Form MO 1120 Instructions Dor Mo 2019

What is the Form MO 1120 Instructions Dor Mo

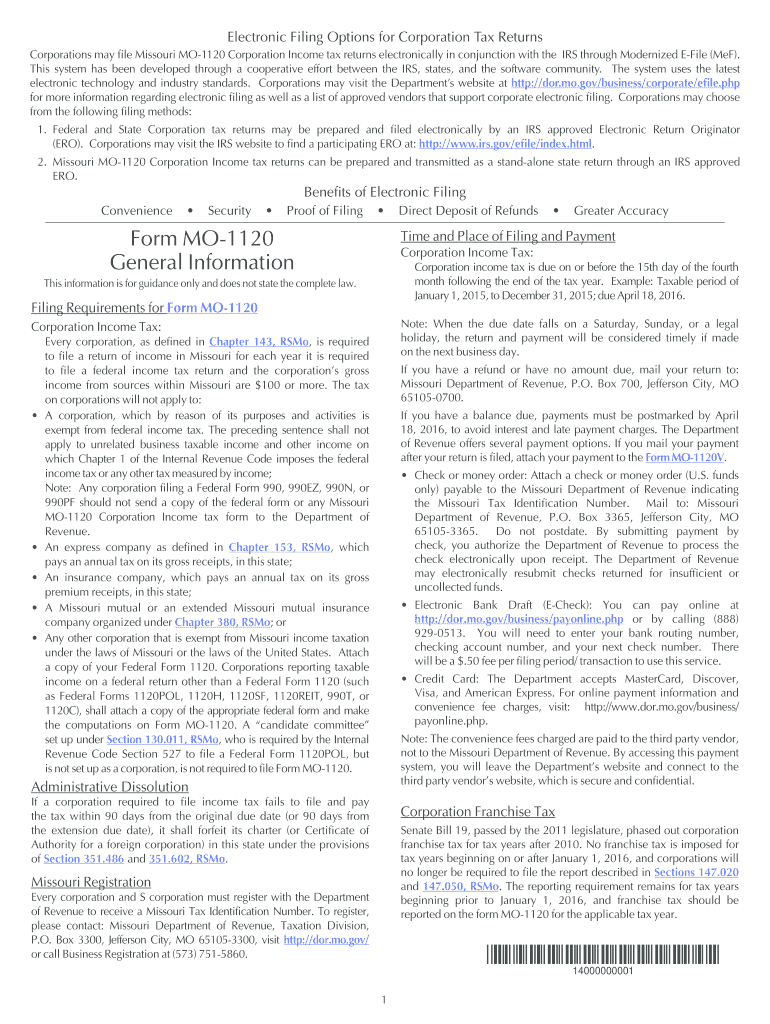

The Form MO 1120 Instructions Dor Mo is a tax document specifically designed for corporations operating in Missouri. It provides guidelines on how to complete the Missouri Corporate Income Tax Return, ensuring compliance with state tax regulations. This form is essential for corporations to report their income, calculate their tax liability, and fulfill their obligations to the Missouri Department of Revenue.

Steps to complete the Form MO 1120 Instructions Dor Mo

Completing the Form MO 1120 requires careful attention to detail. Here are the general steps involved:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Fill out the identification section, providing the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and any other income sources.

- Deduct allowable expenses to determine the taxable income.

- Calculate the tax due based on the applicable tax rate.

- Review the completed form for accuracy and ensure all required signatures are included.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Form MO 1120. Generally, the return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically falls on April 15. It is crucial to file on time to avoid penalties and interest on any unpaid taxes.

Legal use of the Form MO 1120 Instructions Dor Mo

The Form MO 1120 Instructions Dor Mo is legally binding when completed and submitted in accordance with Missouri state laws. It serves as the official record of a corporation's income and tax obligations. To ensure its validity, corporations must adhere to all filing requirements and maintain accurate records that support the information provided on the form.

Key elements of the Form MO 1120 Instructions Dor Mo

Several key elements must be included in the Form MO 1120 to ensure its completeness:

- Identification Information: This includes the corporation's name, address, and EIN.

- Income Reporting: Accurate reporting of total income from all sources.

- Expense Deductions: Detailed listing of all allowable business expenses.

- Tax Calculation: Application of the correct tax rate to the taxable income.

- Signature: Required signatures of authorized corporate officers.

Form Submission Methods (Online / Mail / In-Person)

The Form MO 1120 can be submitted through various methods to accommodate different preferences. Corporations can file electronically through the Missouri Department of Revenue's online portal, which provides a streamlined process. Alternatively, the form can be mailed to the appropriate address provided in the instructions. In-person submissions are also accepted at designated Department of Revenue offices, ensuring that all corporations can comply with their filing obligations conveniently.

Quick guide on how to complete form mo 1120 instructions dor mo

Effortlessly Complete Form MO 1120 Instructions Dor Mo on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly and without delays. Manage Form MO 1120 Instructions Dor Mo on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Edit and eSign Form MO 1120 Instructions Dor Mo with Ease

- Locate Form MO 1120 Instructions Dor Mo and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form MO 1120 Instructions Dor Mo and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1120 instructions dor mo

Create this form in 5 minutes!

How to create an eSignature for the form mo 1120 instructions dor mo

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What are the Form MO 1120 Instructions Dor Mo?

The Form MO 1120 Instructions Dor Mo provide essential guidelines on how to properly complete your Missouri Corporation Income Tax Return. This document outlines the specific lines and boxes you need to fill out, ensuring accurate filing and compliance with state regulations.

-

How can airSlate SignNow assist with filing Form MO 1120 Instructions Dor Mo?

airSlate SignNow simplifies the process of completing and submitting Form MO 1120 Instructions Dor Mo by providing a user-friendly platform for document management and e-signatures. You can easily prepare and sign your tax documents online, saving time and reducing the likelihood of errors.

-

What features does airSlate SignNow offer for handling Form MO 1120 Instructions Dor Mo?

airSlate SignNow offers various features such as customizable templates, real-time collaboration, and secure storage options specifically tailored for documents like Form MO 1120 Instructions Dor Mo. These tools empower businesses to streamline their tax preparation process efficiently.

-

Is there a cost associated with using airSlate SignNow for Form MO 1120 Instructions Dor Mo?

Yes, airSlate SignNow offers several pricing plans based on your business needs, including options that cater specifically to the preparation of Form MO 1120 Instructions Dor Mo. Each plan provides flexibility and access to all essential features for effective document management.

-

Can I integrate airSlate SignNow with other software to help with Form MO 1120 Instructions Dor Mo?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software to facilitate the completion of Form MO 1120 Instructions Dor Mo. This integration allows users to access necessary data and documents without the hassle of switching back and forth between platforms.

-

What benefits does airSlate SignNow provide for businesses preparing Form MO 1120 Instructions Dor Mo?

Using airSlate SignNow for your Form MO 1120 Instructions Dor Mo brings several benefits, including enhanced efficiency and accuracy in completing your tax filings. Its e-signature capability also allows you to get documents signed quickly, reducing delays and streamlining your workflow.

-

How secure is my information when using airSlate SignNow for Form MO 1120 Instructions Dor Mo?

airSlate SignNow prioritizes the security of your documents, particularly when handling sensitive information related to Form MO 1120 Instructions Dor Mo. The platform employs industry-standard encryption and compliance measures to ensure that your data remains private and protected at all times.

Get more for Form MO 1120 Instructions Dor Mo

Find out other Form MO 1120 Instructions Dor Mo

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer