Minnesota Form St3 2019

What is the Minnesota Form St3

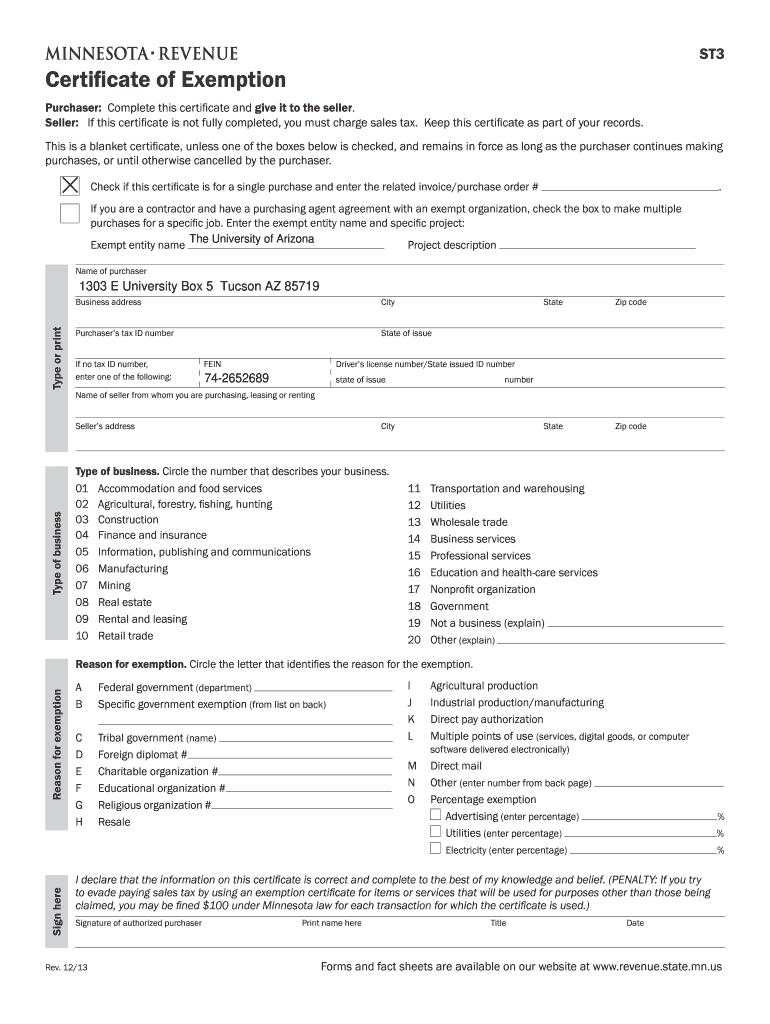

The Minnesota Form St3 is a crucial document used primarily for sales tax exemption purposes in the state of Minnesota. This form allows certain entities, such as nonprofits and government agencies, to purchase goods and services without paying sales tax. By completing the Minnesota Form St3, eligible organizations can demonstrate their tax-exempt status to vendors, ensuring compliance with state tax regulations while minimizing unnecessary expenses.

How to use the Minnesota Form St3

To utilize the Minnesota Form St3 effectively, eligible organizations must first ensure they meet the criteria for tax exemption. Once eligibility is confirmed, the organization should fill out the form with accurate information, including the name, address, and tax identification number. After completing the form, it should be presented to vendors at the time of purchase to claim the exemption. It is essential to keep a copy of the form for the organization's records, as it may be required for future audits or inquiries from the Minnesota Department of Revenue.

Steps to complete the Minnesota Form St3

Completing the Minnesota Form St3 involves several straightforward steps:

- Gather necessary information, including the organization’s name, address, and tax identification number.

- Indicate the type of exemption being claimed, ensuring it aligns with the organization's status.

- Provide details of the vendor from whom goods or services are being purchased.

- Sign and date the form to certify that the information provided is accurate.

- Distribute the completed form to the vendor at the time of purchase.

Legal use of the Minnesota Form St3

The Minnesota Form St3 is legally binding when completed correctly and used in accordance with state laws. It serves as proof of the organization's tax-exempt status, allowing for the exemption of sales tax on qualifying purchases. Misuse of the form, such as providing it to vendors when not eligible, can result in penalties, including back taxes owed and potential fines. Therefore, it is crucial for organizations to ensure their eligibility and maintain compliance with all relevant tax regulations.

Key elements of the Minnesota Form St3

Several key elements must be included in the Minnesota Form St3 for it to be valid:

- Organization Name: The legal name of the entity claiming the exemption.

- Address: The physical address of the organization.

- Tax Identification Number: The unique identifier assigned to the organization by the IRS.

- Type of Exemption: A clear indication of the specific exemption being claimed.

- Signature: An authorized representative must sign the form to validate it.

Who Issues the Form

The Minnesota Form St3 is issued by the Minnesota Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses and organizations. The form can be obtained directly from the Department of Revenue's official website or through authorized tax professionals. It is important for organizations to ensure they are using the most current version of the form to avoid any compliance issues.

Quick guide on how to complete minnesota form st3 2013

Complete Minnesota Form St3 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Handle Minnesota Form St3 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Minnesota Form St3 effortlessly

- Locate Minnesota Form St3 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Confirm the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or mislaid files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Minnesota Form St3 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form st3 2013

Create this form in 5 minutes!

How to create an eSignature for the minnesota form st3 2013

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Minnesota Form St3 and how is it used?

The Minnesota Form St3 is a tax exemption certificate used by purchasers to claim exemption from sales tax on certain purchases. It is essential for businesses in Minnesota to correctly fill out this form to avoid unnecessary tax liabilities. Utilizing airSlate SignNow can streamline the process of signing and submitting Minnesota Form St3 electronically, making it more efficient.

-

How does airSlate SignNow support the Minnesota Form St3 process?

AirSlate SignNow offers a straightforward and efficient way for users to complete and eSign Minnesota Form St3. Our platform allows for secure electronic signing and submission of documents, ensuring compliance and reducing processing time. This means you can manage your tax-exempt purchases without hassle.

-

Are there any costs associated with using airSlate SignNow for the Minnesota Form St3?

AirSlate SignNow offers various pricing plans to accommodate different business needs when handling Minnesota Form St3. The pricing is competitive and designed to provide excellent value, especially for businesses that frequently deal with tax exemption forms. Users can choose the plan that best fits their budget and requirements.

-

What benefits does airSlate SignNow provide for managing Minnesota Form St3?

Using airSlate SignNow to manage Minnesota Form St3 offers several benefits, including improved efficiency, reduced paperwork, and enhanced security. E-signing documents electronically not only saves time but also helps in maintaining accurate records. Furthermore, you can send reminders and notifications to ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for Minnesota Form St3?

Yes, airSlate SignNow integrates seamlessly with various software applications that your business may already use, allowing for easy management of the Minnesota Form St3. This integration enables you to automate workflows and connect your documents with CRM tools, enhancing your overall productivity. Check our available integrations to find the ones that fit your needs.

-

Is assistance available for completing the Minnesota Form St3 using airSlate SignNow?

Absolutely! AirSlate SignNow provides comprehensive support and resources to guide users in completing the Minnesota Form St3. Our customer support team is available to answer any questions and provide assistance throughout the process, ensuring you can confidently utilize our platform.

-

What security features does airSlate SignNow offer for Minnesota Form St3?

AirSlate SignNow prioritizes your data security, offering advanced encryption and compliance with industry standards. When you handle Minnesota Form St3 and other sensitive documents, you can trust that your information is protected from unauthorized access. Our user-friendly interface also allows you to manage permissions effectively.

Get more for Minnesota Form St3

Find out other Minnesota Form St3

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe