for Tax Periods 5 1 14 and After 2019

What is the For Tax Periods 5 1 14 And After

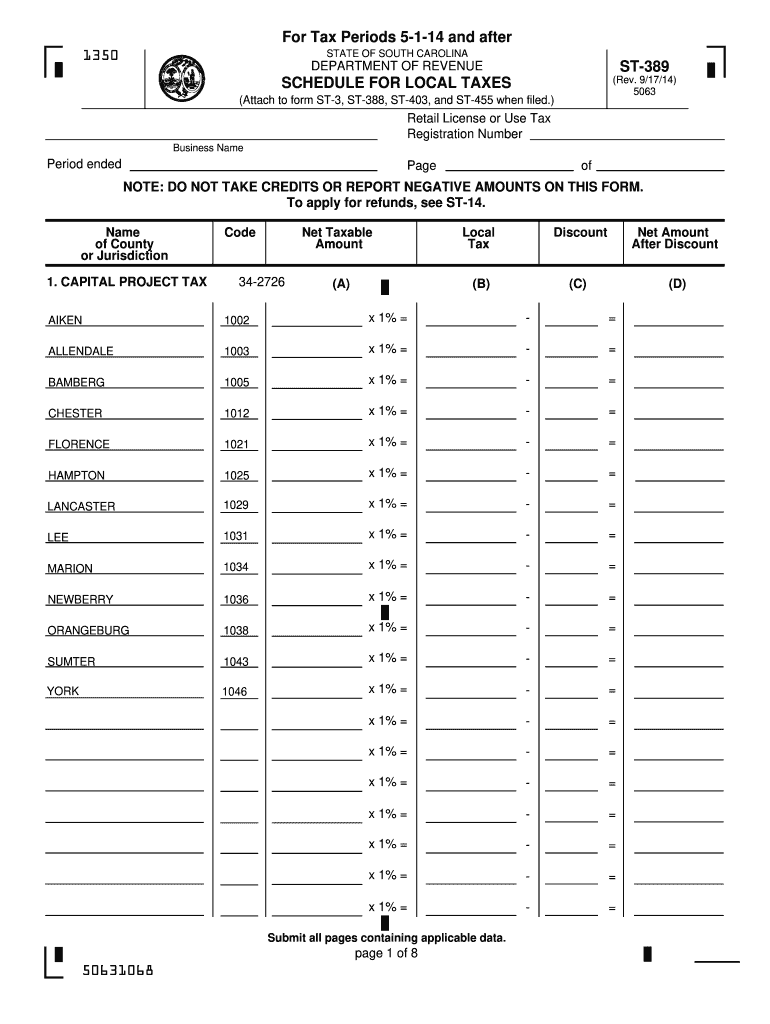

The For Tax Periods 5 1 14 And After form is essential for individuals and businesses to report their income and expenses accurately for tax purposes. This form is particularly relevant for tax years starting from May first, two thousand fourteen, and onwards. It is designed to ensure compliance with federal tax regulations and to facilitate the accurate calculation of tax liabilities. Understanding this form is crucial for maintaining good standing with the Internal Revenue Service (IRS) and avoiding potential penalties.

How to use the For Tax Periods 5 1 14 And After

Using the For Tax Periods 5 1 14 And After form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, receipts for deductible expenses, and any relevant tax documents from previous years. Next, fill out the form with precise information regarding your income, deductions, and credits. It is important to review the form thoroughly for any errors before submission. Once completed, you can eSign the document using a reliable electronic signature service, ensuring it is legally binding.

Steps to complete the For Tax Periods 5 1 14 And After

Completing the For Tax Periods 5 1 14 And After form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts.

- Fill out the form accurately, ensuring that all income and deductions are reported.

- Double-check all entries for accuracy and completeness.

- Use an electronic signature tool to sign the form digitally, ensuring compliance with eSignature laws.

- Submit the completed form to the IRS by the designated deadline, either electronically or via mail.

Legal use of the For Tax Periods 5 1 14 And After

The legal use of the For Tax Periods 5 1 14 And After form is governed by federal tax laws. To be considered valid, the form must be completed accurately and submitted on time. Electronic signatures are legally binding under the ESIGN and UETA acts, provided that the signer has consented to use electronic records and signatures. It is crucial to ensure that all information provided is truthful and complete to avoid legal repercussions, including audits or penalties from the IRS.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the For Tax Periods 5 1 14 And After form. These guidelines include instructions on how to report various types of income, allowable deductions, and credits. Taxpayers are encouraged to refer to the IRS website or consult tax professionals for detailed information on compliance and reporting requirements. Staying informed about any changes in tax laws or guidelines is essential for accurate filing.

Filing Deadlines / Important Dates

Filing deadlines for the For Tax Periods 5 1 14 And After form are critical to avoid penalties. Typically, individual tax returns are due on April fifteenth of each year, but this date may vary if it falls on a weekend or holiday. It is advisable to check the IRS website for any updates regarding filing deadlines and to plan ahead to ensure timely submission. Additionally, taxpayers may consider filing for an extension if they are unable to meet the deadline, but it is important to understand the implications of doing so.

Quick guide on how to complete for tax periods 5 1 14 and after

Effortlessly Prepare For Tax Periods 5 1 14 And After on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any setbacks. Handle For Tax Periods 5 1 14 And After on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to Modify and Electronically Sign For Tax Periods 5 1 14 And After with Ease

- Access For Tax Periods 5 1 14 And After and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and electronically sign For Tax Periods 5 1 14 And After and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for tax periods 5 1 14 and after

Create this form in 5 minutes!

How to create an eSignature for the for tax periods 5 1 14 and after

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What features does airSlate SignNow offer for Tax Periods 5 1 14 And After?

AirSlate SignNow provides a comprehensive suite of features including electronic signatures, document templates, and collaboration tools tailored for businesses and individuals operating for Tax Periods 5 1 14 And After. These features help streamline workflow, enhance productivity, and ensure compliance with tax regulations.

-

How does airSlate SignNow ensure security for documents signed for Tax Periods 5 1 14 And After?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and authentication protocols to protect sensitive information in documents signed for Tax Periods 5 1 14 And After, ensuring that all electronic signatures are secure and compliant with industry standards.

-

What is the pricing structure for using airSlate SignNow for Tax Periods 5 1 14 And After?

AirSlate SignNow offers flexible pricing plans suitable for various business needs, especially for those managing documents for Tax Periods 5 1 14 And After. Our plans are cost-effective, with options for monthly or annual subscriptions that provide access to all essential features without hidden fees.

-

Can I integrate airSlate SignNow with other software for Tax Periods 5 1 14 And After?

Yes, airSlate SignNow supports integration with numerous third-party applications, allowing users to enhance their document management processes for Tax Periods 5 1 14 And After. Integration with tools like CRM systems and cloud storage solutions can further streamline your workflow.

-

How can airSlate SignNow benefit my business for Tax Periods 5 1 14 And After?

Using airSlate SignNow can signNowly enhance operational efficiency for businesses handling documents for Tax Periods 5 1 14 And After. The solution automates the signing process, reduces turnaround times, and improves accuracy, ultimately leading to increased customer satisfaction and productivity.

-

Is airSlate SignNow compliant with tax regulations for Tax Periods 5 1 14 And After?

Absolutely! AirSlate SignNow is designed to meet compliance requirements for electronic signatures, particularly for Tax Periods 5 1 14 And After. Our solutions align with federal regulations ensuring that all signed documents are legally binding and can be used in a tax context.

-

What types of documents can I eSign with airSlate SignNow for Tax Periods 5 1 14 And After?

AirSlate SignNow supports a variety of document types that can be electronically signed for Tax Periods 5 1 14 And After, including contracts, tax forms, and agreements. This versatility enables efficient handling of all necessary paperwork critical for your tax-related needs.

Get more for For Tax Periods 5 1 14 And After

Find out other For Tax Periods 5 1 14 And After

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT