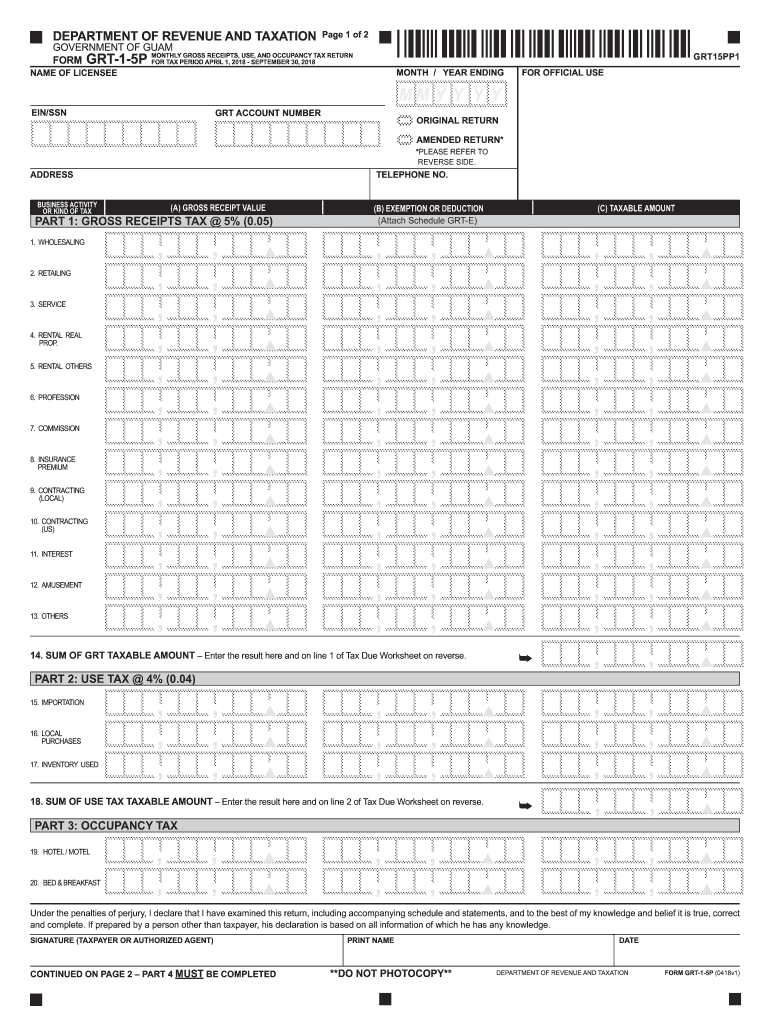

MONTHLY GROSS RECEIPTS, USE, and OCCUPANCY TAX RETURN Form

What is the monthly gross receipts, use, and occupancy tax return

The monthly gross receipts, use, and occupancy tax return is a crucial document for businesses operating in the United States. It serves to report the total gross receipts generated during a specific month, which includes sales, services, and any other income sources. This form is essential for compliance with local tax regulations, ensuring that businesses accurately report their earnings and pay the appropriate taxes. The gross receipts tax is typically levied by state or local governments and may vary based on jurisdiction.

Steps to complete the monthly gross receipts, use, and occupancy tax return

Completing the monthly gross receipts, use, and occupancy tax return involves several key steps:

- Gather financial records: Collect all relevant financial documents, including sales receipts, invoices, and bank statements for the reporting period.

- Calculate total gross receipts: Sum all income sources to determine the total gross receipts for the month.

- Complete the form: Fill out the return accurately, ensuring all figures are correct and reflect the total gross receipts.

- Review for accuracy: Double-check all entries for errors or omissions before submission.

- Submit the form: File the completed return by the designated deadline, either online or through traditional mail.

Legal use of the monthly gross receipts, use, and occupancy tax return

The legal use of the monthly gross receipts, use, and occupancy tax return is pivotal for maintaining compliance with tax laws. Businesses must ensure that the information reported is truthful and accurate, as discrepancies can lead to penalties or audits. The return serves as a formal declaration of income, and its submission is often required by local tax authorities. Understanding the legal implications of this form helps businesses avoid potential legal issues and fosters transparency in financial reporting.

Filing deadlines / important dates

Filing deadlines for the monthly gross receipts, use, and occupancy tax return are typically set by state or local tax authorities. It is crucial for businesses to be aware of these dates to avoid late fees or penalties. Generally, returns are due on a monthly basis, often by the 20th of the following month. Some jurisdictions may have different schedules, so checking with local tax offices for specific deadlines is advisable. Keeping a calendar of important dates can help ensure timely submissions.

Examples of using the monthly gross receipts, use, and occupancy tax return

Businesses across various sectors utilize the monthly gross receipts, use, and occupancy tax return to report their earnings. For instance, a restaurant would include all sales from food and beverage services within the reporting period. Similarly, a retail store would report total sales from merchandise. These examples illustrate the form's versatility in capturing diverse income streams, helping businesses maintain compliance and accurately reflect their financial performance.

Who issues the form

The monthly gross receipts, use, and occupancy tax return is typically issued by state or local tax authorities. Each jurisdiction may have its own version of the form, tailored to meet specific tax regulations. Businesses should obtain the correct form from their local tax office or official government website to ensure compliance with local laws. Understanding the issuing authority is essential for ensuring that the form is filled out and submitted correctly.

Quick guide on how to complete monthly gross receipts use and occupancy tax return

Effortlessly Prepare MONTHLY GROSS RECEIPTS, USE, AND OCCUPANCY TAX RETURN on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle MONTHLY GROSS RECEIPTS, USE, AND OCCUPANCY TAX RETURN on any device using airSlate SignNow’s Android or iOS applications, and streamline your document-related processes today.

How to Edit and Electronically Sign MONTHLY GROSS RECEIPTS, USE, AND OCCUPANCY TAX RETURN with Ease

- Obtain MONTHLY GROSS RECEIPTS, USE, AND OCCUPANCY TAX RETURN and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all information and then click the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Edit and electronically sign MONTHLY GROSS RECEIPTS, USE, AND OCCUPANCY TAX RETURN to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly gross receipts use and occupancy tax return

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What are gross receipts in relation to airSlate SignNow?

Gross receipts refer to the total revenue received by a business from all sources before any deductions. With airSlate SignNow, businesses can streamline the process of tracking gross receipts by integrating eSignatures and document management into their financial workflows, ensuring accuracy and compliance.

-

How does airSlate SignNow help in managing gross receipts?

airSlate SignNow provides a centralized platform for electronic signatures and document organization, making it easier for businesses to manage their gross receipts. This includes the ability to store, track, and retrieve important financial documents securely, enhancing overall efficiency.

-

Is there a cost associated with using airSlate SignNow for gross receipts documentation?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. Whether you're a small business or a large enterprise, you can find a cost-effective solution to manage your gross receipts without compromising on features.

-

What features of airSlate SignNow are beneficial for handling gross receipts?

Key features of airSlate SignNow that benefit gross receipt management include automated reminders for document completion, customizable templates for invoices, and robust security measures. These features ensure that businesses can efficiently manage their gross receipts while maintaining compliance.

-

Can airSlate SignNow be integrated with accounting software for gross receipts?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, allowing businesses to sync their gross receipts data in real-time. This integration helps reduce manual entry errors and ensures that all financial records are up to date.

-

What benefits does eSigning offer for gross receipts documentation?

eSigning through airSlate SignNow speeds up the process of obtaining signatures on gross receipts documentation, allowing for quicker transactions. This not only saves time but also enhances the overall customer experience, leading to increased satisfaction.

-

Is airSlate SignNow suitable for businesses of all sizes managing gross receipts?

Absolutely! airSlate SignNow is designed to meet the needs of businesses of all sizes, from freelancers to large corporations. Its flexible features and pricing make it an ideal choice for anyone looking to efficiently manage gross receipts.

Get more for MONTHLY GROSS RECEIPTS, USE, AND OCCUPANCY TAX RETURN

Find out other MONTHLY GROSS RECEIPTS, USE, AND OCCUPANCY TAX RETURN

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast