Sales and Use Tax Direct Pay Permit Florida Administrative Code Form

Understanding the Florida Direct Pay Permit

The Florida Direct Pay Permit is a valuable tool that allows businesses to self-accrue and remit use tax directly to the Florida Department of Revenue. This permit is particularly useful for companies that frequently purchase taxable goods and services. By obtaining this permit, businesses can streamline their tax compliance process, ensuring that they meet their tax obligations efficiently. It is essential for businesses to understand the legal framework surrounding this permit, as it helps in maintaining compliance with state tax laws.

Steps to Apply for a Florida Direct Pay Permit

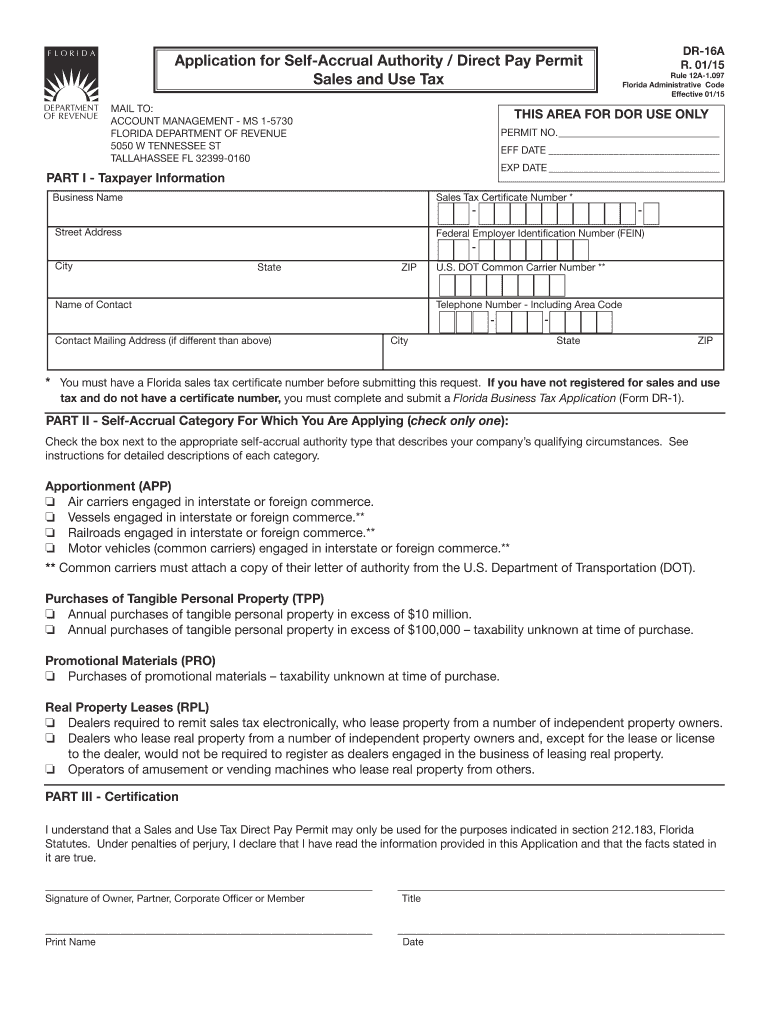

Applying for a direct pay permit involves several key steps. First, businesses must complete the application form provided by the Florida Department of Revenue. This form typically requires basic information about the business, including its name, address, and federal employer identification number (FEIN). After filling out the application, businesses should submit it to the appropriate department for review. It is advisable to keep a copy of the submitted application for record-keeping purposes. Once the application is approved, the business will receive its direct pay permit, allowing it to begin self-accruing and remitting use tax.

Key Elements of the Florida Direct Pay Permit

The Florida Direct Pay Permit includes several important elements that businesses must be aware of. These include the permit number, the effective date, and the specific tax types covered under the permit. Additionally, businesses must ensure they understand their responsibilities under the permit, such as maintaining accurate records of purchases and tax remittances. Compliance with these elements is crucial for avoiding penalties and ensuring smooth operations.

Legal Use of the Florida Direct Pay Permit

To ensure the legal use of the Florida Direct Pay Permit, businesses must adhere to specific guidelines set forth by the Florida Department of Revenue. This includes using the permit only for eligible purchases and accurately reporting use tax on items acquired under the permit. Misuse of the permit can lead to penalties, including fines and revocation of the permit. Therefore, it is essential for businesses to stay informed about the legal requirements and ensure compliance at all times.

Required Documents for the Florida Direct Pay Permit

When applying for the Florida Direct Pay Permit, certain documents are required to support the application. These typically include proof of business registration, such as a business license or articles of incorporation, and documentation of the business's tax identification number. Additional financial documents may also be necessary to demonstrate the business's eligibility for the permit. Having these documents prepared and organized can facilitate a smoother application process.

Penalties for Non-Compliance with the Florida Direct Pay Permit

Failure to comply with the regulations surrounding the Florida Direct Pay Permit can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and even the revocation of the permit itself. Businesses must be diligent in their record-keeping and tax remittance practices to avoid these consequences. Understanding the potential penalties can help businesses prioritize compliance and maintain their good standing with the Florida Department of Revenue.

Quick guide on how to complete sales and use tax direct pay permit florida administrative code

Complete Sales And Use Tax Direct Pay Permit Florida Administrative Code effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without delays. Manage Sales And Use Tax Direct Pay Permit Florida Administrative Code on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-focused operation today.

How to modify and eSign Sales And Use Tax Direct Pay Permit Florida Administrative Code with ease

- Locate Sales And Use Tax Direct Pay Permit Florida Administrative Code and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Sales And Use Tax Direct Pay Permit Florida Administrative Code to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax direct pay permit florida administrative code

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is a Florida direct pay permit?

A Florida direct pay permit allows businesses to purchase taxable items or services without paying sales tax upfront. Instead, they pay the tax directly to the Florida Department of Revenue. This facilitates easier budgeting and enhanced cash flow management for businesses involved in considerable purchases.

-

How can airSlate SignNow assist with the Florida direct pay permit application?

airSlate SignNow streamlines the process of applying for a Florida direct pay permit by allowing you to create, send, and electronically sign documents securely. This easy-to-use platform ensures that all necessary paperwork is completed efficiently, helping you avoid delays and ensuring compliance with state regulations.

-

What are the benefits of using a Florida direct pay permit?

Utilizing a Florida direct pay permit can provide signNow financial benefits, including improved cash flow and savings on upfront sales taxes. By leveraging airSlate SignNow, businesses can easily manage the documentation associated with these permits, ensuring smooth operations and more strategic financial planning.

-

Is there a cost associated with obtaining a Florida direct pay permit?

Applying for a Florida direct pay permit does not have a direct fee, but associated costs may arise from documentation or administrative processes. With airSlate SignNow, businesses can minimize costs by reducing the time spent on paperwork and leveraging an affordable eSignature solution to streamline the permitting process.

-

How does airSlate SignNow ensure compliance with Florida direct pay permit regulations?

airSlate SignNow keeps you compliant by providing templates and customizable documents that meet Florida's legal requirements for direct pay permits. The platform's security features and audit trails guarantee that your documents are protected and easily retrievable in case of an audit by the Department of Revenue.

-

What integrations does airSlate SignNow offer for managing Florida direct pay permits?

airSlate SignNow offers seamless integrations with popular business tools such as CRM systems and accounting software, which can enhance the management of Florida direct pay permits. This allows for automated workflows, ensuring that all necessary information is captured and easily accessible, facilitating better compliance and efficiency.

-

Can I track the status of my Florida direct pay permit application with airSlate SignNow?

Yes, airSlate SignNow provides tools to track the status of your documents and applications, including Florida direct pay permits. You can receive notifications when documents are viewed and signed, ensuring that you are always aware of where your application stands in the process.

Get more for Sales And Use Tax Direct Pay Permit Florida Administrative Code

- Bi mart application form

- Ps4595 form

- California legacy license plate pre order form reg 17l apps dmv ca

- Sf87 form download

- New 1003 loan application pdf form

- Hazardous materials business plan environment health amp safety www ehs ucsd form

- Tim turner dom documents form

- Emergency rental assistance program erap written form

Find out other Sales And Use Tax Direct Pay Permit Florida Administrative Code

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself