Sc Dept of Revenue Form St 389 2019

What is the Sc Dept Of Revenue Form St 389

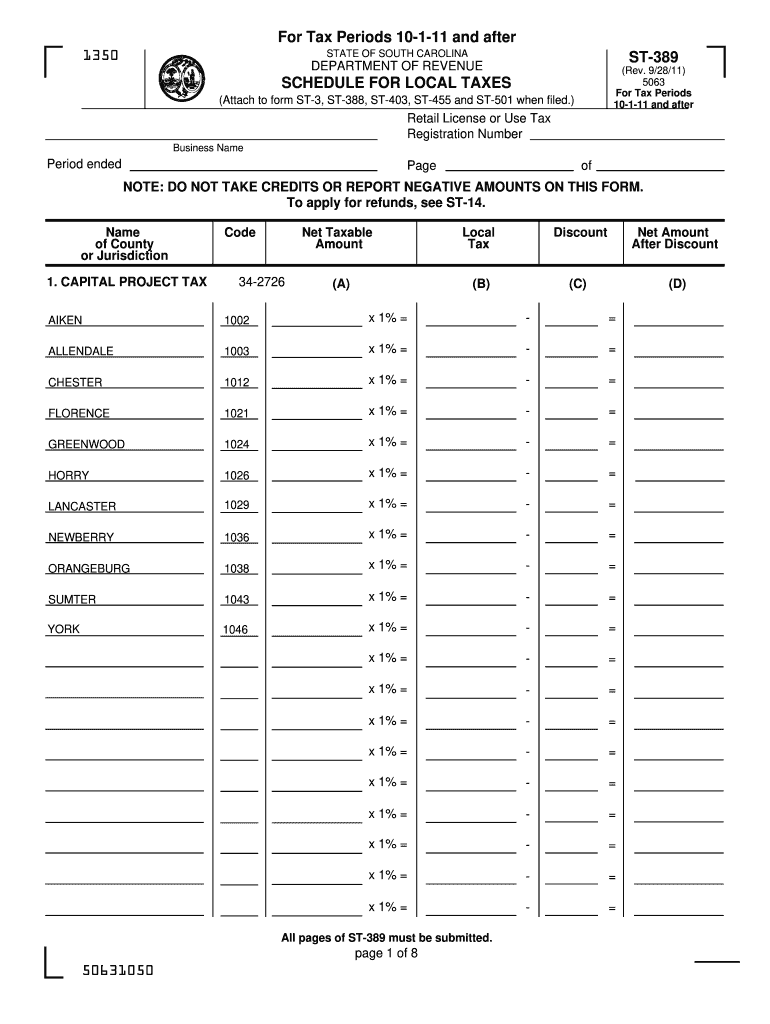

The Sc Dept Of Revenue Form St 389 is a tax-related document used in South Carolina. It serves as an exemption certificate for sales and use tax purposes, allowing qualifying entities to make tax-exempt purchases. This form is primarily utilized by organizations such as non-profits, government entities, and certain educational institutions, which are eligible for sales tax exemptions under state law. Understanding the specific criteria for exemption is crucial for proper completion and use of this form.

How to use the Sc Dept Of Revenue Form St 389

Using the Sc Dept Of Revenue Form St 389 involves several straightforward steps. First, ensure that your organization qualifies for a sales tax exemption. Next, download the form from the South Carolina Department of Revenue website or obtain a physical copy. Fill out the required fields, including the name of the organization, address, and the reason for the exemption. Finally, present the completed form to the vendor at the time of purchase to claim the exemption. It is essential to keep a copy for your records.

Steps to complete the Sc Dept Of Revenue Form St 389

Completing the Sc Dept Of Revenue Form St 389 requires attention to detail. Begin by entering your organization’s legal name and address accurately. Specify the type of exemption you are claiming by selecting the appropriate box on the form. Provide a brief explanation of how the purchase relates to your exempt purpose. Ensure that an authorized representative signs and dates the form before submission. Double-check all entries for accuracy to prevent delays or issues during processing.

Legal use of the Sc Dept Of Revenue Form St 389

The legal use of the Sc Dept Of Revenue Form St 389 is governed by South Carolina tax law. To be valid, the form must be completed accurately and signed by an authorized individual within the organization. Misuse of the form, such as claiming exemptions for ineligible purchases, can lead to penalties, including back taxes and fines. It is important to understand the legal implications and ensure compliance with state regulations when utilizing this exemption certificate.

Form Submission Methods

The Sc Dept Of Revenue Form St 389 can be submitted in various ways, depending on the vendor's acceptance policies. Typically, the form is presented directly to the vendor at the point of sale. Some vendors may require a physical copy, while others may accept a digital version. It is advisable to confirm with the vendor regarding their preferred submission method to ensure the exemption is honored. Keeping a record of the submitted form is also recommended for future reference.

Key elements of the Sc Dept Of Revenue Form St 389

Key elements of the Sc Dept Of Revenue Form St 389 include the organization's name, address, and the specific exemption reason. The form also requires a signature from an authorized representative, affirming that the information provided is accurate and that the purchase qualifies for tax exemption. Additionally, the form may include sections for listing the types of purchases being made under the exemption, which helps clarify the intended use of the tax-exempt status.

Quick guide on how to complete sc dept of revenue form st 389 2011

Easily Prepare Sc Dept Of Revenue Form St 389 on Any Device

Digital document management has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Sc Dept Of Revenue Form St 389 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Most Efficient Way to Modify and eSign Sc Dept Of Revenue Form St 389 Seamlessly

- Obtain Sc Dept Of Revenue Form St 389 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive data with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your updates.

- Choose your preferred method to send your form via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from whichever device you prefer. Modify and electronically sign Sc Dept Of Revenue Form St 389 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc dept of revenue form st 389 2011

Create this form in 5 minutes!

How to create an eSignature for the sc dept of revenue form st 389 2011

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the SC Dept Of Revenue Form St 389?

The SC Dept Of Revenue Form St 389 is a tax-exempt certificate used in South Carolina to exempt certain purchases from sales tax. It is typically utilized by organizations and businesses making eligible purchases. Understanding how to properly fill and submit this form can help streamline your tax processes.

-

How can airSlate SignNow assist with the SC Dept Of Revenue Form St 389?

airSlate SignNow offers a user-friendly platform to create, send, and eSign the SC Dept Of Revenue Form St 389 efficiently. With our document management tools, you can streamline the approval process and ensure the form is signed by all necessary parties. This helps save time and reduces the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for the SC Dept Of Revenue Form St 389?

Yes, airSlate SignNow offers various pricing plans designed to suit different business needs. The costs are competitive and provide excellent value, especially considering the time savings and efficiency you gain when using our platform to manage the SC Dept Of Revenue Form St 389. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for managing the SC Dept Of Revenue Form St 389?

Our platform includes features such as customizable templates, secure eSigning, and automated workflows, all of which enhance the process of handling the SC Dept Of Revenue Form St 389. Additionally, you can track the status of your documents in real-time, ensuring everything is moving smoothly toward completion.

-

Can airSlate SignNow integrate with other software for managing the SC Dept Of Revenue Form St 389?

Absolutely! airSlate SignNow provides integrations with numerous applications such as CRM systems, cloud storage services, and accounting software. This connectivity allows you to efficiently manage the SC Dept Of Revenue Form St 389 alongside your existing tools, enhancing overall productivity and workflow.

-

How secure is the airSlate SignNow platform for signing the SC Dept Of Revenue Form St 389?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication methods to protect your data when signing the SC Dept Of Revenue Form St 389. You can confidently send and manage documents knowing they are secured against unauthorized access.

-

What are the benefits of using airSlate SignNow for the SC Dept Of Revenue Form St 389?

By using airSlate SignNow for the SC Dept Of Revenue Form St 389, you experience faster turnaround times, reduced paperwork, and enhanced collaboration among teams. Our platform simplifies the eSigning process, making it easier than ever to complete necessary documentation without delays.

Get more for Sc Dept Of Revenue Form St 389

- Thedigitalhippies com billofsale form

- Dnr form new mexico

- Law of conservation of mass worksheet fill in the blank with the correct number form

- Equal housing opportunity rental application form 100083213

- Coa paracetamol form

- Siop lesson plan example 1st grade form

- Www pdffiller com360542463 medicaladminrecordcamp medication administration form fill online printable

- Clinician ordersprogress notes patient labelclini form

Find out other Sc Dept Of Revenue Form St 389

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer