Md Return Tax Property Form 2021

What is the Md Return Tax Property Form

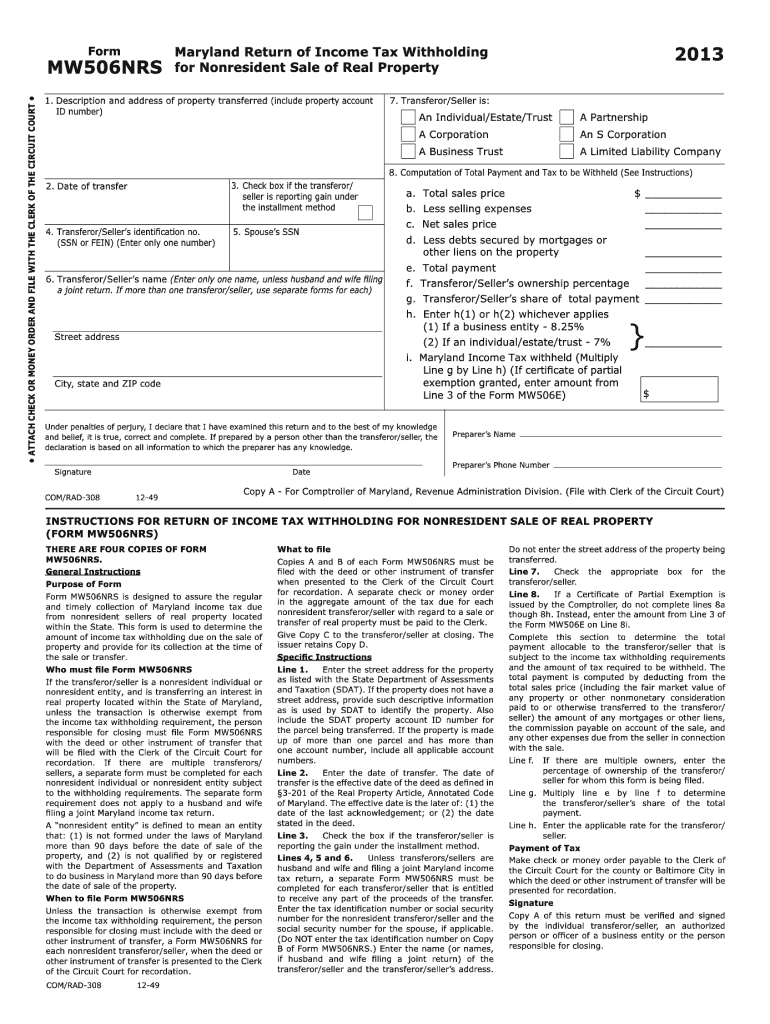

The Md Return Tax Property Form is a specific document used by property owners in Maryland to report property taxes. This form is essential for ensuring compliance with state tax regulations. It provides the necessary information about property ownership, assessed value, and any exemptions that may apply. Understanding this form is crucial for property owners to accurately report their tax obligations and avoid potential penalties.

How to use the Md Return Tax Property Form

Using the Md Return Tax Property Form involves several steps to ensure accurate completion. First, gather all relevant information about the property, including its location, assessed value, and any applicable exemptions. Next, fill out the form carefully, ensuring that all sections are completed. After filling out the form, review it for accuracy before submitting it. It is important to keep a copy for your records. If you are unsure about any section, consider consulting a tax professional for guidance.

Steps to complete the Md Return Tax Property Form

Completing the Md Return Tax Property Form requires attention to detail. Follow these steps:

- Obtain the form from the appropriate state or local tax authority.

- Fill in your personal information, including your name and address.

- Provide details about the property, such as its location and type.

- Include the assessed value of the property as determined by the local tax assessor.

- Indicate any exemptions for which you may qualify.

- Review the completed form for accuracy.

- Submit the form by the designated deadline.

Legal use of the Md Return Tax Property Form

The Md Return Tax Property Form is legally binding and must be completed in accordance with Maryland tax laws. Accurate reporting is essential to avoid penalties or legal issues. The form must be submitted by the deadline set by the state to ensure compliance. Failure to submit this form or providing false information can result in fines or other legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Md Return Tax Property Form are crucial for property owners to remember. Typically, the form must be submitted annually by a specific date set by the Maryland State Department of Assessments and Taxation. Missing this deadline can result in penalties or loss of exemptions. It is advisable to check the official state resources for the most current deadlines and any changes to filing requirements.

Required Documents

When completing the Md Return Tax Property Form, certain documents may be required to support your claims. These can include:

- Proof of property ownership, such as a deed.

- Previous tax returns related to the property.

- Documentation of any exemptions, such as senior citizen or disability status.

- Assessment notices from the local tax authority.

Form Submission Methods (Online / Mail / In-Person)

The Md Return Tax Property Form can typically be submitted through various methods. Property owners may choose to file online through the state’s tax portal, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated offices. Each method has its own advantages, and it is important to choose the one that best suits your needs while ensuring timely submission.

Quick guide on how to complete 2013 md return tax property form

Complete Md Return Tax Property Form effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed files, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to generate, modify, and eSign your documents quickly without delays. Oversee Md Return Tax Property Form on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Md Return Tax Property Form effortlessly

- Locate Md Return Tax Property Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form: via email, text message (SMS), invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, frustrating form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management within a few clicks from any device you prefer. Modify and eSign Md Return Tax Property Form to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 md return tax property form

Create this form in 5 minutes!

How to create an eSignature for the 2013 md return tax property form

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the Md Return Tax Property Form?

The Md Return Tax Property Form is a document used by property owners in Maryland to report property taxes. This form is essential for maintaining accurate tax records and ensuring compliance with state regulations. Completing the Md Return Tax Property Form will help you understand your tax obligations better.

-

How can airSlate SignNow help with the Md Return Tax Property Form?

AirSlate SignNow streamlines the process of completing and eSigning the Md Return Tax Property Form. With its user-friendly interface, you can easily fill out the form, add your electronic signature, and send it securely. This eliminates the hassle of paperwork and speeds up the submission process.

-

Is there a fee to use airSlate SignNow for the Md Return Tax Property Form?

Yes, airSlate SignNow offers a cost-effective subscription plan that varies depending on the features you need. However, using our service to manage the Md Return Tax Property Form can save you time and reduce errors, ultimately making it a worthwhile investment. Check our pricing page for detailed plans.

-

Can I store my Md Return Tax Property Form documents in airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your important documents, including the Md Return Tax Property Form. You can easily access and manage your documents anytime, ensuring that your records are always organized and readily available for review.

-

What features does airSlate SignNow offer for managing the Md Return Tax Property Form?

airSlate SignNow offers several features tailored for managing the Md Return Tax Property Form, including customizable templates, real-time tracking, and the ability to invite multiple signers. These features not only enhance efficiency but also ensure that your document is processed accurately and quickly.

-

Are there integrations available for airSlate SignNow to automate the Md Return Tax Property Form process?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing the automation of the Md Return Tax Property Form process. Whether you're using CRM tools, document management systems, or accounting software, you can easily connect and streamline your workflow, increasing productivity.

-

Is airSlate SignNow secure for handling the Md Return Tax Property Form?

Security is a top priority at airSlate SignNow, and we employ advanced encryption methods to protect all documents, including the Md Return Tax Property Form. Our platform complies with industry standards to ensure that your data remains confidential and secure, providing peace of mind to our users.

Get more for Md Return Tax Property Form

- Firefox bi mart form

- Homestead act for clermont county ohio to fill out online form

- Ri 30 3 form

- School social work referral form template

- Wayleave agreement template form

- Regence uniform medical claim form

- In the circuit court of the eleventh judicial circ form

- Treasurer tax collector biographies current news form

Find out other Md Return Tax Property Form

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free