Ebf 1 Form

What is the Ebf 1 Form

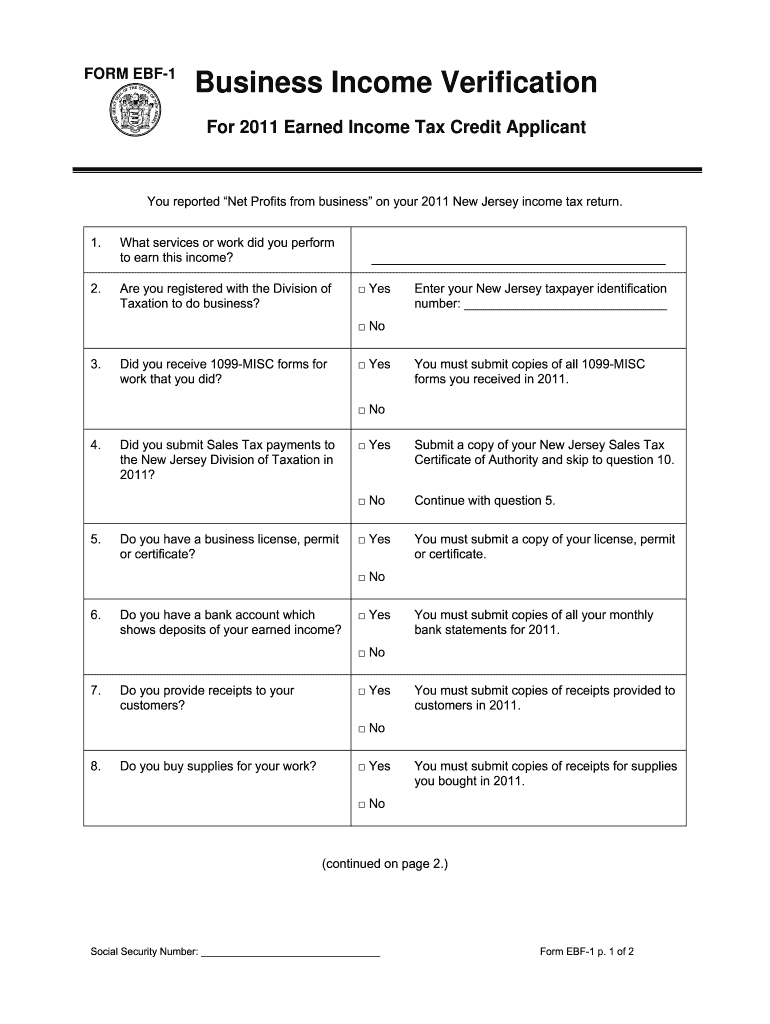

The business income verification form EBF 1 in New Jersey is a crucial document used to verify income for various purposes, including tax credits and financial assistance programs. This form is specifically designed for businesses to report their income accurately, ensuring compliance with state regulations. The EBF 1 form plays a significant role in determining eligibility for the EBF earned income tax credit, which can provide substantial financial benefits to qualifying individuals and families.

How to Use the Ebf 1 Form

To effectively use the business income verification form EBF 1, businesses must first gather all necessary financial documents, such as profit and loss statements, tax returns, and payroll records. Once these documents are prepared, the form can be filled out with accurate income figures. It is essential to review the completed form for any errors before submission, as inaccuracies can lead to delays or denials in processing applications for tax credits or other financial assistance.

Steps to Complete the Ebf 1 Form

Completing the EBF 1 form involves several key steps:

- Gather all relevant financial documents, including tax returns and income statements.

- Fill out the form with accurate income figures, ensuring that all sections are completed.

- Review the form for accuracy and completeness.

- Sign the form electronically or manually, depending on the submission method.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal Use of the Ebf 1 Form

The EBF 1 form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, businesses must adhere to the guidelines set forth by New Jersey's tax authorities. This includes providing truthful information and maintaining compliance with all relevant laws regarding income verification. Utilizing a reliable electronic signature platform can enhance the form's legal standing by ensuring secure and verified submissions.

Required Documents

When filling out the EBF 1 form, several documents are required to substantiate the income reported. These documents typically include:

- Recent tax returns (federal and state)

- Profit and loss statements

- Payroll records

- Any additional documentation that supports income claims, such as bank statements or contracts

Form Submission Methods

The EBF 1 form can be submitted through various methods, providing flexibility for businesses. Common submission methods include:

- Online submission through designated state platforms

- Mailing the completed form to the appropriate tax authority

- In-person submission at local tax offices or designated locations

Eligibility Criteria

To qualify for the benefits associated with the EBF 1 form, businesses must meet specific eligibility criteria. These criteria often include:

- Operating within New Jersey

- Providing accurate income information

- Meeting income thresholds set by state regulations

Understanding these criteria is essential for businesses seeking to maximize their potential tax credits and financial assistance opportunities.

Quick guide on how to complete ebf 1 form

Easily Prepare Ebf 1 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents promptly without delays. Manage Ebf 1 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

Effortlessly Edit and eSign Ebf 1 Form

- Obtain Ebf 1 Form and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant sections of your documents or black out sensitive details with the tools that airSlate SignNow offers specifically for that aim.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Select how you would like to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Ebf 1 Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ebf 1 form

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the business income verification form EBF 1 New Jersey?

The business income verification form EBF 1 New Jersey is a specific document used to authenticate the income of New Jersey-based businesses. This form is essential for various financial transactions, loan applications, or when securing funding. Using a reliable eSigning solution like airSlate SignNow can streamline the process of completing and submitting this necessary form.

-

How does airSlate SignNow facilitate the completion of the EBF 1 form?

airSlate SignNow allows users to easily create, send, and eSign the business income verification form EBF 1 New Jersey from any device. The platform offers a user-friendly interface that simplifies the document management process, ensuring that businesses can complete their forms efficiently without any hassle.

-

What are the pricing options for using airSlate SignNow for the EBF 1 form?

airSlate SignNow offers various pricing plans to cater to different business needs, with competitive rates designed to provide value for your investment. Each plan includes access to essential features for managing documents like the business income verification form EBF 1 New Jersey. Visit our website for detailed pricing information and choose the plan that suits your needs best.

-

What features does airSlate SignNow provide for managing business documents?

airSlate SignNow provides several features to enhance document management, including templates, electronic signatures, and secure cloud storage. These tools are particularly useful for managing the business income verification form EBF 1 New Jersey, ensuring that documents are processed quickly and securely. The platform also supports customization, so businesses can tailor their documents to fit their specific requirements.

-

Is airSlate SignNow secure for handling sensitive documents like the EBF 1 form?

Yes, airSlate SignNow prioritizes the security of your documents, including the business income verification form EBF 1 New Jersey. The platform uses advanced encryption and security protocols to protect sensitive information. You can rest assured that your documents are safe while being stored and transmitted through our system.

-

Can I integrate airSlate SignNow with other software to manage the EBF 1 form?

Absolutely! airSlate SignNow offers integration capabilities with various software platforms, enhancing your workflow efficiency when handling the business income verification form EBF 1 New Jersey. You can seamlessly connect tools such as CRM systems or accounting software, allowing for better document management and communication across your organization.

-

What benefits does using airSlate SignNow provide for businesses handling the EBF 1 form?

By using airSlate SignNow for the business income verification form EBF 1 New Jersey, businesses can save time and reduce paperwork. The platform's electronic signature capability speeds up the signing process, while its intuitive design ensures that users can quickly navigate through document completion. This efficiency can lead to improved productivity and a smoother overall process.

Get more for Ebf 1 Form

Find out other Ebf 1 Form

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now