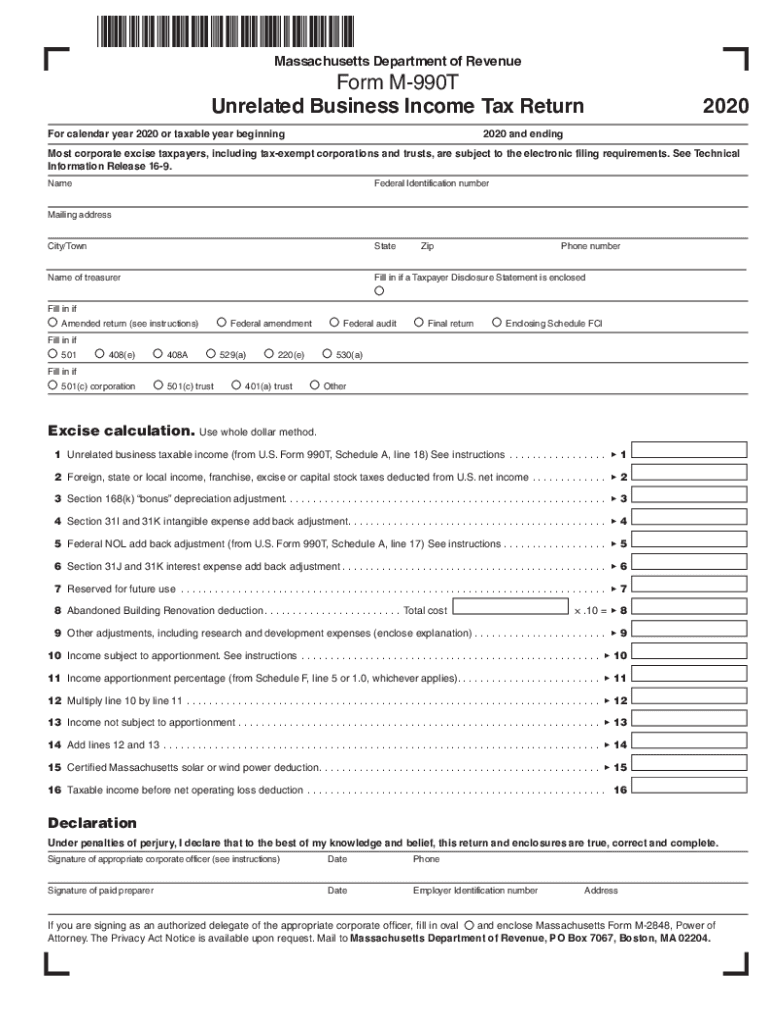

Massachusetts Department of Revenue Form M 990T Unrelated 2020

What is the Massachusetts Department Of Revenue Form M 990T Unrelated

The Massachusetts Department of Revenue Form M 990T is a tax return specifically designed for organizations that are exempt from federal income tax but have income from unrelated business activities. This form is essential for reporting income that is generated from activities not substantially related to the organization's exempt purpose. The income reported on this form is subject to taxation under Massachusetts law. Understanding the purpose of Form M 990T helps organizations maintain compliance with state tax regulations while ensuring that they fulfill their obligations regarding unrelated business income.

How to use the Massachusetts Department Of Revenue Form M 990T Unrelated

Using the Massachusetts Form M 990T involves several key steps. First, organizations must gather all relevant financial information related to their unrelated business activities. This includes revenue generated, expenses incurred, and any deductions applicable to the unrelated income. Next, organizations should complete the form accurately, ensuring that all sections are filled out correctly to avoid delays or penalties. After completing the form, it must be submitted to the Massachusetts Department of Revenue by the specified deadline. Utilizing digital tools, such as e-signature solutions, can streamline the submission process and enhance accuracy.

Steps to complete the Massachusetts Department Of Revenue Form M 990T Unrelated

Completing the Massachusetts Form M 990T requires careful attention to detail. Follow these steps for a successful filing:

- Collect financial records related to unrelated business income.

- Fill out the identification section, including the organization's name and tax identification number.

- Report all unrelated business income and expenses in the appropriate sections of the form.

- Calculate the taxable income by subtracting allowable expenses from total income.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the Massachusetts Department of Revenue by the due date.

Legal use of the Massachusetts Department Of Revenue Form M 990T Unrelated

The legal use of Form M 990T is governed by Massachusetts tax laws, which require organizations to report unrelated business income accurately. Failure to file this form or inaccuracies in reporting can lead to penalties and interest on unpaid taxes. Organizations must ensure that they understand the legal implications of their unrelated business activities and comply with all reporting requirements. This form serves as a critical tool for maintaining tax compliance and avoiding legal complications related to unrelated income.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Form M 990T are crucial for compliance. Typically, the form is due on the fifteenth day of the fifth month following the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due on May 15. It is essential to be aware of these deadlines to avoid late fees and penalties. Additionally, organizations should keep track of any changes to filing dates that may occur due to state regulations or extensions.

Penalties for Non-Compliance

Non-compliance with the filing requirements for Form M 990T can result in significant penalties. Organizations that fail to file by the due date may incur late filing fees, which can accumulate over time. Additionally, if an organization underreports its unrelated business income, it may face additional taxes, interest, and potential legal action. Understanding these penalties emphasizes the importance of timely and accurate filing to maintain compliance with Massachusetts tax laws.

Quick guide on how to complete massachusetts department of revenue form m 990t unrelated

Effortlessly Prepare Massachusetts Department Of Revenue Form M 990T Unrelated on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the appropriate template and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle Massachusetts Department Of Revenue Form M 990T Unrelated on any device with the airSlate SignNow apps for Android or iOS and simplify any document-driven process today.

How to Modify and Electronically Sign Massachusetts Department Of Revenue Form M 990T Unrelated with Ease

- Find Massachusetts Department Of Revenue Form M 990T Unrelated and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent parts of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Massachusetts Department Of Revenue Form M 990T Unrelated to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form m 990t unrelated

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form m 990t unrelated

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the m 990t feature in airSlate SignNow?

The m 990t feature in airSlate SignNow allows users to efficiently manage their document workflows. It simplifies the process of sending and eSigning documents, ensuring compliance and security. This powerful tool saves time and boosts productivity for any business.

-

How does airSlate SignNow pricing work for m 990t users?

airSlate SignNow offers competitive pricing for users looking to leverage the m 990t feature. Plans are designed to cater to businesses of all sizes, with flexible monthly or annual subscriptions. This ensures you pay only for what you need while accessing premium electronic signature services.

-

What are the key benefits of using the m 990t feature?

The m 990t feature offers numerous benefits, including streamlined workflows, improved efficiency, and enhanced security for document transactions. Additionally, it provides audit trails and compliance features that are essential for legal document management. Overall, it simplifies the eSigning process for everyone involved.

-

Can I integrate the m 990t feature with other software?

Yes, the m 990t feature in airSlate SignNow can easily integrate with various third-party applications such as CRM systems, project management tools, and accounting software. This seamless integration helps you maintain your existing workflows while enhancing document management. Integration options are user-friendly and support various business needs.

-

Is the m 990t feature suitable for small businesses?

Absolutely! The m 990t feature is particularly beneficial for small businesses looking for an affordable yet powerful eSigning solution. It offers scalability, allowing businesses to grow without the need for extensive IT support. This makes it an ideal choice for startups and local businesses.

-

What types of documents can I use with the m 990t feature?

With the m 990t feature, airSlate SignNow supports a wide range of document types such as contracts, agreements, invoices, and NDAs. This versatility ensures you can effectively manage any legal or business document requiring a signature. The platform’s user-friendly interface makes document preparation quick and straightforward.

-

How secure is the m 990t feature for signing documents?

The m 990t feature is built with top-notch security protocols to protect your sensitive information. airSlate SignNow uses encryption and compliance standards like HIPAA and GDPR to ensure your documents remain confidential and secure. Users can confidently eSign knowing their data is safeguarded.

Get more for Massachusetts Department Of Revenue Form M 990T Unrelated

Find out other Massachusetts Department Of Revenue Form M 990T Unrelated

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document