Minnesota Estimated Tax Voucher Form

What is the Minnesota Estimated Tax Voucher

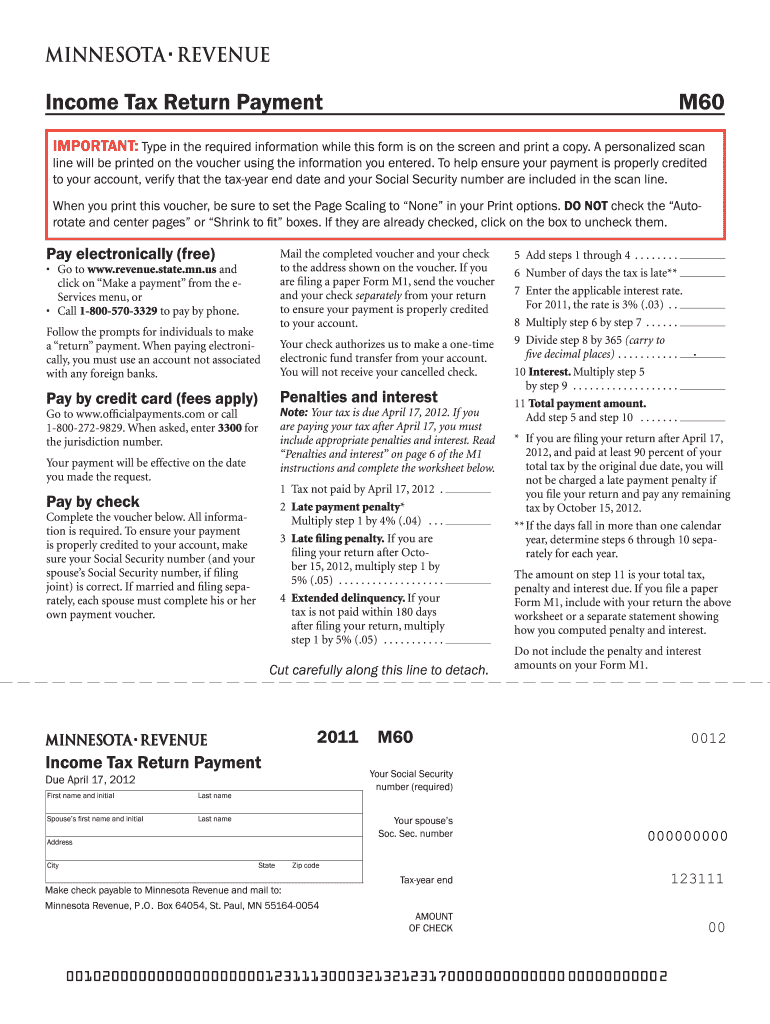

The Minnesota Estimated Tax Voucher is a crucial document for individuals and businesses who expect to owe tax to the state of Minnesota. This form allows taxpayers to make estimated tax payments throughout the year, rather than waiting until the annual tax return is filed. The voucher is specifically designed for those who have income that is not subject to withholding, such as self-employment income, rental income, or investment income. By using this voucher, taxpayers can avoid potential penalties for underpayment and ensure they meet their tax obligations in a timely manner.

How to use the Minnesota Estimated Tax Voucher

Using the Minnesota Estimated Tax Voucher involves several straightforward steps. First, determine the amount of estimated tax you owe based on your expected income for the year. Next, fill out the voucher with your personal information, including your name, address, and Social Security number. Indicate the payment amount and the period for which the payment is being made. Finally, submit the voucher along with your payment to the Minnesota Department of Revenue. It is important to keep a copy of the voucher for your records as proof of payment.

Steps to complete the Minnesota Estimated Tax Voucher

Completing the Minnesota Estimated Tax Voucher requires careful attention to detail. Follow these steps:

- Obtain the Minnesota Estimated Tax Voucher form, which can be downloaded from the Minnesota Department of Revenue website.

- Fill in your personal information, including your name and address.

- Calculate your estimated tax liability based on your income projections.

- Enter the total amount you wish to pay on the voucher.

- Review the completed form for accuracy.

- Submit the voucher along with your payment either online, by mail, or in person at designated locations.

Key elements of the Minnesota Estimated Tax Voucher

The Minnesota Estimated Tax Voucher contains several key elements that are essential for proper completion. These include:

- Taxpayer Information: Name, address, and Social Security number or taxpayer identification number.

- Payment Amount: The total estimated tax payment being submitted.

- Tax Period: The specific period for which the estimated tax payment applies.

- Signature: The taxpayer's signature to validate the submission.

Legal use of the Minnesota Estimated Tax Voucher

The Minnesota Estimated Tax Voucher is legally binding when completed and submitted according to state regulations. It serves as a formal declaration of the taxpayer's intent to pay estimated taxes and must be filled out accurately to avoid potential legal issues. Compliance with the Minnesota Department of Revenue guidelines is essential to ensure that the payment is recognized and processed correctly. Failure to use the voucher properly may result in penalties or interest charges on unpaid taxes.

Filing Deadlines / Important Dates

Timely filing of the Minnesota Estimated Tax Voucher is critical to avoid penalties. The state typically requires estimated tax payments to be made quarterly. The specific deadlines for submission are:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should be aware of these deadlines to ensure compliance and avoid any late fees.

Quick guide on how to complete minnesota estimated tax voucher 2020

Complete Minnesota Estimated Tax Voucher effortlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers since you can access the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Minnesota Estimated Tax Voucher on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to edit and eSign Minnesota Estimated Tax Voucher with ease

- Obtain Minnesota Estimated Tax Voucher and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form – via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Minnesota Estimated Tax Voucher to ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota estimated tax voucher 2020

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is an MN tax payment voucher?

An MN tax payment voucher is a document used by Minnesota taxpayers to make their tax payments. It provides the necessary information for the Minnesota Department of Revenue to process payments efficiently. Using airSlate SignNow, you can easily create and send this voucher electronically, ensuring a hassle-free submission.

-

How can airSlate SignNow help with MN tax payment vouchers?

airSlate SignNow streamlines the process of creating and signing MN tax payment vouchers. Our platform allows you to upload your documents, customize them, and share them for eSignature with ease. This saves you time and ensures that your vouchers are submitted correctly and promptly.

-

Is airSlate SignNow a cost-effective solution for MN tax payment vouchers?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing MN tax payment vouchers. We offer competitive pricing plans that cater to businesses of all sizes. By reducing the need for paper and streamlining the process, our platform helps save you both time and money.

-

What features does airSlate SignNow offer for MN tax payment vouchers?

airSlate SignNow features a user-friendly interface for creating and managing MN tax payment vouchers. Key features include customizable templates, secure eSignature options, and real-time tracking of document status. These tools empower you to manage your tax payments efficiently and effortlessly.

-

Can I integrate airSlate SignNow with other applications for MN tax payment vouchers?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow for MN tax payment vouchers. You can connect with popular apps like Google Drive, Dropbox, and major CRMs. This flexibility makes it easier to manage all your important documents in one place.

-

What are the benefits of using airSlate SignNow for MN tax payment vouchers?

Using airSlate SignNow for MN tax payment vouchers provides numerous benefits, including faster processing times and reduced paper usage. Our electronic solution ensures compliance and security while making it easier to track and manage your payments. Additionally, you can access your documents from anywhere, at any time.

-

Is it easy to get started with airSlate SignNow for MN tax payment vouchers?

Absolutely! Getting started with airSlate SignNow for MN tax payment vouchers is straightforward and user-friendly. Simply sign up for an account, access our templates, and you can begin creating and sending your vouchers in minutes. Our support team is also available to assist with any questions.

Get more for Minnesota Estimated Tax Voucher

Find out other Minnesota Estimated Tax Voucher

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile