Maine Form 1040x 2012

What is the Maine Form 1040x

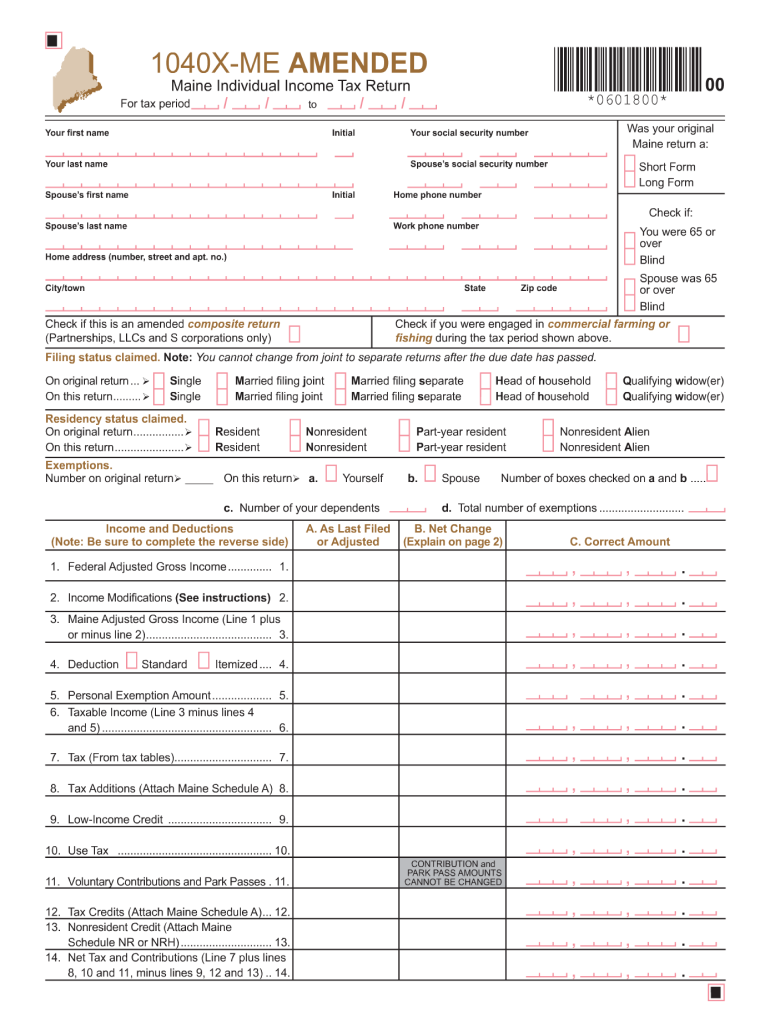

The Maine Form 1040x is a state-specific tax form used by individuals to amend their previously filed Maine income tax returns. This form allows taxpayers to correct errors, change filing statuses, or claim additional deductions or credits that were not included in the original submission. It is crucial for ensuring that the information on file with the state is accurate and up-to-date, which can help avoid potential penalties or issues with future tax filings.

How to use the Maine Form 1040x

Using the Maine Form 1040x involves a few straightforward steps. First, obtain the form from the Maine Revenue Services website or through authorized tax preparation software. Next, fill out the form by providing the necessary information, including your personal details and the specific changes you are making. Be sure to reference the original return to accurately reflect any adjustments. After completing the form, review it for accuracy before submitting it to ensure all corrections are properly documented.

Steps to complete the Maine Form 1040x

Completing the Maine Form 1040x requires careful attention to detail. Follow these steps:

- Begin by entering your name, address, and Social Security number at the top of the form.

- Indicate the tax year you are amending.

- Provide the original amounts from your initial return, along with the corrected figures.

- Clearly explain the reason for each change in the designated section.

- Sign and date the form before submission.

Legal use of the Maine Form 1040x

The Maine Form 1040x is legally binding when filled out and submitted according to state regulations. To ensure its legality, the form must be signed by the taxpayer or their authorized representative. Additionally, the submission must comply with the Maine tax laws and guidelines set forth by the Maine Revenue Services. This includes adhering to deadlines and providing accurate information to avoid issues such as penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Maine Form 1040x are critical for compliance. Generally, the form must be submitted within three years of the original return's due date, including extensions. Taxpayers should also be aware of any specific deadlines for claiming refunds or making payments related to the amended return. Keeping track of these dates helps ensure that taxpayers do not miss opportunities for corrections or refunds.

Form Submission Methods (Online / Mail / In-Person)

The Maine Form 1040x can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online submission via authorized tax software that supports e-filing.

- Mailing the completed form to the appropriate address provided by the Maine Revenue Services.

- In-person submission at designated state tax offices, although this may require an appointment.

Required Documents

When filing the Maine Form 1040x, certain documents may be required to support the changes being made. These can include:

- A copy of the original tax return.

- Any relevant supporting documentation for the changes, such as W-2s, 1099s, or schedules.

- Proof of payment for any additional taxes owed, if applicable.

Quick guide on how to complete maine form 1040x 2006

Effortlessly Prepare Maine Form 1040x on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Maine Form 1040x on any device using airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

How to Edit and Electronically Sign Maine Form 1040x with Ease

- Obtain Maine Form 1040x and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive data using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Maine Form 1040x to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maine form 1040x 2006

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the Maine Form 1040x?

The Maine Form 1040x is an amendment form that allows taxpayers to correct errors on their originally filed Maine individual income tax return. If you've made mistakes, such as reporting income or deductions incorrectly, this form ensures you can rectify those errors. Using airSlate SignNow, you can easily eSign and submit your Maine Form 1040x online.

-

How can airSlate SignNow assist with the Maine Form 1040x?

airSlate SignNow streamlines the process of filling out and submitting the Maine Form 1040x by providing an easy-to-use platform for online document management. You can securely eSign your amended returns and share them with tax professionals or directly with the state. This eliminates the hassle of printing and mailing paper forms, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for Maine Form 1040x?

Yes, there is a subscription cost associated with using airSlate SignNow, but it offers a cost-effective solution for businesses and individuals needing to eSign documents, including the Maine Form 1040x. Pricing is competitive and based on various plans to accommodate different needs. Plus, investing in a reliable eSigning solution can save you money in the long run by streamlining your tax preparation process.

-

What features does airSlate SignNow offer for handling Maine Form 1040x?

airSlate SignNow includes several features designed for easy document management, such as customizable templates, secure storage, and online collaboration. These tools help ensure that filling out your Maine Form 1040x is efficient and error-free. The ability to access your documents anytime, anywhere adds flexibility to the filing process.

-

Are there any benefits to using airSlate SignNow for my Maine Form 1040x submissions?

Using airSlate SignNow for your Maine Form 1040x brings numerous benefits, including enhanced document security and reduced processing times. The platform allows you to track the status of your submissions easily, ensuring that you know when your amendments have been filed. Additionally, the user-friendly interface helps boost productivity.

-

Can I integrate airSlate SignNow with other software for my Maine Form 1040x needs?

Yes, airSlate SignNow offers integrations with various software solutions that facilitate easy document management and eSigning. Whether you're using accounting software or a tax preparation application, you can seamlessly incorporate airSlate SignNow into your workflow for your Maine Form 1040x and ensure a smooth filing process.

-

How does airSlate SignNow ensure the security of my Maine Form 1040x data?

airSlate SignNow prioritizes the security of your data with state-of-the-art encryption and secure cloud storage. When you eSign your Maine Form 1040x, your personal information remains protected against unauthorized access. Trust is crucial when handling sensitive tax documents, and SignNow offers the level of security you need.

Get more for Maine Form 1040x

- Eta 671 3141 form

- Umass lowell transcript request form

- Format of certificate to be issued by the district education officer

- Non probate affidavit form arizona

- Fresno police report online form

- Travel voucher pdf broward county public schools broward k12 fl form

- Vol app 07 08 columbia county schools form

- Lake county pre arranged absence form

Find out other Maine Form 1040x

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast