Www Uslegalforms Comform Library537411 CautionGet CAUTION This Tax Return Must Be Filed Electronically 2021-2026

Understanding the Massachusetts 990T Tax Return

The Massachusetts 990T tax return is specifically designed for organizations that engage in unrelated business income activities. This form is essential for tax-exempt entities, including charities and nonprofits, to report income generated from activities not directly related to their primary purpose. Filing this form ensures compliance with state tax regulations and helps maintain the organization's tax-exempt status.

Steps to Complete the Massachusetts 990T Form

Completing the Massachusetts 990T form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports related to unrelated business activities.

- Fill out the form accurately, ensuring all income and expenses are reported in the appropriate sections.

- Calculate the tax owed based on the reported unrelated business income.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines for the Massachusetts 990T

It is crucial to be aware of the filing deadlines for the Massachusetts 990T. Typically, the form is due on the fifteenth day of the fifth month following the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due by May 15. Extensions may be available, but they must be requested prior to the original deadline.

Required Documents for Filing

When preparing to file the Massachusetts 990T, organizations should have the following documents ready:

- Financial statements detailing unrelated business income and expenses.

- Records of any deductions claimed.

- Documentation supporting the tax-exempt status of the organization.

Penalties for Non-Compliance

Failure to file the Massachusetts 990T by the deadline can result in significant penalties. Organizations may incur fines based on the amount of tax owed and the length of the delay. Additionally, non-compliance can jeopardize the organization’s tax-exempt status, leading to further financial implications.

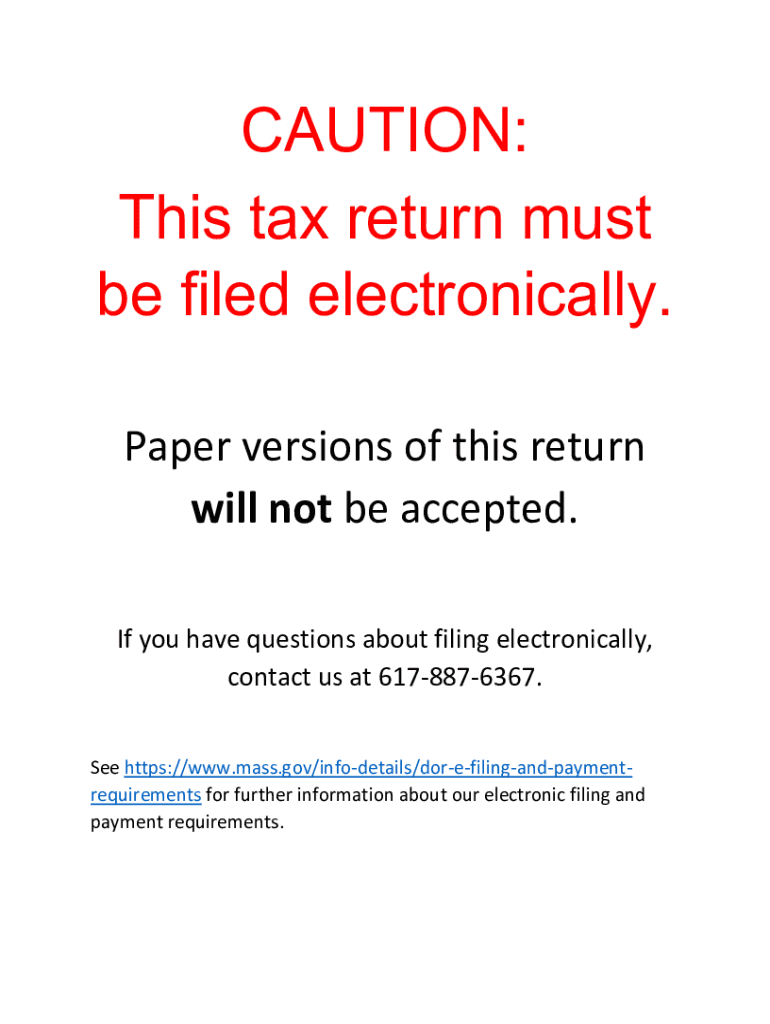

Digital vs. Paper Version of the Massachusetts 990T

Organizations have the option to file the Massachusetts 990T either digitally or via paper. Filing electronically is often faster and more efficient, allowing for quicker processing and confirmation of receipt. However, some organizations may prefer to submit a paper version for record-keeping purposes. Regardless of the method chosen, it is essential to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete wwwuslegalformscomform library537411 cautionget caution this tax return must be filed electronically

Effortlessly finalize Www uslegalforms comform library537411 cautionGet CAUTION This Tax Return Must Be Filed Electronically on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Www uslegalforms comform library537411 cautionGet CAUTION This Tax Return Must Be Filed Electronically across any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to alter and eSign Www uslegalforms comform library537411 cautionGet CAUTION This Tax Return Must Be Filed Electronically with ease

- Locate Www uslegalforms comform library537411 cautionGet CAUTION This Tax Return Must Be Filed Electronically and click on Get Form to begin.

- Make use of the tools at your disposal to fill out your form.

- Emphasize important sections of the documents or conceal confidential information with the features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and then click the Done button to store your changes.

- Select your preferred method for sending your form: via email, SMS, or a shared link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document versions. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Www uslegalforms comform library537411 cautionGet CAUTION This Tax Return Must Be Filed Electronically and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwuslegalformscomform library537411 cautionget caution this tax return must be filed electronically

Create this form in 5 minutes!

How to create an eSignature for the wwwuslegalformscomform library537411 cautionget caution this tax return must be filed electronically

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts 990T form?

The Massachusetts 990T form is an essential tax document for organizations doing business in Massachusetts that need to report unrelated business income. It helps organizations comply with state tax regulations while ensuring transparency in their operations. Understanding this form is crucial for proper tax filing and maintaining compliance.

-

How can airSlate SignNow help with managing Massachusetts 990T forms?

airSlate SignNow provides a streamlined platform that simplifies the process of preparing and eSigning your Massachusetts 990T forms. With its user-friendly interface, you can easily collect signatures and store documents securely in the cloud. This ensures you can manage your filing efficiently and stay organized.

-

What features does airSlate SignNow offer for eSigning Massachusetts 990T forms?

airSlate SignNow offers features like customizable templates, bulk sending, and real-time tracking for eSigning Massachusetts 990T forms. You can also integrate with popular business applications to streamline your workflow further. These features facilitate a seamless signing experience tailored to your specific needs.

-

Is airSlate SignNow cost-effective for filing Massachusetts 990T forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to file Massachusetts 990T forms. With affordable pricing plans and a pay-as-you-go model, you can access the tools you need without breaking the bank. This makes it an attractive option for organizations of all sizes.

-

How secure is airSlate SignNow when managing sensitive Massachusetts 990T information?

AirSlate SignNow prioritizes security by employing advanced encryption and stringent data protection measures for handling sensitive Massachusetts 990T information. The cloud-based platform ensures that your documents are stored securely and that access is granted only to authorized personnel. You can trust that your data remains confidential.

-

Are there any integrations available with airSlate SignNow for handling Massachusetts 990T forms?

Absolutely! airSlate SignNow integrates seamlessly with various popular applications like CRM and accounting software, making it easier to manage Massachusetts 990T forms within your existing workflow. These integrations enhance productivity and ensure that all relevant data is synced effortlessly.

-

Can airSlate SignNow help track the status of my Massachusetts 990T form submissions?

Yes, airSlate SignNow includes real-time tracking features that allow you to monitor the status of your Massachusetts 990T form submissions. You will receive notifications when documents are viewed, signed, or completed, ensuring that you stay informed throughout the process without any hassle.

Get more for Www uslegalforms comform library537411 cautionGet CAUTION This Tax Return Must Be Filed Electronically

Find out other Www uslegalforms comform library537411 cautionGet CAUTION This Tax Return Must Be Filed Electronically

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer