Md Form 502d

What is the Md Form 502d

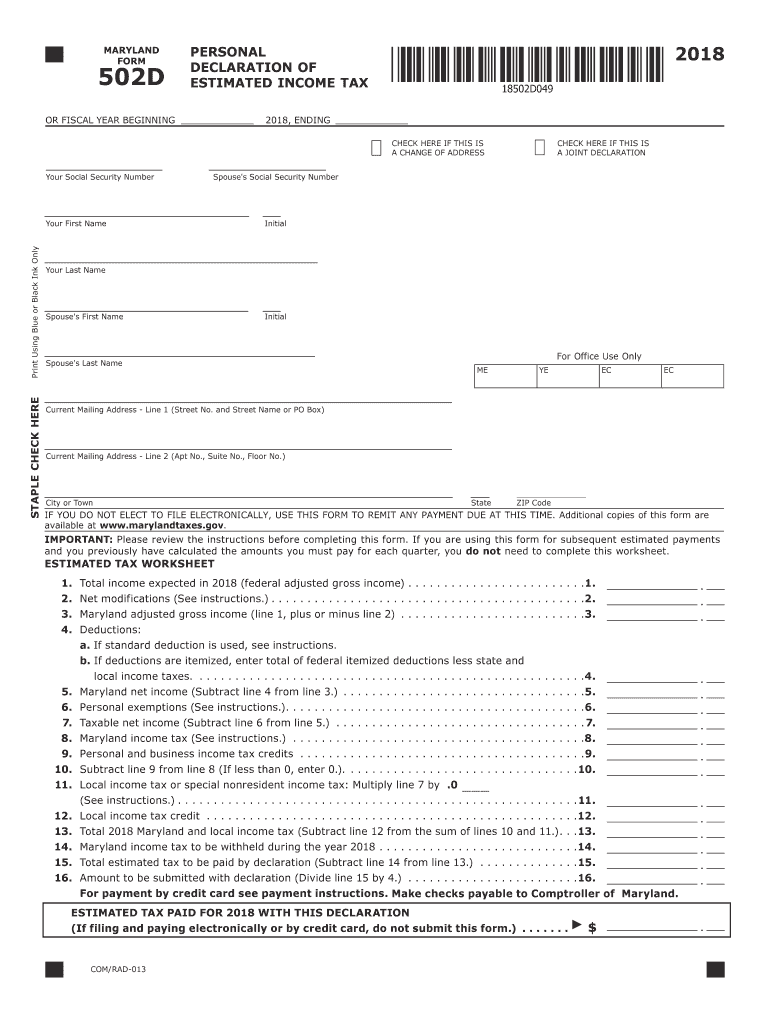

The Maryland Form 502D is an essential document used for estimating income tax obligations for residents of Maryland. This form allows individuals and businesses to calculate their expected tax liability for the year based on their income projections. By providing an estimate, taxpayers can make timely payments throughout the year, avoiding potential penalties for underpayment. The form is particularly useful for those who have income that is not subject to withholding, such as self-employed individuals or those with investment income.

How to use the Md Form 502d

Using the Maryland Form 502D involves several straightforward steps. First, gather all necessary financial information, including income sources and deductions. Next, fill out the form by entering your estimated income and any applicable deductions. The form will guide you through the calculations needed to determine your estimated tax liability. Finally, submit the completed form along with your payment to the Maryland State Comptroller's Office. This ensures that your estimated tax payments are recorded and processed correctly.

Steps to complete the Md Form 502d

Completing the Maryland Form 502D can be broken down into clear steps:

- Gather financial documents, including pay stubs, investment income statements, and previous tax returns.

- Calculate your estimated total income for the year, considering all sources of income.

- Determine any deductions you are eligible for, such as business expenses or retirement contributions.

- Fill out the form by entering your estimated income and deductions in the appropriate sections.

- Calculate your estimated tax liability using the provided tax tables or formulas.

- Review the completed form for accuracy before submitting it.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 502D are crucial for avoiding penalties. Generally, the estimated tax payments are due in four installments throughout the year: April 15, June 15, September 15, and January 15 of the following year. It is important to adhere to these deadlines to ensure compliance with state tax regulations and to avoid interest and penalties on late payments.

Required Documents

To complete the Maryland Form 502D accurately, certain documents are required. These include:

- Previous year’s tax return for reference.

- W-2 forms from employers for wage income.

- 1099 forms for any freelance or contract work.

- Documentation of any other income sources, such as rental or investment income.

- Records of deductible expenses, such as business-related costs or contributions to retirement accounts.

Legal use of the Md Form 502d

The Maryland Form 502D is legally recognized for estimating income tax obligations. When completed and submitted correctly, it serves as a formal declaration of expected income and tax liability. This form is compliant with Maryland tax laws and is essential for maintaining accurate tax records. Utilizing this form helps taxpayers fulfill their legal obligations and avoid potential legal issues related to tax underpayment.

Quick guide on how to complete md form 502d

Complete Md Form 502d effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, alter, and eSign your documents quickly without any hold-ups. Manage Md Form 502d on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to alter and eSign Md Form 502d with ease

- Obtain Md Form 502d and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact confidential information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Md Form 502d while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the md form 502d

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is Maryland estimated income tax and how is it calculated?

Maryland estimated income tax is a pay-as-you-go tax system that requires individuals and businesses to estimate their tax liability for the year and pay a portion of it quarterly. The calculation is based on the previous year’s income or an estimate of the current year's income, ensuring taxpayers meet their obligations and avoid penalties.

-

How can airSlate SignNow help with managing Maryland estimated income tax documents?

airSlate SignNow provides an easy-to-use platform for sending and signing tax-related documents, including those for Maryland estimated income tax. With its eSignature capabilities, you can streamline the process of collecting signatures on important tax documents, ensuring compliance and timely submission.

-

Are there any costs associated with using airSlate SignNow for Maryland estimated income tax forms?

Yes, airSlate SignNow offers a range of pricing plans that cater to different needs, including individuals and businesses handling Maryland estimated income tax forms. The cost is generally affordable compared to traditional methods, providing a cost-effective solution for document management.

-

What features does airSlate SignNow offer to simplify Maryland estimated income tax processes?

AirSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage, making it perfect for managing Maryland estimated income tax processes. These tools enhance efficiency and ensure that all important documents are easily accessible and organized.

-

Can I integrate airSlate SignNow with other software to assist in Maryland estimated income tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software to enhance your Maryland estimated income tax workflow. This integration allows for greater efficiency, ensuring all relevant information is easily shared and accessed.

-

Is airSlate SignNow secure for handling Maryland estimated income tax documents?

Yes, airSlate SignNow employs robust security measures, including bank-level encryption and multi-factor authentication, to protect your Maryland estimated income tax documents. You can trust that your sensitive financial information is secure when using our platform.

-

What benefits does using airSlate SignNow provide for Maryland estimated income tax submissions?

Using airSlate SignNow for Maryland estimated income tax submissions offers several benefits, including reduced processing time and improved accuracy. The eSignature feature allows for quick sign-offs, while automated reminders help you stay on track with payment deadlines.

Get more for Md Form 502d

Find out other Md Form 502d

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe