Form 722 Vi 2017

What is the Form 722 Vi

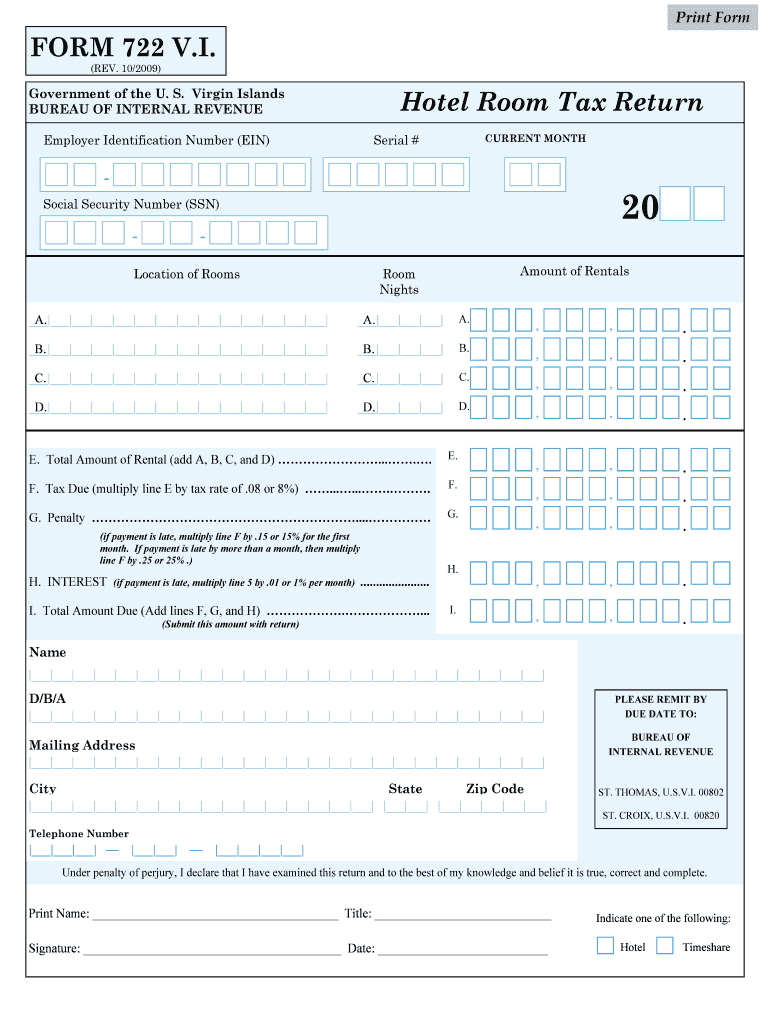

The Form 722 Vi is a specific document used primarily for reporting certain types of income or financial information to the Internal Revenue Service (IRS). This form is essential for individuals or entities who need to disclose particular financial details in compliance with U.S. tax regulations. Understanding the purpose of this form is crucial for accurate reporting and avoiding potential penalties.

How to use the Form 722 Vi

Using the Form 722 Vi involves several straightforward steps. First, gather all necessary financial documents and information that pertain to the income or details you need to report. Next, fill out the form accurately, ensuring that all required fields are completed. After filling out the form, review it carefully for any errors or omissions before submission. It is also advisable to keep a copy of the completed form for your records.

Steps to complete the Form 722 Vi

Completing the Form 722 Vi requires attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide the specific financial details as required by the form, ensuring accuracy in all figures.

- Review the form for completeness, checking that all necessary signatures are included.

- Submit the form according to the guidelines provided, whether online, by mail, or in person.

Legal use of the Form 722 Vi

The legal use of the Form 722 Vi is governed by IRS regulations. To ensure compliance, it is important to understand the legal implications of the information reported. The form must be filled out truthfully and submitted by the appropriate deadlines to avoid penalties. Additionally, using electronic signature solutions can enhance the legal validity of the document, provided they meet the requirements set forth by the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Form 722 Vi are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, it is essential to check for any specific deadlines that may apply to your situation, as extensions or changes can occur. Staying informed about these dates helps avoid late fees and potential penalties.

Required Documents

When preparing to complete the Form 722 Vi, certain documents are necessary to provide accurate information. These may include:

- Previous tax returns for reference.

- Financial statements or records related to the income being reported.

- Any relevant correspondence from the IRS or other financial institutions.

Having these documents ready can streamline the completion process and ensure that all required information is accurately reported.

Quick guide on how to complete form 722 vi 2009

Complete Form 722 Vi effortlessly on any device

Digitally managing documents has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle Form 722 Vi on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 722 Vi without any hassle

- Find Form 722 Vi and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 722 Vi and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 722 vi 2009

Create this form in 5 minutes!

How to create an eSignature for the form 722 vi 2009

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is Form 722 Vi?

Form 722 Vi is a specialized document used for various compliance and organizational purposes. It allows users to streamline their processes, particularly in the realm of eSigning and document management. Understanding Form 722 Vi is essential for businesses looking to enhance their operational efficiency.

-

How does airSlate SignNow support the completion of Form 722 Vi?

airSlate SignNow offers a user-friendly platform that simplifies the signing and submission of Form 722 Vi. With its intuitive interface, businesses can prepare, send, and track the document easily. This helps ensure that the process of completing Form 722 Vi is quick and hassle-free.

-

What are the pricing options for airSlate SignNow when using Form 722 Vi?

airSlate SignNow provides several pricing tiers to accommodate different business needs while managing Form 722 Vi. Each plan offers various features, including document templates, team collaboration, and secure storage. Evaluate your requirements to choose the most suitable plan for handling Form 722 Vi.

-

Can I integrate airSlate SignNow with other applications while using Form 722 Vi?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance the management of Form 722 Vi. This includes popular CRMs, cloud storage services, and productivity tools. These integrations provide additional efficiency and streamline the workflow related to Form 722 Vi.

-

What are the benefits of using airSlate SignNow for Form 722 Vi?

Using airSlate SignNow for Form 722 Vi allows businesses to experience improved document turnaround times and increased accuracy. The platform ensures that all signatures are legally binding and securely stored. This makes managing Form 722 Vi not only efficient but also compliant with industry standards.

-

Is airSlate SignNow secure for handling Form 722 Vi?

Absolutely! airSlate SignNow employs advanced encryption and complies with data protection regulations to ensure the security of Form 722 Vi. With strict access controls and secure cloud storage, you can trust that your documents remain protected throughout the signing process.

-

How can I get started with airSlate SignNow for Form 722 Vi?

Getting started with airSlate SignNow for Form 722 Vi is simple. Visit our website, sign up for an account, and explore the easy-to-use platform. You can access comprehensive tutorials and support resources to assist you in managing Form 722 Vi effectively.

Get more for Form 722 Vi

Find out other Form 722 Vi

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online