility for the Louisiana solar tax credit, depending on the situation. Buyers appreciate homes with solar systems due to the potential for energy savings and the financial benefits associated with the tax credit.

-

What are the long-term benefits of the Louisiana solar tax credit?

The Louisiana solar tax credit promotes long-term financial benefits, including lower energy bills and increased property value. By taking advantage of this tax credit, you can maximize your return on investment while contributing to a more sustainable energy future.

Get more for R 1086 118

Find out other R 1086 118

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter