Ptrintable W9 Form

What is the printable W-9 form?

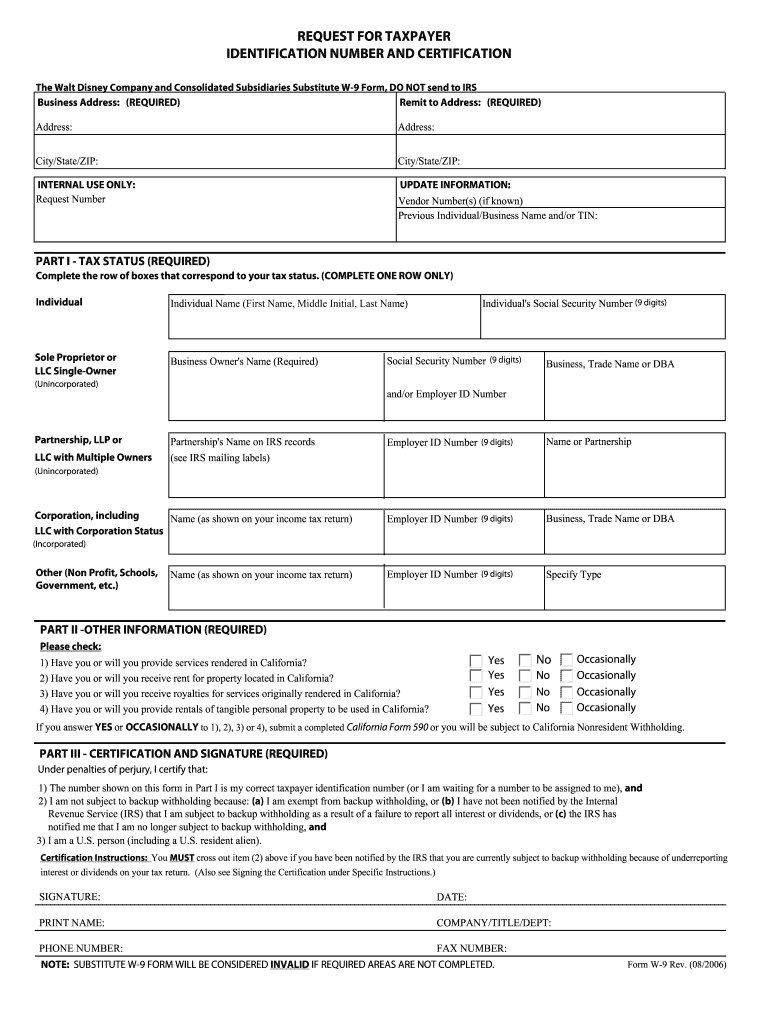

The printable W-9 form is an essential document used in the United States for tax purposes. It is primarily utilized by individuals and businesses to provide their taxpayer identification information to entities that will report income paid to them. This form is crucial for freelancers, contractors, and other self-employed individuals who need to report their earnings accurately to the Internal Revenue Service (IRS).

The W-9 form collects information such as the name, business name (if applicable), address, and taxpayer identification number (TIN) of the individual or business. The information provided on this form helps ensure that the correct amount of taxes is withheld and reported to the IRS.

How to obtain the printable W-9 form

Obtaining the printable W-9 form is a straightforward process. The form can be downloaded directly from the IRS website or accessed through various tax-related resources online. It is available in PDF format, making it easy to print and fill out.

To ensure you have the most current version of the form, it is advisable to check the IRS website regularly, especially during tax season. This ensures compliance with any updates or changes made to the form by the IRS.

Steps to complete the printable W-9 form

Completing the printable W-9 form involves several simple steps:

- Download the form: Access the latest version of the W-9 form from the IRS website.

- Fill in your information: Provide your name, business name (if applicable), and address in the designated fields.

- Enter your taxpayer identification number: This can be your Social Security Number (SSN) or Employer Identification Number (EIN), depending on your status.

- Sign and date the form: Ensure you sign the form to validate it, and include the date of completion.

Once completed, the form can be submitted to the requesting entity, ensuring that they have the necessary information for tax reporting purposes.

Legal use of the printable W-9 form

The legal use of the printable W-9 form is governed by IRS regulations. It is important to use the form correctly to avoid potential penalties or issues with tax reporting. The form serves as a declaration of your taxpayer status and must be filled out accurately to reflect your current situation.

Entities that receive the W-9 form are required to keep it on file for their records. This helps them report payments made to you accurately on forms such as the 1099-MISC or 1099-NEC, which are used to report non-employee compensation.

IRS guidelines for the printable W-9 form

The IRS provides specific guidelines for completing and submitting the W-9 form. These guidelines include:

- Ensure that all information is accurate and up-to-date.

- Use the form only for its intended purpose, which is to provide taxpayer information to entities required to report payments.

- Retain a copy of the completed form for your records.

Following these guidelines helps maintain compliance with IRS regulations and ensures that you are prepared for any tax-related inquiries.

Common scenarios for using the printable W-9 form

The printable W-9 form is commonly used in various scenarios, including:

- Freelancers providing services to businesses.

- Contractors working on projects for companies.

- Individuals receiving rental income or other types of payments.

In these situations, the W-9 form is essential for ensuring that the correct tax information is reported and that the appropriate tax withholding occurs.

Quick guide on how to complete ptrintable w9 form

Complete Ptrintable W9 Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents rapidly without delays. Manage Ptrintable W9 Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Ptrintable W9 Form with ease

- Obtain Ptrintable W9 Form and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Ptrintable W9 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptrintable w9 form

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a W9 form, and when should I use it?

A W9 form is a tax document used in the United States for individuals and entities to provide their Taxpayer Identification Number (TIN) to someone who is required to file an information return with the IRS. You should use the W9 form when you are working as an independent contractor or freelancer, and your client requires your tax information to report payments.

-

How does airSlate SignNow simplify the process of completing a W9 form?

AirSlate SignNow offers a user-friendly platform that allows you to easily fill out and eSign the W9 form online. With its simple interface, you can quickly enter your information and save time compared to traditional paper methods, making it a preferred solution for many businesses and freelancers.

-

What are the benefits of using airSlate SignNow for W9 form management?

Using airSlate SignNow for W9 form management improves efficiency and reduces errors, as you can electronically sign and store your forms securely. Additionally, the platform provides access to templates and customizable workflows that help streamline your document processes, saving time and ensuring compliance.

-

Is there a cost associated with using the airSlate SignNow platform for W9 forms?

Yes, airSlate SignNow offers various pricing plans tailored for individuals and businesses. However, the cost is typically very competitive and provides great value for the features available, especially when you consider the time saved in managing W9 forms and other documents.

-

Can I integrate airSlate SignNow with other applications for managing my W9 forms?

Absolutely! airSlate SignNow supports integrations with numerous applications like Google Drive, Zapier, and more. This allows you to streamline your workflows further, ensuring that your W9 forms and related documents are easily accessible and managed within your existing systems.

-

Is it safe to use airSlate SignNow for sensitive documents like the W9 form?

Yes, airSlate SignNow prioritizes security and ensures that your documents, including W9 forms, are protected with advanced encryption and compliance standards. The platform also features secure access controls, providing peace of mind when handling sensitive information.

-

How can I track the status of my W9 form submissions with airSlate SignNow?

AirSlate SignNow includes robust tracking tools that allow you to monitor the status of your W9 form submissions in real-time. You will receive notifications for actions such as when the document is viewed, signed, or completed, ensuring transparency throughout the process.

Get more for Ptrintable W9 Form

Find out other Ptrintable W9 Form

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement