Florida Public Service Tax 2016-2026

What is the Florida Public Service Tax

The Florida Public Service Tax is a tax levied on certain public services provided to consumers, including electricity, water, and telecommunications. This tax is typically applied to residential and commercial utility bills, and it is governed by specific regulations outlined by the state of Florida. The revenue generated from this tax is used to fund local government services and infrastructure projects. Understanding the Florida Public Service Tax is essential for both consumers and businesses to ensure compliance and proper financial planning.

Steps to complete the Florida Public Service Tax

Completing the Florida Public Service Tax involves several key steps to ensure accuracy and compliance. Here are the main steps:

- Gather necessary information, including your utility account numbers and billing statements.

- Determine the applicable tax rate based on your location and the type of service.

- Calculate the total amount of tax owed by applying the tax rate to your utility charges.

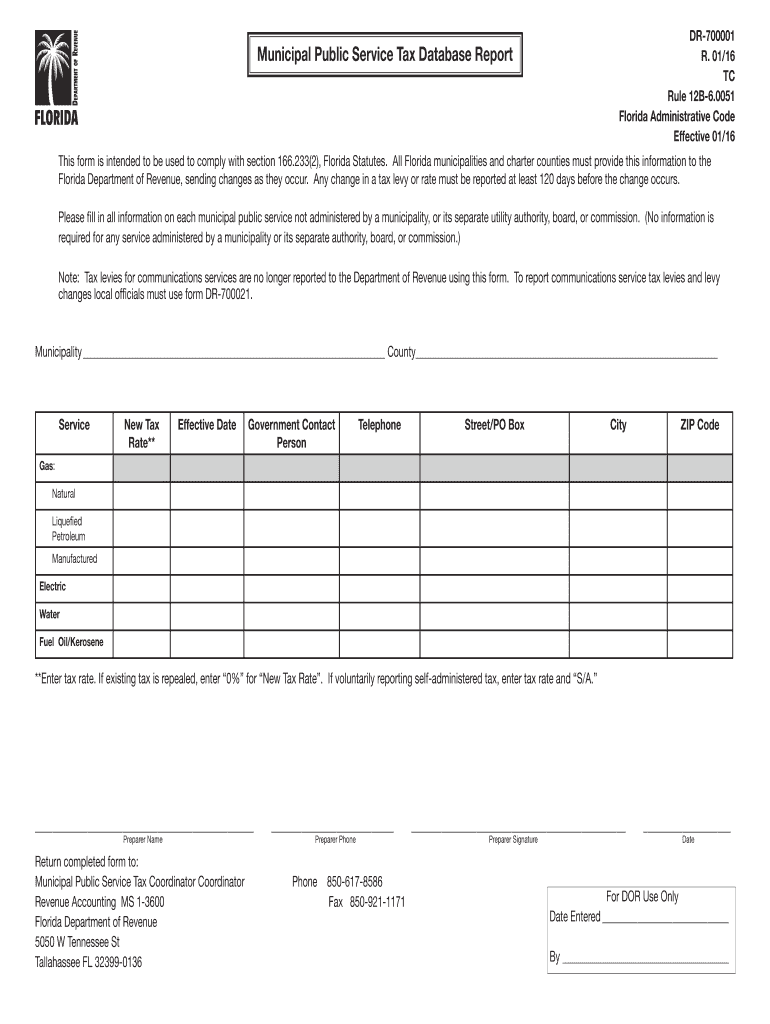

- Complete the required forms, such as the DR-700001 form, ensuring all information is accurate.

- Submit the completed form along with any payment due to the appropriate local tax authority.

Legal use of the Florida Public Service Tax

The legal use of the Florida Public Service Tax is governed by state laws and regulations. It is important for taxpayers to understand their obligations under these laws to avoid penalties. The tax must be collected by service providers and remitted to the state. Additionally, consumers have the right to dispute any charges they believe are incorrect. Keeping thorough records of all transactions and communications related to the tax is crucial for legal compliance.

Required Documents

When filing the Florida Public Service Tax, several documents are required to ensure a complete and accurate submission. These documents include:

- Utility bills that detail the services provided and the corresponding charges.

- The DR-700001 form, which serves as the official tax report.

- Any additional documentation requested by the local tax authority, such as proof of exemption if applicable.

Form Submission Methods

The Florida Public Service Tax form can be submitted through various methods to accommodate different preferences. These methods include:

- Online submission via the designated state or local tax authority website.

- Mailing the completed form and payment to the appropriate tax office.

- In-person submission at local tax offices, where assistance may be available.

Penalties for Non-Compliance

Failure to comply with the Florida Public Service Tax regulations can result in various penalties. These may include:

- Fines for late payments or underreporting of taxable amounts.

- Interest charges on unpaid taxes, which can accumulate over time.

- Potential legal action taken by state authorities to recover owed amounts.

Quick guide on how to complete florida public service tax

Complete Florida Public Service Tax effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, alter, and eSign your documents promptly without interruptions. Handle Florida Public Service Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to alter and eSign Florida Public Service Tax smoothly

- Locate Florida Public Service Tax and click on Get Form to initiate the process.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Florida Public Service Tax to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida public service tax

Create this form in 5 minutes!

How to create an eSignature for the florida public service tax

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the Florida public service tax?

The Florida public service tax is a tax imposed on the sale of certain services and utilities in the state of Florida. This tax affects both consumers and businesses, impacting overall pricing structures. Understanding this tax is essential for compliance and can influence your business operations.

-

How does airSlate SignNow help with Florida public service tax compliance?

airSlate SignNow provides a streamlined document management solution that includes features for tracking and managing tax-related documentation. By integrating our eSignature functionalities, businesses can ensure that all agreements regarding the Florida public service tax are properly documented and easily accessible. This minimizes the risk of non-compliance.

-

What are the costs associated with airSlate SignNow regarding Florida public service tax?

airSlate SignNow offers various pricing plans that are designed to be cost-effective, especially for businesses dealing with the Florida public service tax. Our pricing is transparent, allowing you to assess costs based on your specific needs without hidden fees. This makes it easier to budget for tax compliance.

-

Can I integrate airSlate SignNow with accounting software for managing Florida public service tax?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, facilitating easier management of the Florida public service tax. This integration allows for accurate tracking of taxable transactions and simplifies the reporting process. By automating these tasks, businesses can focus more on growth and compliance.

-

What features in airSlate SignNow are most beneficial for handling Florida public service tax?

Key features of airSlate SignNow that benefit users handling Florida public service tax include advanced document routing and template creation. These functionalities allow businesses to standardize their tax-related documents, ensuring consistency and compliance. Additionally, eSigning speeds up the approval process for tax-related documents.

-

How does eSigning improve efficiency for Florida public service tax documentation?

eSigning through airSlate SignNow enhances the efficiency of Florida public service tax documentation by enabling quick approvals without the need for physical paperwork. This reduces processing times signNowly and helps maintain a clear digital record of all transactions. As a result, businesses can respond faster to tax-related inquiries.

-

What support does airSlate SignNow provide for Florida public service tax queries?

airSlate SignNow offers comprehensive support for businesses navigating the complexities of the Florida public service tax. Our dedicated customer service team is available to assist you with any concerns or questions regarding documentation and compliance. This ensures a smoother experience for all users.

Get more for Florida Public Service Tax

Find out other Florida Public Service Tax

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter