it 203 F 2016-2026

What is the IT 203 F?

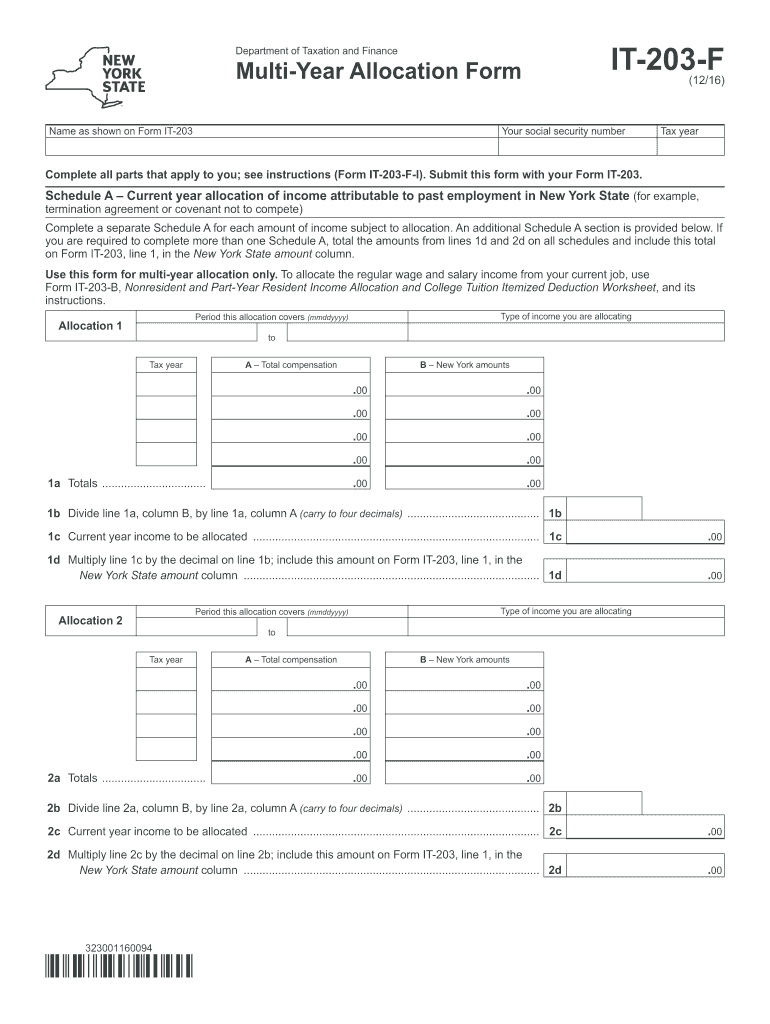

The IT 203 F, also known as the New York State Non-Resident and Part-Year Resident Income Tax Return, is a tax form used by individuals who earn income in New York but do not reside in the state for the entire year. This form allows non-residents to report their income earned from New York sources and calculate their tax liability accordingly. Understanding the purpose of this form is essential for compliance with New York tax laws and ensuring accurate reporting of income.

How to Use the IT 203 F

Using the IT 203 F involves several steps to accurately report your income and determine your tax obligations. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements related to your earnings from New York sources. Next, follow the instructions provided on the form to fill it out correctly. Be sure to include any applicable deductions or credits that may apply to your situation. Once completed, review the form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Steps to Complete the IT 203 F

Completing the IT 203 F requires careful attention to detail. Here are the key steps:

- Gather all relevant income documents, such as W-2 forms and 1099s.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your income earned from New York sources in the appropriate sections of the form.

- Calculate your tax liability based on the income reported and any applicable deductions.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the IT 203 F

The IT 203 F is legally recognized as a valid document for reporting income to the state of New York. It complies with the necessary tax regulations and guidelines established by the New York State Department of Taxation and Finance. Properly completing and submitting this form ensures that non-residents fulfill their tax obligations and avoid potential penalties for non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the IT 203 F are critical to ensure compliance with New York tax laws. Typically, the form must be filed by April fifteenth of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed of any changes to deadlines, as they can vary from year to year.

Required Documents

To successfully complete the IT 203 F, several documents are required:

- W-2 forms from employers reporting income earned in New York.

- 1099 forms for any freelance or contract work performed in the state.

- Documentation of any deductions or credits you plan to claim.

- Identification information, including your Social Security number.

Form Submission Methods

The IT 203 F can be submitted through various methods. Taxpayers may choose to file the form online through the New York State Department of Taxation and Finance website, which offers a secure and efficient way to submit tax returns. Alternatively, individuals can mail a paper copy of the form to the appropriate address indicated in the filing instructions. In-person submissions may also be possible at designated tax offices, depending on local regulations.

Quick guide on how to complete it 203 f

Effortlessly prepare It 203 F on any device

Managing documents online has become increasingly popular among enterprises and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Handle It 203 F on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign It 203 F with ease

- Obtain It 203 F and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with specialized tools provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to share your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your preferred device. Edit and eSign It 203 F and ensure effective communication throughout the form preparation phase with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 203 f

Create this form in 5 minutes!

How to create an eSignature for the it 203 f

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the New York Form IT-203 F?

The New York Form IT-203 F is the Non-Resident and Part-Year Resident Income Tax Return used to report income for individuals who do not reside in New York State full-time. Knowing how to fill out the New York Form IT-203 F correctly can help ensure compliance with state tax regulations and avoid costly errors.

-

How can airSlate SignNow help with the New York Form IT-203 F?

AirSlate SignNow provides an efficient platform for businesses and individuals to fill out, sign, and manage New York Form IT-203 F electronically. With its user-friendly interface and advanced features, you can streamline the document signing process and save precious time during tax season.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers several pricing plans to suit different needs, each designed to provide easy access to electronic signatures and document management, including the New York Form IT-203 F. By selecting a plan that fits your requirements, you can take advantage of all the features needed to efficiently manage your tax documents.

-

Does airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, helping you manage your workflow effectively. Whether you’re using accounting software or document storage services, you can easily connect these tools to streamline filling out the New York Form IT-203 F.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers features like templates, in-app notifications, and secure cloud storage for your documents. These tools facilitate the efficient management of your New York Form IT-203 F, allowing you to track changes and maintain compliance.

-

Is my data secure when using airSlate SignNow for the New York Form IT-203 F?

Absolutely! airSlate SignNow prioritizes data security with advanced encryption technologies. When handling sensitive tax documents like the New York Form IT-203 F, you can trust that your information is safe and protected.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to fill out and sign the New York Form IT-203 F on-the-go. This flexibility ensures that you can manage your important documents whenever and wherever you need.

Get more for It 203 F

Find out other It 203 F

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe