Form M 990T Mass Gov Mass 2020

What is the Form M 990T Mass Gov Mass

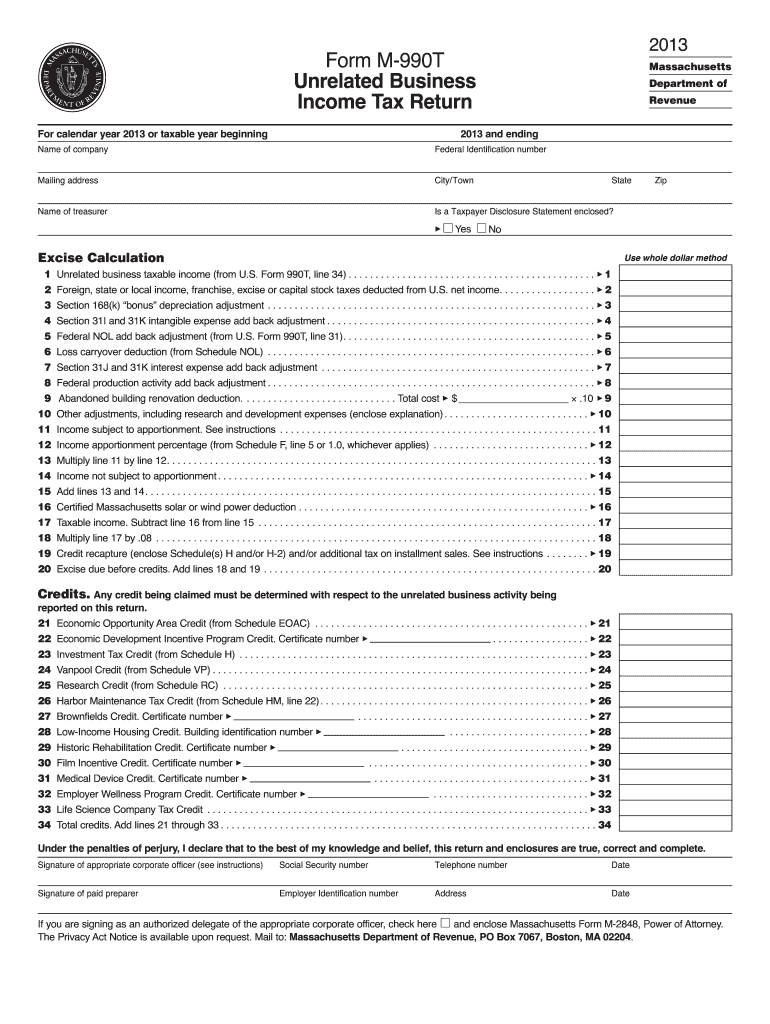

The Form M 990T is a tax form used by organizations in Massachusetts to report unrelated business income. This form is essential for tax-exempt entities that engage in activities unrelated to their primary purpose, as it ensures compliance with state tax regulations. By filing this form, organizations disclose their income from these activities and calculate the tax owed on that income. Understanding the purpose and requirements of Form M 990T is crucial for maintaining tax compliance and avoiding penalties.

Steps to complete the Form M 990T Mass Gov Mass

Completing the Form M 990T involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records related to unrelated business activities. Next, fill out the form by providing detailed information about the organization, the unrelated business income, and any allowable deductions. It is important to carefully review the instructions provided with the form to ensure all sections are completed correctly. After filling out the form, double-check for any errors before submitting it to the appropriate state agency.

How to obtain the Form M 990T Mass Gov Mass

The Form M 990T can be obtained directly from the Massachusetts Department of Revenue's website. It is available as a downloadable PDF, which can be printed and filled out manually. Alternatively, organizations may also find the form through various tax preparation software that includes Massachusetts tax forms. Ensuring you have the most current version of the form is important, as tax regulations can change annually.

Legal use of the Form M 990T Mass Gov Mass

The legal use of Form M 990T is governed by Massachusetts tax laws, which require tax-exempt organizations to report any unrelated business income. This form must be filed accurately and on time to avoid penalties. Organizations should ensure that they are familiar with the legal implications of their unrelated business activities and how they impact their tax-exempt status. Failure to file or inaccuracies in reporting can lead to significant legal and financial consequences.

Filing Deadlines / Important Dates

Filing deadlines for Form M 990T are typically aligned with the organization's fiscal year. Generally, the form is due on the 15th day of the fifth month after the end of the fiscal year. It is crucial for organizations to mark these dates on their calendars to ensure timely submission. Late filings may incur penalties, so staying informed about these deadlines is essential for compliance.

Penalties for Non-Compliance

Non-compliance with the filing requirements of Form M 990T can result in various penalties imposed by the Massachusetts Department of Revenue. These penalties may include fines for late submissions or inaccuracies in reporting. Additionally, failure to file can jeopardize an organization’s tax-exempt status, leading to further financial and legal repercussions. Understanding these penalties highlights the importance of accurate and timely filing.

Quick guide on how to complete form m 990t massgov mass

Prepare Form M 990T Mass Gov Mass effortlessly on any platform

Managing documents online has gained signNow traction among both businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Handle Form M 990T Mass Gov Mass on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form M 990T Mass Gov Mass with ease

- Find Form M 990T Mass Gov Mass and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of the document or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and then click on the Done button to finalize your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form M 990T Mass Gov Mass to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form m 990t massgov mass

Create this form in 5 minutes!

How to create an eSignature for the form m 990t massgov mass

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is Form M 990T Mass Gov Mass and who needs to file it?

Form M 990T Mass Gov Mass is a tax return filed by organizations for unrelated business income. Nonprofits and other tax-exempt organizations in Massachusetts that generate income from activities not related to their primary purpose are required to file this form. Understanding the requirements for Form M 990T Mass Gov Mass is crucial for maintaining compliance.

-

How can airSlate SignNow help with the submission of Form M 990T Mass Gov Mass?

airSlate SignNow provides an efficient platform for eSigning and sending documents related to Form M 990T Mass Gov Mass. With its user-friendly interface, you can easily upload, sign, and send your tax forms securely. This streamlines the filing process and ensures that you submit your documents accurately and on time.

-

Is airSlate SignNow cost-effective for filing tax documents like Form M 990T Mass Gov Mass?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to file tax documents like Form M 990T Mass Gov Mass. With flexible pricing plans, you can choose the one that best fits your budget and requirements. This affordability makes it accessible for organizations of all sizes.

-

What features does airSlate SignNow offer for handling Form M 990T Mass Gov Mass?

airSlate SignNow includes features such as customizable templates, secure eSignature options, and tracking capabilities for your Form M 990T Mass Gov Mass submission. These features enhance productivity and ensure that you can manage your tax documents efficiently. You can access everything you need in one intuitive platform.

-

Can I integrate airSlate SignNow with my existing accounting software for Form M 990T Mass Gov Mass?

Absolutely! airSlate SignNow can be integrated with various accounting software solutions, allowing seamless handling of Form M 990T Mass Gov Mass. Integration automates data transfer and document management, reducing the chances of errors and streamlining your filing process. Enjoy the convenience of a connected workflow.

-

What are the benefits of using airSlate SignNow for Form M 990T Mass Gov Mass?

Using airSlate SignNow for Form M 990T Mass Gov Mass brings numerous benefits, including time savings and enhanced accuracy. The platform simplifies the process of preparing, signing, and sending tax forms. This efficiency can signNowly reduce the stress associated with tax season and filing deadlines.

-

Is my data secure when using airSlate SignNow for Form M 990T Mass Gov Mass?

Yes, airSlate SignNow prioritizes data security and compliance, ensuring that your information related to Form M 990T Mass Gov Mass is protected. The platform utilizes advanced encryption and security measures to safeguard your documents. Rest assured that your sensitive tax information remains confidential and secure.

Get more for Form M 990T Mass Gov Mass

Find out other Form M 990T Mass Gov Mass

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple