540x Form 2014

What is the 540x Form

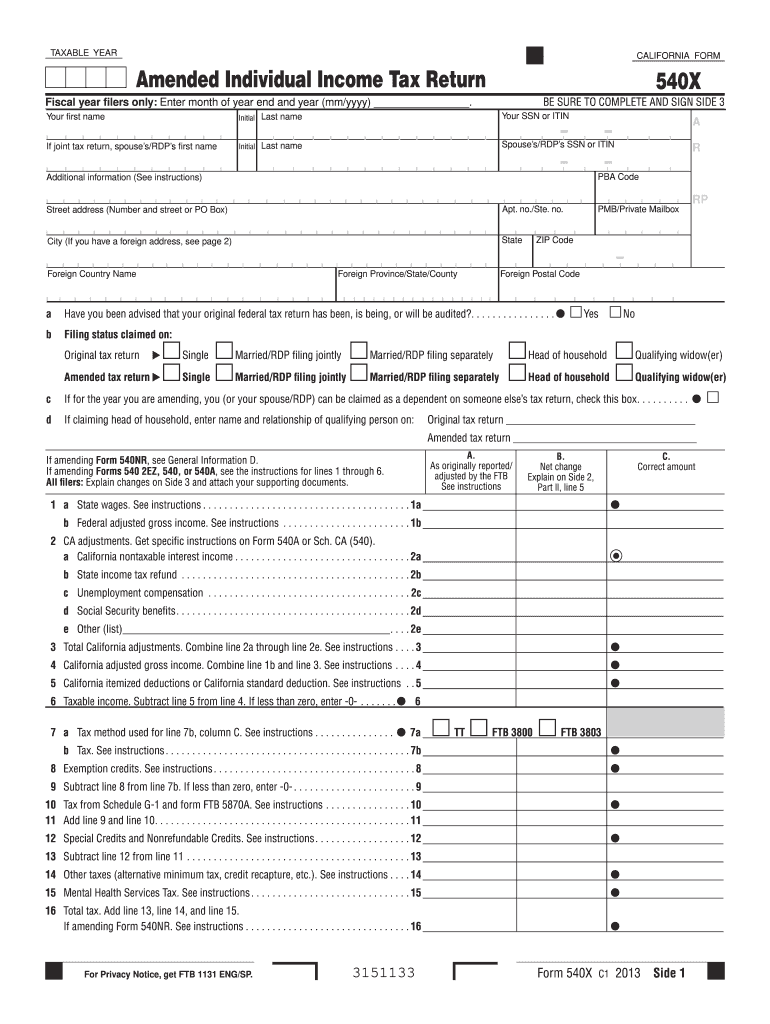

The 540x Form is a California state tax form used for amending a previously filed California income tax return. Taxpayers may need to complete this form to correct errors or make adjustments to their original return. The form allows individuals to report changes in income, deductions, or credits that may affect their tax liability. It is essential for ensuring that taxpayers meet their obligations accurately and receive any potential refunds due to amended claims.

How to use the 540x Form

Using the 540x Form involves several steps to ensure accurate completion. First, gather all necessary documents related to the original return, including W-2s, 1099s, and any other relevant tax information. Next, fill out the 540x Form by providing the required personal information, including your name, address, and Social Security number. Indicate the changes you are making and the reasons for these changes. Finally, review the form for accuracy before submitting it to the California Franchise Tax Board.

Steps to complete the 540x Form

Completing the 540x Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the 540x Form from the California Franchise Tax Board website.

- Fill in your personal information, ensuring it matches your original return.

- Clearly indicate the changes you are making in the appropriate sections.

- Provide explanations for each change in the designated area.

- Calculate any additional tax owed or refund due based on the changes.

- Sign and date the form before submission.

Legal use of the 540x Form

The 540x Form is legally recognized for amending tax returns in California. To ensure its legal validity, it must be completed accurately and submitted within the specified time frame. Taxpayers should retain copies of both the original return and the amended form for their records. Compliance with state tax laws is crucial, as failure to do so may result in penalties or interest on any additional tax owed.

Filing Deadlines / Important Dates

Filing deadlines for the 540x Form are crucial for compliance. Generally, the form must be filed within six months of the original return's due date. For example, if you filed your original return by April 15, you would have until October 15 to submit your amendment. It is important to check for any specific deadlines related to your situation, as they may vary based on individual circumstances or changes in tax law.

Required Documents

When completing the 540x Form, certain documents are necessary to support your amendments. These may include:

- Your original tax return (Form 540 or 540NR).

- Any supporting documentation for changes, such as W-2s or 1099s.

- Records of any deductions or credits you are claiming.

- Any correspondence from the California Franchise Tax Board regarding your original return.

Form Submission Methods (Online / Mail / In-Person)

The 540x Form can be submitted through various methods. Taxpayers may choose to file online using the California Franchise Tax Board's e-file options, which can streamline the process. Alternatively, the form can be mailed to the designated address provided in the instructions. In-person submission is also an option at local Franchise Tax Board offices, although it is advisable to check for any specific requirements or appointments needed before visiting.

Quick guide on how to complete 2013 540x form

Accomplish 540x Form seamlessly on any gadget

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the appropriate template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage 540x Form on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest method to alter and electronically sign 540x Form effortlessly

- Find 540x Form and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all entered information and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or missing documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and electronically sign 540x Form to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 540x form

Create this form in 5 minutes!

How to create an eSignature for the 2013 540x form

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the 540x Form and how is it used?

The 540x Form is a tax amendment form used by individuals to correct their California state tax returns. This form allows taxpayers to report changes to their income, deductions, or credits after submitting their original return, making it essential for accurate tax reporting in California.

-

How can airSlate SignNow help with submitting the 540x Form?

airSlate SignNow streamlines the submission of the 540x Form by allowing users to eSign and send documents securely. This ensures that your amended tax return is submitted promptly and efficiently, saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 540x Form?

Yes, there is a pricing plan for using airSlate SignNow, but it remains an affordable option compared to traditional methods. The pricing provides businesses with a cost-effective solution for sending and eSigning documents like the 540x Form without hidden fees.

-

What features does airSlate SignNow offer for the 540x Form?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking for the 540x Form. These features help users manage their documents efficiently and ensure that the amendment process is smooth and hassle-free.

-

Can I integrate airSlate SignNow with other software for the 540x Form?

Absolutely! airSlate SignNow integrates with various applications such as Google Drive, Salesforce, and Zapier, making it easy to manage the 540x Form alongside your existing tools. This integration enhances workflow efficiency and document management.

-

How does electronic signing of the 540x Form work?

With airSlate SignNow, you can electronically sign the 540x Form using a secure and compliant process. Users can add their signature via a mouse, touchscreen, or mobile device, making the eSigning process quick and accessible.

-

What are the benefits of using airSlate SignNow for amending tax returns with the 540x Form?

Using airSlate SignNow for the 540x Form offers signNow benefits, including increased speed and efficiency, as well as enhanced security for sensitive tax information. Additionally, it reduces paper usage and allows for easier document management.

Get more for 540x Form

- Operation christmas child volunteer waiver form

- Job application template form

- Proces verbaal van oplevering voorbeeld form

- Sodexo fmla form

- Local guardian letter for hostel form

- Agora charter school enrollment notification form 15 16 pn doc

- Madhya pradesh labour welfare fund act 1982 pdf form

- Steve jobs article form

Find out other 540x Form

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now