589 Tax Form

What is the 589 Tax

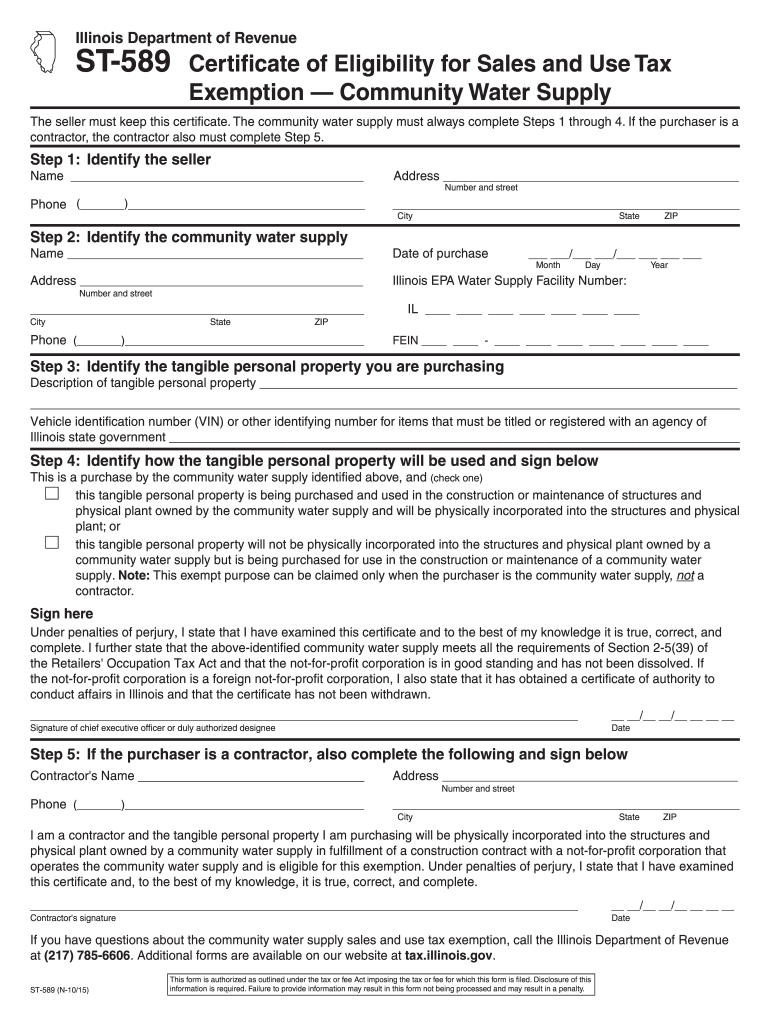

The 589 tax, often referred to as the Illinois 589 exemption, is a specific tax exemption form utilized in the state of Illinois. This form is primarily designed to allow certain entities and individuals to claim exemptions from sales tax on specific purchases. The exemptions can apply to various categories, including items used in manufacturing, research and development, and other qualified uses. Understanding the purpose and application of the 589 tax is essential for businesses and individuals who seek to reduce their tax liabilities legally.

Steps to Complete the 589 Tax

Completing the 589 exemption form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details and the specific items for which you are claiming the exemption. Next, accurately fill out the form by providing the required details, such as the type of exemption being claimed and the relevant tax identification numbers. After completing the form, review it carefully to ensure all information is correct. Finally, submit the form according to the specified submission methods, which can include online, by mail, or in person.

Eligibility Criteria

To qualify for the 589 exemption, certain eligibility criteria must be met. Typically, the exemption is available to businesses engaged in manufacturing, research and development, or other specified activities that justify the exemption from sales tax. Additionally, the entity must possess a valid tax identification number and be able to demonstrate how the purchased items directly relate to their exempt activities. It is crucial to review the specific guidelines set forth by the Illinois Department of Revenue to ensure compliance with all eligibility requirements.

Key Elements of the 589 Tax

Several key elements define the 589 tax exemption form. These include the specific types of purchases that qualify for exemption, such as machinery, equipment, and materials used in production. Additionally, the form requires detailed information about the purchaser and the nature of the exempt use. Understanding these elements helps ensure that applicants provide the necessary documentation and justification for their claims, which is critical for approval.

Form Submission Methods

The submission of the 589 exemption form can be done through various methods, depending on the preferences of the applicant. Common submission methods include online filing through the Illinois Department of Revenue's website, mailing a physical copy of the form to the appropriate office, or delivering it in person. Each method has its advantages, and applicants should choose the one that best fits their needs while ensuring timely processing of their exemption claims.

Legal Use of the 589 Tax

The legal use of the 589 tax exemption form is governed by Illinois state tax laws. It is essential for applicants to understand the legal framework surrounding the exemption to avoid potential penalties for misuse. The form must be used strictly for qualifying purchases, and any misrepresentation or fraudulent claims can lead to significant legal repercussions. Compliance with all applicable laws and regulations is crucial to maintaining the integrity of the exemption process.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the 589 exemption can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important for individuals and businesses to understand the implications of non-compliance and to ensure that all claims made on the 589 tax form are accurate and justified. Regular audits and reviews of exemption claims can help mitigate the risk of penalties and ensure adherence to state tax laws.

Quick guide on how to complete 589 tax

Effortlessly Prepare 589 Tax on Any Device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the features you require to swiftly create, modify, and electronically sign your documents without unnecessary delays. Manage 589 Tax on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign 589 Tax with Ease

- Obtain 589 Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or disorganized documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign 589 Tax to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 589 tax

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the form 589 exemption and how does it work?

The form 589 exemption allows businesses to claim specific tax exemptions for certain transactions. This form helps streamline your accounting processes, ensuring you comply with necessary regulations while maximizing your financial efficiency. Utilizing airSlate SignNow, you can easily fill out, send, and eSign the form 589 exemption quickly.

-

How can airSlate SignNow help with completing the form 589 exemption?

airSlate SignNow simplifies the process of completing the form 589 exemption by providing an intuitive interface for document management and eSigning. With automated workflows, you can ensure that all necessary parties receive the form for review and signatures promptly. This reduces delays and enhances operational efficiency.

-

What features does airSlate SignNow offer for managing form 589 exemption?

With airSlate SignNow, you gain access to features like customizable templates, document tracking, and secure cloud storage for your form 589 exemption. These features enable you to customize your forms as needed, monitor their status, and ensure secure handling of sensitive information throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for form 589 exemption?

Yes, there is a pricing structure associated with airSlate SignNow, designed to cater to businesses of all sizes. You can choose from several plans that fit your needs, ensuring you have the right tools for managing documents like the form 589 exemption without breaking the bank. The solution is built to be cost-effective while providing high-quality features.

-

Can I integrate airSlate SignNow with other software for handling form 589 exemption?

Definitely! airSlate SignNow offers integrations with a wide variety of popular software, enhancing your workflow for the form 589 exemption. Whether you use CRM systems or other document management solutions, these integrations facilitate smoother processes and increased productivity.

-

What are the benefits of using airSlate SignNow for the form 589 exemption?

Using airSlate SignNow for the form 589 exemption streamlines your documentation process, reduces errors, and saves time. The platform allows for quick electronic signatures, which speeds up approvals and finalization of your forms. Additionally, it promotes a paperless environment, contributing to sustainability efforts.

-

Is airSlate SignNow secure for handling sensitive documents like form 589 exemption?

Yes, airSlate SignNow employs industry-leading security measures to protect your sensitive documents, including the form 589 exemption. With encryption and secure data storage, you can trust that your information is safe from unauthorized access, enabling you to focus on your business without worries.

Get more for 589 Tax

Find out other 589 Tax

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast