5081, Sales, Use and Withholding Taxes Annual Return Form

What is the 5081, Sales, Use And Withholding Taxes Annual Return

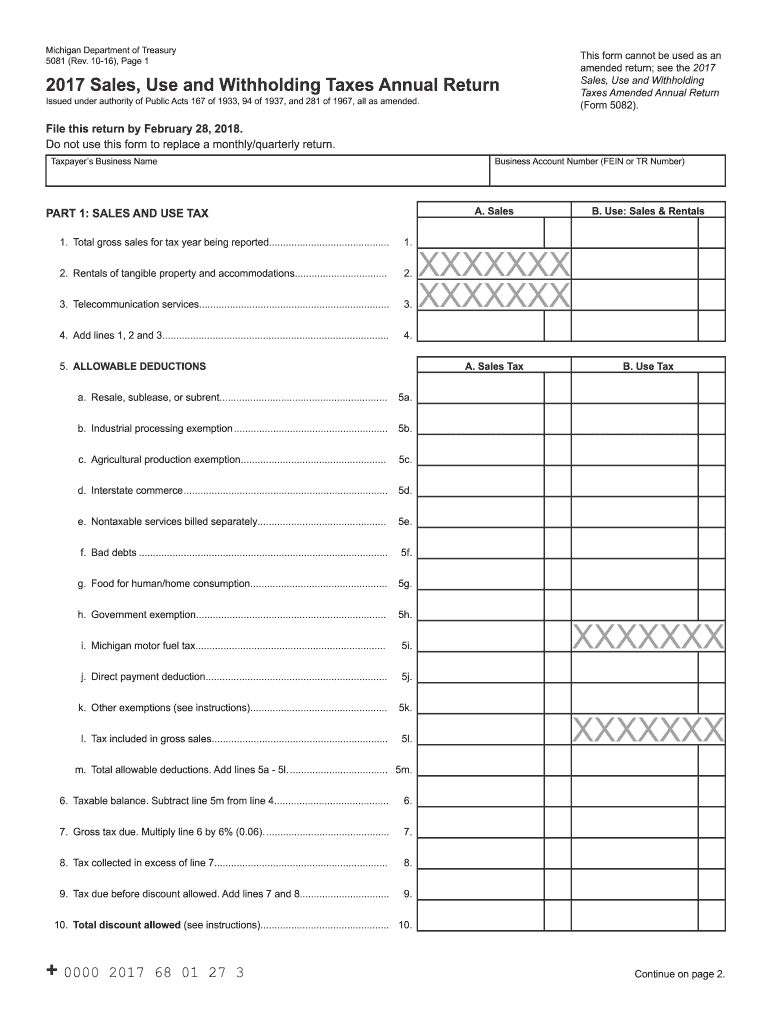

The 5081 form, officially known as the Sales, Use And Withholding Taxes Annual Return, is a tax document used primarily by businesses in the United States to report sales and use taxes collected during the tax year. This form is essential for ensuring compliance with state tax regulations. It typically includes information about total sales, taxable sales, and the amount of sales tax collected. Businesses must accurately complete this form to avoid penalties and ensure that they are fulfilling their tax obligations.

Steps to complete the 5081, Sales, Use And Withholding Taxes Annual Return

Completing the 5081 form involves several key steps:

- Gather necessary financial records, including sales receipts and tax collected.

- Fill in the business information section, including your business name, address, and tax identification number.

- Report total sales and calculate the taxable sales amount.

- Enter the total sales tax collected during the reporting period.

- Review the completed form for accuracy and ensure all calculations are correct.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the 5081, Sales, Use And Withholding Taxes Annual Return

The 5081 form is legally binding when completed and submitted in accordance with state regulations. To ensure its legal validity, businesses must adhere to the guidelines set forth by the relevant taxing authorities. This includes providing accurate information and maintaining records that support the figures reported on the form. Compliance with eSignature laws, such as the ESIGN Act, is essential when submitting the form electronically, as it ensures that the digital signature is recognized legally.

Filing Deadlines / Important Dates

Filing deadlines for the 5081 form can vary by state, but they typically align with the end of the tax year. Businesses should be aware of these important dates to avoid late fees and penalties. It is advisable to check with the state tax authority for specific deadlines and any changes that may occur annually. Keeping a calendar of these dates can help ensure timely submission and compliance.

Form Submission Methods (Online / Mail / In-Person)

The 5081 form can usually be submitted through various methods, including:

- Online Submission: Many states offer electronic filing options through their tax authority websites, allowing for quick and efficient submission.

- Mail: Businesses can print the completed form and send it via postal mail to the designated tax authority address.

- In-Person: Some states may allow in-person submissions at local tax offices, providing an option for those who prefer direct interaction.

Penalties for Non-Compliance

Failure to file the 5081 form by the deadline or providing inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand the implications of non-compliance and take proactive measures to ensure timely and accurate submissions. Regular training and updates on tax obligations can help mitigate these risks.

Quick guide on how to complete 5081 sales use and withholding taxes annual return 101881273

Effortlessly Prepare 5081, Sales, Use And Withholding Taxes Annual Return on Any Device

Managing documents online has gained traction among both organizations and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without delays. Handle 5081, Sales, Use And Withholding Taxes Annual Return on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

The easiest way to edit and electronically sign 5081, Sales, Use And Withholding Taxes Annual Return with ease

- Find 5081, Sales, Use And Withholding Taxes Annual Return and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Mark important sections of the documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal value as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign 5081, Sales, Use And Withholding Taxes Annual Return to ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5081 sales use and withholding taxes annual return 101881273

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is tax form 5081 used for?

Tax form 5081 is utilized for reporting certain tax-related transactions depending on your business needs. It is essential for ensuring compliance with federal regulations, making accurate reporting crucial for your financial records.

-

How can airSlate SignNow help me with tax form 5081?

airSlate SignNow simplifies the process of completing and eSign tax form 5081, allowing you to easily fill in fields and capture signatures. With our platform, you can efficiently manage the document flow, ensuring your forms are signed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for tax form 5081?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business sizes and needs. Our plans are designed to provide a cost-effective solution for handling documents like tax form 5081, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with my existing software to manage tax form 5081?

Absolutely! airSlate SignNow supports integrations with a wide variety of existing software, making it easy to incorporate tax form 5081 into your current workflow. Our platform seamlessly connects with tools you already use, enhancing productivity.

-

What features does airSlate SignNow offer for handling tax form 5081?

airSlate SignNow provides features such as document templates, eSignatures, and secure cloud storage specifically designed for tax form 5081. These tools streamline your documentation process, ensuring accuracy and timely submission.

-

How does airSlate SignNow ensure the security of my tax form 5081?

The security of your tax form 5081 is a top priority at airSlate SignNow. We implement advanced encryption methods and comply with industry standards to protect your sensitive information throughout the signing process and beyond.

-

Can I track the status of my tax form 5081 with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features that allow you to monitor the status of your tax form 5081. You will receive notifications when your document is viewed, signed, or completed, giving you peace of mind.

Get more for 5081, Sales, Use And Withholding Taxes Annual Return

Find out other 5081, Sales, Use And Withholding Taxes Annual Return

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter