Nc Tax 2011-2026

What is the NC Tax?

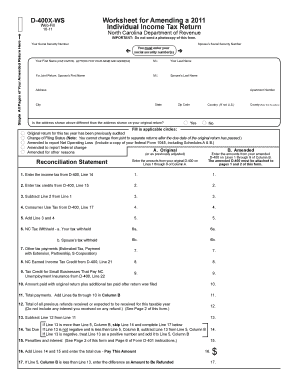

The North Carolina tax, often referred to as the NC tax, encompasses various state tax obligations, including income tax, sales tax, and property tax. The income tax is particularly relevant for individuals and businesses, as it determines the amount owed to the state based on earnings. North Carolina's tax system operates on a progressive scale, meaning that higher income levels are taxed at higher rates. Understanding the specifics of the NC tax is essential for accurate tax filing and compliance with state regulations.

Steps to Complete the NC Tax

Completing the NC tax involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, determine your filing status, which can affect your tax rate and deductions. After that, calculate your total income and applicable deductions, such as standard deductions or itemized deductions. Once you have your tax form total, ensure that you review all entries for accuracy before submission. Finally, file your completed tax return either electronically or via mail, adhering to the state's deadlines.

Legal Use of the NC Tax

The legal use of the NC tax is governed by state laws and regulations. It is crucial to understand that all taxpayers are required to file their tax returns accurately and on time. Failure to comply with these legal obligations can result in penalties, including fines and interest on unpaid taxes. Additionally, eSignatures on electronic tax submissions are legally binding, provided they meet the requirements set forth by the ESIGN Act and UETA. Utilizing a reliable electronic signature solution can help ensure that your tax documents are executed legally and securely.

Filing Deadlines / Important Dates

Staying informed about filing deadlines and important dates is essential for meeting tax obligations in North Carolina. Typically, individual income tax returns are due on April 15 of each year, unless it falls on a weekend or holiday, in which case the deadline may be extended. Additionally, estimated tax payments for self-employed individuals and businesses are generally due quarterly. Marking these dates on your calendar can help you avoid late fees and ensure timely compliance with state tax laws.

Required Documents

To complete the NC tax return accurately, specific documents are required. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

- Documentation for any additional income, such as rental or investment income

Having these documents organized and readily available can streamline the filing process and help ensure that all information is accurate.

Form Submission Methods

North Carolina offers multiple methods for submitting tax forms, catering to different preferences and needs. Taxpayers can file their returns electronically through approved e-filing software, which is often the fastest and most efficient method. Alternatively, individuals may choose to print their completed forms and submit them via mail. In-person submissions are also an option at designated tax offices. Understanding these methods can help taxpayers select the most convenient way to file their returns.

Quick guide on how to complete 2011 nc tax

Effortlessly Prepare Nc Tax on Any Device

Managing documents online has gained traction among companies and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Nc Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Modify and eSign Nc Tax with Ease

- Locate Nc Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark essential sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method of sending the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors necessitating new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and eSign Nc Tax and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 nc tax

Create this form in 5 minutes!

How to create an eSignature for the 2011 nc tax

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the tax form total feature in airSlate SignNow?

The tax form total feature in airSlate SignNow allows users to calculate and summarize total amounts on various tax forms seamlessly. This function is designed to make tax document handling more efficient, ensuring that all necessary calculations are accurate. By leveraging this feature, businesses can streamline their tax-related workflows and minimize errors.

-

How does airSlate SignNow ensure the accuracy of tax form totals?

airSlate SignNow employs advanced calculation tools and validation mechanisms to ensure that tax form totals are accurate and reliable. The platform automatically updates totals as users fill out the forms, reducing the risk of errors. This accuracy is crucial for compliance and helps businesses avoid potential penalties during tax season.

-

Is airSlate SignNow compatible with existing financial software for tax form totals?

Yes, airSlate SignNow integrates with various financial and accounting software to support effective management of tax form totals. These integrations allow businesses to import data directly, eliminating the need for manual entry and ensuring consistency across platforms. This capability enhances productivity and accuracy for tax-related tasks.

-

What are the benefits of using airSlate SignNow for tax form management?

Using airSlate SignNow benefits businesses by simplifying the eSigning and document management processes related to tax forms. It provides a user-friendly interface that allows for quick completion of tax form totals and reduces paperwork. Additionally, its security features ensure that sensitive tax information is protected during transactions.

-

What pricing plans are available for accessing the tax form total feature?

airSlate SignNow offers a variety of pricing plans to cater to different business needs, including access to the tax form total feature. Each plan is designed to provide value, ranging from essential capabilities to comprehensive solutions. Prospective users can choose a plan that best aligns with their requirements and budget.

-

Can I collaborate with my team on tax forms using airSlate SignNow?

Absolutely! airSlate SignNow allows for real-time collaboration on tax forms, making it easy for teams to work together on calculating tax form totals. Team members can access, edit, and eSign documents simultaneously, which fosters communication and saves time during the tax preparation process.

-

Is it easy to learn how to use the tax form total feature?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to learn to use the tax form total feature quickly. The platform includes tutorials and customer support to assist users in navigating its functionalities. This ensures that even those less tech-savvy can effectively manage their tax form totals with confidence.

Get more for Nc Tax

Find out other Nc Tax

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament