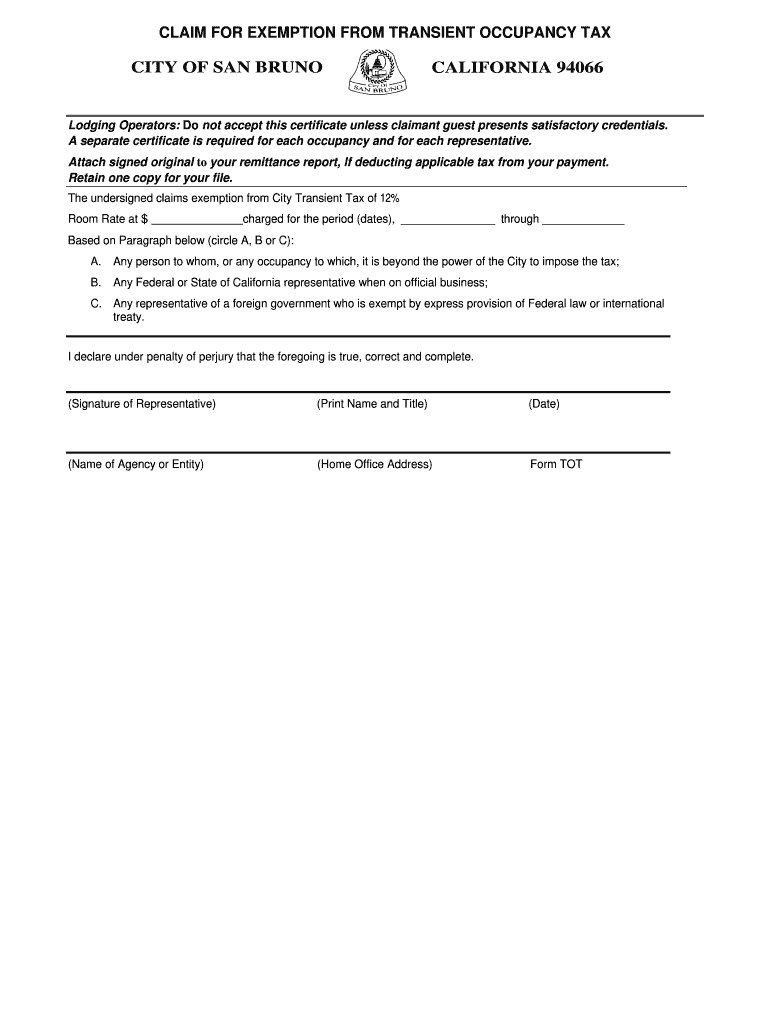

Exemption Form City of San Bruno State of California Sanbruno Ca

Understanding the California Tax Exempt Form

The California tax exempt form is a crucial document for individuals and businesses seeking to claim tax exemptions within the state. This form allows eligible taxpayers to declare their exemption status, which can significantly reduce their tax liabilities. Understanding the purpose and implications of this form is essential for compliance with state tax regulations.

Steps to Complete the California Tax Exempt Form

Filling out the California tax exempt form requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Gather necessary information, including your taxpayer identification number and details about your exemption eligibility.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate your claim.

Obtaining the California Tax Exempt Form

The California tax exempt form can be obtained through various channels. You can download it directly from the California Department of Tax and Fee Administration website or request a physical copy from your local tax office. It is important to ensure you are using the most current version of the form to avoid any compliance issues.

Legal Use of the California Tax Exempt Form

The legal use of the California tax exempt form is governed by state tax laws. To ensure compliance, it is vital to understand the specific exemptions you are claiming and the legal requirements associated with them. Misuse of the form can lead to penalties, including fines or denial of the claimed exemption.

Eligibility Criteria for the California Tax Exempt Form

Eligibility for the California tax exempt form varies based on the type of exemption being claimed. Common eligibility criteria include:

- Nonprofit organizations that meet specific requirements.

- Individuals or businesses that qualify under state tax codes.

- Certain types of property or purchases that are exempt from sales tax.

Examples of Using the California Tax Exempt Form

There are various scenarios in which the California tax exempt form may be utilized. For instance, a nonprofit organization may use this form to purchase supplies without incurring sales tax. Additionally, businesses may apply for exemptions related to specific goods or services under state tax regulations. Understanding these examples can help taxpayers navigate their exemption claims effectively.

Quick guide on how to complete exemption form city of san bruno state of california sanbruno ca

Complete Exemption Form City Of San Bruno State Of California Sanbruno Ca seamlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Exemption Form City Of San Bruno State Of California Sanbruno Ca on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Exemption Form City Of San Bruno State Of California Sanbruno Ca effortlessly

- Obtain Exemption Form City Of San Bruno State Of California Sanbruno Ca and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Exemption Form City Of San Bruno State Of California Sanbruno Ca and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exemption form city of san bruno state of california sanbruno ca

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a claim of exemption in California?

A claim of exemption in California is a legal declaration that allows certain individuals to avoid specific proceedings or seizures related to legal judgments. Understanding how to file a claim of exemption in California can be crucial for protecting your assets from collection actions. This document helps you assert your rights under California law, ensuring that you're safeguarded during financial challenges.

-

How can airSlate SignNow help with filing a claim of exemption in California?

airSlate SignNow streamlines the process of filing a claim of exemption in California by allowing users to easily create, sign, and send documents electronically. Our platform ensures that your documents are legally binding and securely stored, making it simpler for you to manage your legal paperwork. With airSlate SignNow, you can expedite your claim of exemption process while ensuring compliance with California laws.

-

What are the costs associated with using airSlate SignNow for a claim of exemption California?

Pricing for airSlate SignNow is designed to be affordable, catering to businesses and individuals looking to file a claim of exemption in California. Our plans are flexible and typically include various features such as unlimited signing and document storage. To find the best fit for your needs, you can explore our pricing tiers on the airSlate SignNow website.

-

Is airSlate SignNow compliant with California regulations regarding claims of exemption?

Yes, airSlate SignNow is fully compliant with California regulations concerning electronic signatures and document submissions, including those related to a claim of exemption in California. Our platform adheres to state laws, ensuring that your documents are valid and recognized by California courts. You can confidently use airSlate SignNow to handle your legal documentation.

-

Can I integrate airSlate SignNow with other software for handling claims of exemption in California?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, allowing you to manage your claim of exemption in California alongside other legal and business applications. Whether you're using CRM systems or document management software, our integrations enhance your workflow and simplify document handling.

-

What features does airSlate SignNow offer for processing claims of exemption in California?

airSlate SignNow provides a variety of features designed to help you with your claim of exemption in California. These include customizable templates, bulk sending capabilities, and advanced tracking to monitor the status of your documents. Our user-friendly interface makes it easy to navigate the process of electronic signing, keeping you organized and efficient.

-

How does electronic signing benefit my claim of exemption in California?

Electronic signing offers signNow benefits for your claim of exemption in California, including speed and convenience. With airSlate SignNow, you can sign documents anytime, anywhere, reducing the time it takes to complete necessary paperwork. This efficiency not only accelerates the filing process but also ensures that you maintain accurate records of all transactions.

Get more for Exemption Form City Of San Bruno State Of California Sanbruno Ca

- Example of completed ap1 form

- Notice to leave premises ohio form 211799805

- Affidavit template qld form

- Form a2 acknowledgement

- Maryland confidential morbidity report form

- Indiana articles of dissolution form 49465

- Logo design rubric form

- Note all sheets must be reviewed miami dade portal miamidade form

Find out other Exemption Form City Of San Bruno State Of California Sanbruno Ca

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form