Fillable Form 943 Request for Tax Clearance 1 Does Missouri 2022-2026

Understanding the Fillable Form 943 Request for Tax Clearance

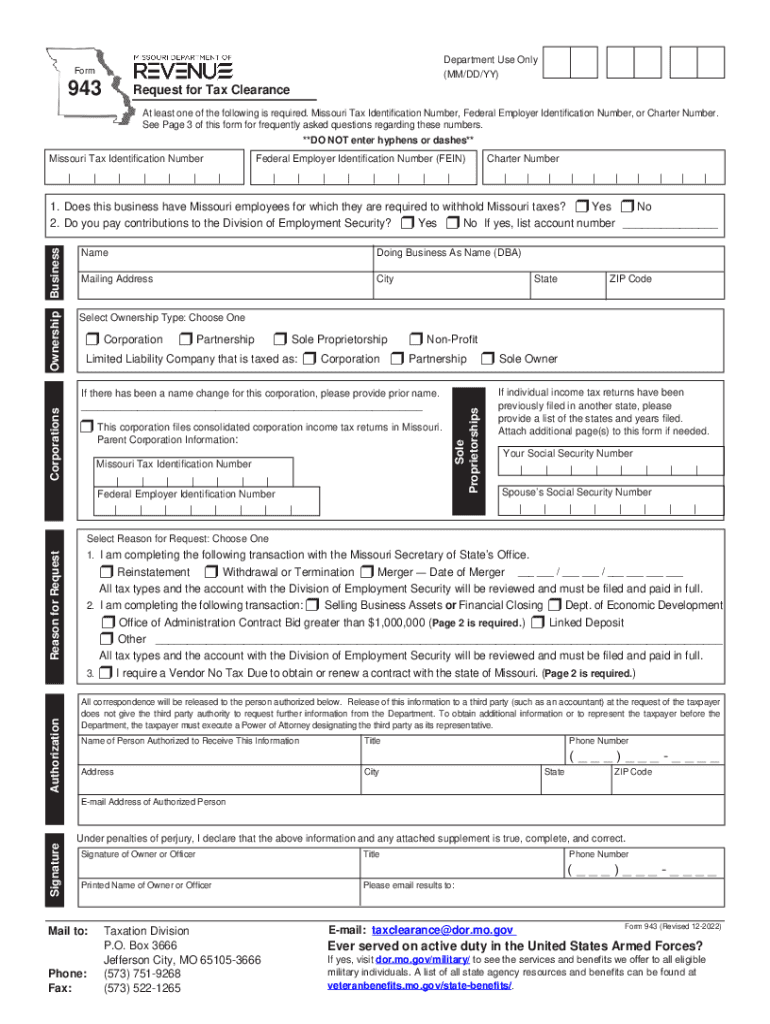

The Fillable Form 943, also known as the Missouri Form 943 Request for Tax Clearance, is a crucial document for individuals and businesses seeking to verify their tax compliance status in Missouri. This form is typically required when applying for various licenses, permits, or contracts that necessitate proof of good standing with the Missouri Department of Revenue. It serves as an official declaration that all tax obligations have been met, ensuring that the individual or entity is in compliance with state tax laws.

Steps to Complete the Fillable Form 943 Request for Tax Clearance

Filling out the Missouri Form 943 involves several steps to ensure accuracy and compliance. First, gather all necessary information, including your tax identification number and details about your tax filings. Next, download the form from the Missouri Department of Revenue website or access it through a digital platform that supports eSigning. Carefully fill out the required fields, ensuring that all information is correct. After completing the form, review it for any errors before submitting it. Finally, choose your submission method—whether online, by mail, or in-person—to ensure that it reaches the appropriate department.

Required Documents for Form 943 Submission

When preparing to submit the Missouri Form 943, certain documents may be required to accompany your request. These typically include proof of identity, such as a driver’s license or state ID, and any relevant tax documents that demonstrate compliance with state tax laws. Additionally, if you are submitting the form for a business entity, you may need to provide documentation related to the business’s tax filings and status. Ensuring that all required documents are included can help expedite the processing of your request.

Legal Use of the Fillable Form 943 Request for Tax Clearance

The legal validity of the Missouri Form 943 hinges on its proper completion and submission. This form must be filled out accurately to reflect true tax compliance, as any discrepancies could lead to legal repercussions or delays in processing. The form is recognized by state authorities and can be used in various legal contexts, such as securing business licenses or permits. It is essential to understand that submitting a false form can result in penalties, including fines or legal action.

Form Submission Methods for Form 943

Submitting the Missouri Form 943 can be done through multiple methods, providing flexibility to users. The form can be submitted online through the Missouri Department of Revenue’s website, allowing for quick processing. Alternatively, individuals may choose to mail the completed form to the designated address or deliver it in person at a local Department of Revenue office. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Eligibility Criteria for Filing Form 943

To file the Missouri Form 943, individuals and businesses must meet specific eligibility criteria. Generally, the form is intended for those who have tax obligations in Missouri and require proof of tax clearance for various purposes. This includes businesses applying for licenses, individuals seeking permits, or those involved in transactions that necessitate verification of tax compliance. Understanding these criteria is essential to ensure that your request for tax clearance is valid and accepted.

Quick guide on how to complete fillable form 943 request for tax clearance 1 does missouri

Complete Fillable Form 943 Request For Tax Clearance 1 Does Missouri with ease on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and safely keep it stored online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Fillable Form 943 Request For Tax Clearance 1 Does Missouri on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Fillable Form 943 Request For Tax Clearance 1 Does Missouri effortlessly

- Obtain Fillable Form 943 Request For Tax Clearance 1 Does Missouri and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Select essential sections of your documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign Fillable Form 943 Request For Tax Clearance 1 Does Missouri and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable form 943 request for tax clearance 1 does missouri

Create this form in 5 minutes!

How to create an eSignature for the fillable form 943 request for tax clearance 1 does missouri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 943 Missouri?

Form 943 Missouri is a state-specific tax form used by employers to report income and payroll taxes for agricultural employees. It is essential for businesses in the agriculture sector in Missouri to file this form correctly to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with Form 943 Missouri?

airSlate SignNow streamlines the process of filling out and eSigning Form 943 Missouri. Our platform provides templates and easy-to-use tools that allow businesses to complete and send this form efficiently, reducing the time spent on paperwork.

-

Is airSlate SignNow affordable for small businesses needing Form 943 Missouri?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses needing to manage Form 943 Missouri. We aim to provide a budget-friendly solution without compromising on features, so businesses can achieve compliance without breaking the bank.

-

What features does airSlate SignNow provide for managing Form 943 Missouri?

airSlate SignNow offers robust features such as customizable templates, eSigning capabilities, and document tracking. These features simplify the management of Form 943 Missouri, allowing businesses to focus on their operations rather than paperwork.

-

Are there mobile options for completing Form 943 Missouri with airSlate SignNow?

Absolutely! airSlate SignNow has a mobile-friendly interface that allows users to complete and eSign Form 943 Missouri from any device. This flexibility ensures that employers can manage their payroll documents anytime, anywhere.

-

Can I integrate airSlate SignNow with other software for Form 943 Missouri filing?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for filing Form 943 Missouri. This integration allows for easy document sharing and improved tracking of tax-related documents.

-

What benefits does airSlate SignNow provide for businesses needing Form 943 Missouri?

Using airSlate SignNow for Form 943 Missouri helps businesses save time and ensure accuracy in their filings. With automated eSigning and document management, companies can reduce errors and stay organized while meeting compliance requirements.

Get more for Fillable Form 943 Request For Tax Clearance 1 Does Missouri

Find out other Fillable Form 943 Request For Tax Clearance 1 Does Missouri

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe