Communications Services Tax Brochure GT 800011 Form

What is the Communications Services Tax Brochure GT 800011

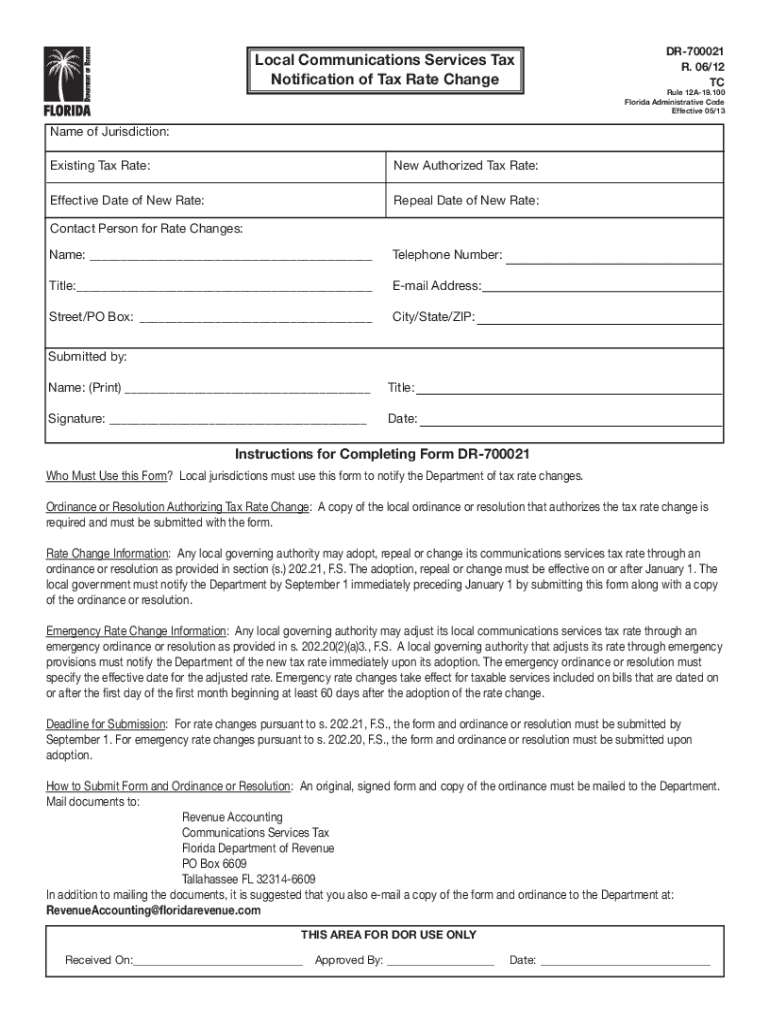

The Communications Services Tax Brochure GT 800011 is a specific form used in the United States for reporting and documenting communications services tax obligations. This form is essential for businesses that provide communication services, ensuring compliance with state and federal tax regulations. It outlines the necessary information required to accurately report these taxes, helping businesses avoid penalties and maintain good standing with tax authorities.

How to use the Communications Services Tax Brochure GT 800011

Using the Communications Services Tax Brochure GT 800011 involves several steps to ensure accurate completion. First, gather all relevant financial records related to your communications services. This includes invoices, receipts, and any prior tax filings. Next, fill out the form with precise details regarding your services, revenue, and applicable tax rates. It is crucial to review the completed form for accuracy before submission to prevent any discrepancies that could lead to compliance issues.

Steps to complete the Communications Services Tax Brochure GT 800011

Completing the Communications Services Tax Brochure GT 800011 requires a systematic approach:

- Collect all necessary documentation, including sales records and previous tax returns.

- Fill in the form by entering your business information, including name, address, and tax identification number.

- Detail the types of communication services provided and the corresponding revenue generated.

- Calculate the total tax due based on the applicable rates for your services.

- Review all entries for accuracy and completeness.

- Submit the form according to the specified filing methods.

Legal use of the Communications Services Tax Brochure GT 800011

The legal use of the Communications Services Tax Brochure GT 800011 is governed by state and federal tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted by the designated deadlines. Any discrepancies or late submissions can lead to penalties or audits. Utilizing a reliable eSignature solution can further enhance the legal validity of your submission, ensuring compliance with eSignature laws.

Key elements of the Communications Services Tax Brochure GT 800011

Key elements of the Communications Services Tax Brochure GT 800011 include:

- Business identification details, such as name and tax ID.

- Types of communication services offered.

- Revenue figures for the reporting period.

- Applicable tax rates and calculations.

- Signature and date of submission to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Communications Services Tax Brochure GT 800011 vary by state and may depend on the frequency of your tax reporting. Generally, forms must be submitted quarterly or annually. It is essential to check with your state tax authority for specific deadlines to avoid late fees and penalties. Mark these dates on your calendar to ensure timely compliance.

Quick guide on how to complete communications services tax brochure gt 800011

Complete Communications Services Tax Brochure GT 800011 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly solution to conventional printed and signed papers, as you can easily access the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents swiftly without any holdups. Manage Communications Services Tax Brochure GT 800011 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Communications Services Tax Brochure GT 800011 effortlessly

- Find Communications Services Tax Brochure GT 800011 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device of your choice. Edit and eSign Communications Services Tax Brochure GT 800011 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the communications services tax brochure gt 800011

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the Communications Services Tax Brochure GT 800011?

The Communications Services Tax Brochure GT 800011 is a comprehensive guide that explains the regulations and requirements for businesses regarding communications services tax. It provides detailed insights to help businesses understand their tax obligations and ensure compliance. With this brochure, you gain a valuable resource for navigating complex taxation issues in your communication services.

-

How can the Communications Services Tax Brochure GT 800011 help my business?

By using the Communications Services Tax Brochure GT 800011, your business can streamline its understanding of tax implications related to communication services. This resource empowers you to accurately assess your tax liabilities and avoid potential penalties. It ultimately aids in making informed financial decisions regarding your communication services.

-

Is there a cost associated with the Communications Services Tax Brochure GT 800011?

The Communications Services Tax Brochure GT 800011 may be available free of charge, depending on the source you obtain it from. However, always check for the latest offerings and whether any additional resources are provided. Investing in valuable tax resources like this brochure can save you money in the long run by ensuring compliance.

-

What features does the Communications Services Tax Brochure GT 800011 include?

The Communications Services Tax Brochure GT 800011 includes features like comprehensive tax guidelines, sample calculations, and FAQs regarding tax obligations. It is designed to be user-friendly, making complex tax information accessible to all business owners. This helps you understand the essential details relevant to your specific communication services.

-

How does the Communications Services Tax Brochure GT 800011 integrate with other business tools?

The Communications Services Tax Brochure GT 800011 serves as a standalone educational resource, but it can be complemented with various business tools like accounting software. Integrating your learnings from the brochure with your financial systems can enhance accuracy in tax reporting and compliance. Always consider using it alongside your existing tools for maximum benefit.

-

Can I get support when using the Communications Services Tax Brochure GT 800011?

Yes, many organizations that provide the Communications Services Tax Brochure GT 800011 also offer customer support and additional resources. This support can help you interpret the brochure effectively and apply its guidelines to your specific situation. Don’t hesitate to signNow out for assistance if you have further questions.

-

What are the benefits of referring to the Communications Services Tax Brochure GT 800011?

Referencing the Communications Services Tax Brochure GT 800011 can lead to better compliance and informed decision-making for your business. The benefits include reduced risk of tax penalties, elucidation of tax obligations, and an overall enhanced understanding of the financial landscape. This knowledge contributes to a well-informed strategy for your communication services.

Get more for Communications Services Tax Brochure GT 800011

Find out other Communications Services Tax Brochure GT 800011

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free