South Carolina Form St 389 2019

What is the South Carolina Form ST-389

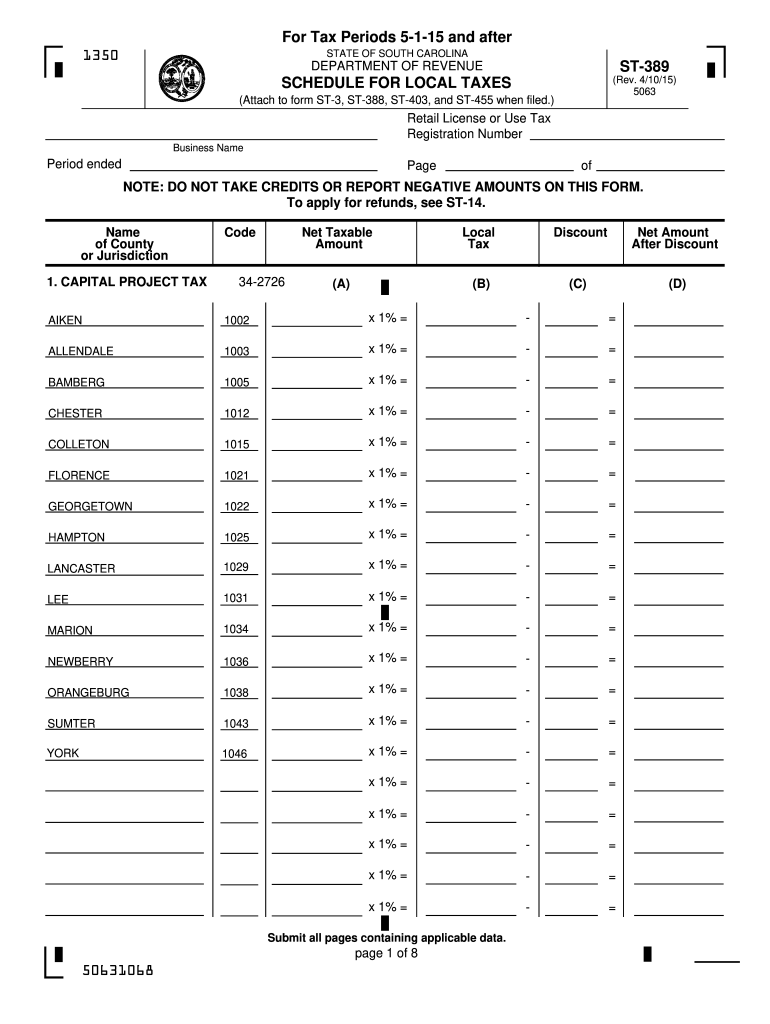

The South Carolina Form ST-389 is a document used primarily for tax exemption purposes. This form is essential for organizations and individuals seeking to claim exemption from sales and use tax in South Carolina. It is typically utilized by non-profit organizations, government entities, and certain educational institutions. By completing this form, eligible parties can avoid paying sales tax on qualifying purchases, thereby supporting their operations and missions.

How to use the South Carolina Form ST-389

To effectively use the South Carolina Form ST-389, individuals or organizations must first determine their eligibility for tax exemption. Once eligibility is established, the form should be filled out accurately, providing all necessary information, including the name of the organization, tax identification number, and the specific nature of the exemption being claimed. After completing the form, it should be submitted to the appropriate vendor or supplier to ensure that sales tax is not charged on exempt purchases.

Steps to complete the South Carolina Form ST-389

Completing the South Carolina Form ST-389 involves several key steps:

- Gather necessary information, such as your organization's name, address, and tax identification number.

- Identify the specific type of exemption you are claiming.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the vendor or supplier from whom you are purchasing goods or services.

Legal use of the South Carolina Form ST-389

The legal use of the South Carolina Form ST-389 is governed by state tax laws, which outline the criteria for tax exemption. It is important for users to understand that misuse of the form, such as claiming exemptions without proper eligibility, can lead to penalties and legal repercussions. Organizations must maintain accurate records and documentation to support their claims, ensuring compliance with all applicable regulations.

Who Issues the Form

The South Carolina Form ST-389 is issued by the South Carolina Department of Revenue. This state agency is responsible for administering tax laws and providing necessary forms and guidance for taxpayers. Organizations seeking to use this form should refer to the Department of Revenue for the most current version and any updates regarding tax exemption policies.

Form Submission Methods

The South Carolina Form ST-389 can be submitted in various ways, depending on the vendor's preferences. Common submission methods include:

- In-person delivery to the vendor or supplier.

- Mailing the completed form directly to the vendor.

- Submitting the form electronically if the vendor supports digital submissions.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the South Carolina Form ST-389 can result in significant penalties. These may include fines, back taxes owed, and interest on unpaid amounts. It is crucial for organizations to ensure they are eligible for the exemptions claimed and to use the form correctly to avoid these consequences.

Quick guide on how to complete south carolina form st 389 2015

Complete South Carolina Form St 389 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, modify, and eSign your documents quickly and without delays. Manage South Carolina Form St 389 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign South Carolina Form St 389 seamlessly

- Find South Carolina Form St 389 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to deliver your form: via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign South Carolina Form St 389 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct south carolina form st 389 2015

Create this form in 5 minutes!

How to create an eSignature for the south carolina form st 389 2015

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is South Carolina Form St 389?

South Carolina Form St 389 is a specific tax form required for certain tax filings in the state. It is essential for individuals and businesses to ensure compliance with state tax regulations. airSlate SignNow allows users to easily prepare, send, and eSign this important document online.

-

How can airSlate SignNow help with South Carolina Form St 389?

airSlate SignNow simplifies the process of completing and submitting South Carolina Form St 389 by offering easy document editing and signing features. Users can customize the form, gather signatures, and send it securely, all from one platform. This streamlines the filing process and enhances overall efficiency.

-

Is airSlate SignNow affordable for small businesses dealing with South Carolina Form St 389?

Yes, airSlate SignNow provides a cost-effective solution for small businesses managing South Carolina Form St 389. With flexible pricing plans, users can choose a package that fits their budget while accessing powerful features for document management. This affordability makes it accessible for businesses of all sizes.

-

What features does airSlate SignNow offer for managing South Carolina Form St 389?

airSlate SignNow includes multiple features for managing South Carolina Form St 389, such as template creation, automated workflows, and secure eSignatures. Additionally, users can track document statuses and receive notifications when forms are signed. These features enhance productivity and ensure timely submissions.

-

Can I integrate airSlate SignNow with other applications for South Carolina Form St 389?

Yes, airSlate SignNow offers integration options with various applications that can help streamline your workflow involving South Carolina Form St 389. Tools like CRM systems, cloud storage services, and accounting software can easily connect with airSlate SignNow. This integration allows for a seamless experience across different platforms.

-

How secure is the signing process for South Carolina Form St 389 through airSlate SignNow?

The signing process for South Carolina Form St 389 through airSlate SignNow is highly secure. The platform employs advanced encryption and authentication measures to protect sensitive information. Users can trust that their documents will be handled with the utmost security throughout the signing process.

-

Can multiple parties eSign South Carolina Form St 389 using airSlate SignNow?

Absolutely! airSlate SignNow supports multiple parties eSigning South Carolina Form St 389 seamlessly. Whether it’s a single signatory or several signers needing to collaborate, the platform facilitates easy coordination and ensures all required signatures are collected efficiently.

Get more for South Carolina Form St 389

Find out other South Carolina Form St 389

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure