Missouri Tax Clearance Form 2015

What is the Missouri Tax Clearance Form

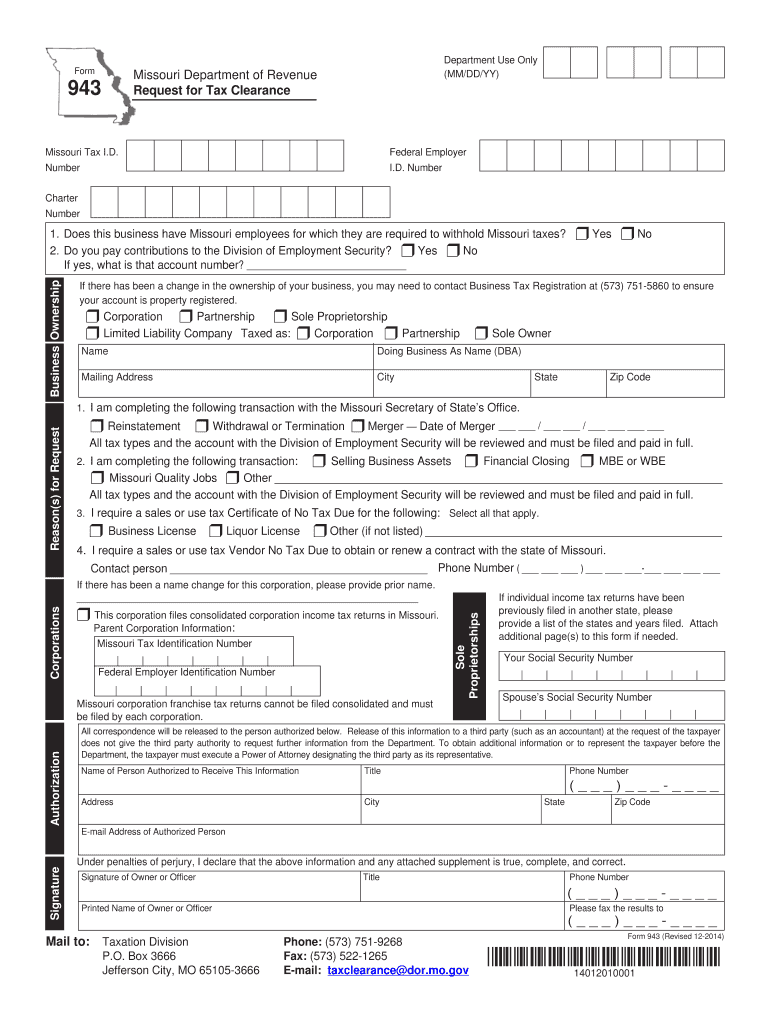

The Missouri Tax Clearance Form is a document that certifies an individual's or business's compliance with state tax obligations. This form is often required for various purposes, including business licensing, loan applications, and other official transactions. It serves as proof that all taxes owed to the state have been paid or that the taxpayer is in good standing with the Missouri Department of Revenue. This form is essential for individuals and businesses looking to establish credibility and ensure smooth operations within the state.

How to obtain the Missouri Tax Clearance Form

To obtain the Missouri Tax Clearance Form, individuals or businesses can visit the Missouri Department of Revenue's website. The form is typically available for download in a PDF format, allowing users to complete it electronically or print it for manual completion. Additionally, applicants may request the form directly from their local tax office or through customer service channels provided by the Department of Revenue. It is important to ensure that the most current version of the form is used to avoid any issues during submission.

Steps to complete the Missouri Tax Clearance Form

Completing the Missouri Tax Clearance Form involves several key steps:

- Download the form from the Missouri Department of Revenue website or obtain a copy from a local tax office.

- Fill out the required information, including personal details or business information, tax identification numbers, and any relevant tax periods.

- Review the form for accuracy and completeness to ensure all necessary information is provided.

- Sign the form electronically or manually, depending on the submission method chosen.

- Submit the completed form through the designated channels, which may include online submission, mailing it to the appropriate office, or delivering it in person.

Legal use of the Missouri Tax Clearance Form

The Missouri Tax Clearance Form is legally binding when completed and submitted according to state regulations. It is important to ensure that the information provided is accurate and truthful, as any discrepancies may lead to legal consequences or delays in processing. The form must be signed by the taxpayer or an authorized representative, and it is advisable to keep a copy of the submitted form for personal records. Compliance with all relevant laws and regulations is crucial to maintain good standing with the state.

Key elements of the Missouri Tax Clearance Form

Key elements of the Missouri Tax Clearance Form include:

- Taxpayer identification information, such as name, address, and Social Security or Employer Identification Number.

- Details regarding the type of taxes being cleared, including income tax, sales tax, and other applicable taxes.

- Signature of the taxpayer or authorized representative, affirming the accuracy of the information provided.

- Any additional documentation or information required by the Missouri Department of Revenue.

Form Submission Methods

The Missouri Tax Clearance Form can be submitted through various methods:

- Online: Some users may have the option to submit the form electronically through the Missouri Department of Revenue's online portal.

- Mail: The completed form can be mailed to the appropriate tax office, as specified on the form or the Department's website.

- In-Person: Taxpayers may also choose to deliver the form in person at their local tax office for immediate processing.

Quick guide on how to complete missouri tax clearance 2014 form

Effortlessly Prepare Missouri Tax Clearance Form on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Missouri Tax Clearance Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Missouri Tax Clearance Form effortlessly

- Locate Missouri Tax Clearance Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Missouri Tax Clearance Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri tax clearance 2014 form

Create this form in 5 minutes!

How to create an eSignature for the missouri tax clearance 2014 form

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is a Missouri Tax Clearance Form?

A Missouri Tax Clearance Form is an official document that verifies an individual or business's compliance with state tax obligations. It is often required for licensing, bidding on contracts, or applying for certain permits in Missouri. Obtaining this form ensures that all state taxes are paid and your compliance is up to date.

-

How can airSlate SignNow help with the Missouri Tax Clearance Form?

airSlate SignNow simplifies the process of obtaining and signing the Missouri Tax Clearance Form. With our easy-to-use platform, you can securely eSign this document and send it directly to the relevant authorities. This not only saves time but also provides a streamlined experience for all your document management needs.

-

Is there a cost associated with using airSlate SignNow for the Missouri Tax Clearance Form?

Using airSlate SignNow comes with various pricing plans that are tailored to fit different business needs. Our plans are cost-effective and designed to ensure you get the best value while managing your documents, such as the Missouri Tax Clearance Form. You can choose the plan that best fits your usage requirements.

-

What are the key features of airSlate SignNow when processing the Missouri Tax Clearance Form?

airSlate SignNow offers features like eSignature, document templates, and automated workflows specifically for documents like the Missouri Tax Clearance Form. Additionally, you can track document status and receive notifications, ensuring that you never miss an important deadline. Our platform enhances efficiency in managing tax-related paperwork.

-

Can I integrate airSlate SignNow with other software to manage the Missouri Tax Clearance Form?

Yes, airSlate SignNow allows integrations with various other software and applications to streamline your workflow, including popular business and productivity tools. This integration capability means you can efficiently manage the Missouri Tax Clearance Form alongside your other business processes, improving overall productivity.

-

What are the benefits of using eSignatures for my Missouri Tax Clearance Form?

Using airSlate SignNow for eSignatures on your Missouri Tax Clearance Form offers numerous benefits, such as enhanced security, reduced turnaround time, and convenience. Electronic signatures are legally binding and provide a paperless solution that is both eco-friendly and efficient. This modern approach eliminates the hassle of printing, scanning, and mailing documents.

-

How long does it take to get a Missouri Tax Clearance Form processed using airSlate SignNow?

The processing time for a Missouri Tax Clearance Form can vary depending on various factors, but airSlate SignNow signNowly expedites the signing process. Once you have completed all necessary steps, the form can be submitted quickly, allowing you to receive confirmations faster than traditional methods. This speed can help you meet important deadlines.

Get more for Missouri Tax Clearance Form

- Coaching intake form 84244043

- American express letterhead form

- Past simple past continuous exercises pdf macmillan form

- Check in form

- Zoning variance application city of orlando cityoforlando form

- Instructions for form 8889 instructions for form 8889 health savings accounts hsas

- Aremslicense form

- Expungement application 784477030 form

Find out other Missouri Tax Clearance Form

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed