Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically in Conjunction with the IRS through Moderni 2017

Understanding the Missouri MO 1120 Corporation Income Tax Return

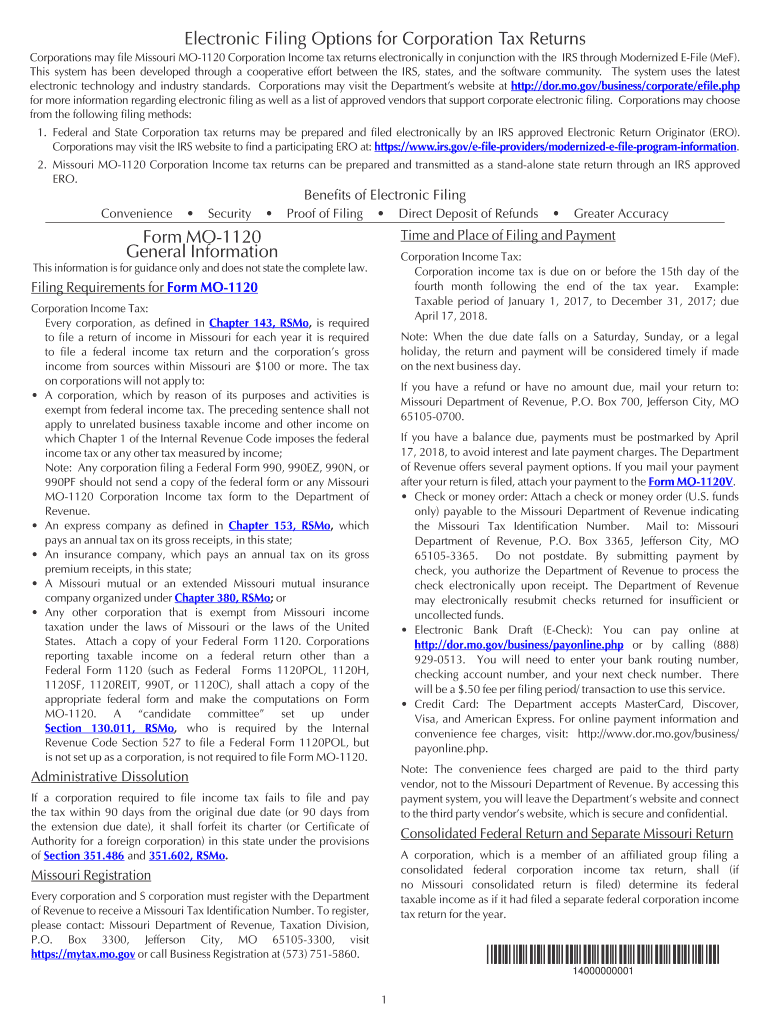

The Missouri MO 1120 Corporation Income Tax Return is a crucial document for corporations operating in Missouri. This form allows corporations to report their income, deductions, and credits to the state. Filing this form electronically in conjunction with the IRS streamlines the process, ensuring compliance with both state and federal tax regulations. By utilizing modern eFiling solutions, businesses can efficiently manage their tax obligations while reducing the risk of errors associated with manual submissions.

Steps to Complete the Missouri MO 1120 Corporation Income Tax Return

Completing the Missouri MO 1120 Corporation Income Tax Return involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Access the eFiling platform that supports the Missouri MO 1120 form.

- Input the required information, ensuring accuracy in reporting income, deductions, and credits.

- Review the completed form for any discrepancies or missing information.

- Submit the form electronically through the designated eFiling system.

Legal Use of the Missouri MO 1120 Corporation Income Tax Return

The Missouri MO 1120 form is legally binding when filed electronically, provided that it meets specific legal requirements. These include obtaining valid electronic signatures and ensuring compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Utilizing a reliable eSignature solution can enhance the legal standing of the submitted document, protecting both the corporation and its stakeholders.

IRS Guidelines for Filing the Missouri MO 1120 Form

When filing the Missouri MO 1120 Corporation Income Tax Return, it is essential to adhere to IRS guidelines. This includes understanding the tax treatment of various income types, allowable deductions, and credits. Corporations must also be aware of the deadlines for filing, as late submissions may incur penalties. Consulting IRS resources or a tax professional can provide additional clarity on compliance and filing requirements.

Required Documents for Filing the Missouri MO 1120 Form

To successfully file the Missouri MO 1120 Corporation Income Tax Return, corporations need to prepare several key documents:

- Financial statements, including profit and loss statements and balance sheets.

- Previous year's tax returns for reference.

- Documentation for any credits or deductions claimed.

- Proof of payment for any estimated taxes previously submitted.

Filing Deadlines for the Missouri MO 1120 Corporation Income Tax Return

Corporations must be mindful of the filing deadlines for the Missouri MO 1120 form. Typically, the return is due on the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. Missing this deadline can result in penalties and interest on any unpaid taxes, making timely filing essential for compliance.

Quick guide on how to complete corporations may file missouri mo 1120 corporation income tax returns electronically in conjunction with the irs through

Effortlessly complete Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni effortlessly

- Find Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporations may file missouri mo 1120 corporation income tax returns electronically in conjunction with the irs through

Create this form in 5 minutes!

How to create an eSignature for the corporations may file missouri mo 1120 corporation income tax returns electronically in conjunction with the irs through

How to create an eSignature for your Corporations May File Missouri Mo 1120 Corporation Income Tax Returns Electronically In Conjunction With The Irs Through online

How to generate an electronic signature for the Corporations May File Missouri Mo 1120 Corporation Income Tax Returns Electronically In Conjunction With The Irs Through in Google Chrome

How to make an electronic signature for putting it on the Corporations May File Missouri Mo 1120 Corporation Income Tax Returns Electronically In Conjunction With The Irs Through in Gmail

How to make an eSignature for the Corporations May File Missouri Mo 1120 Corporation Income Tax Returns Electronically In Conjunction With The Irs Through from your smart phone

How to make an eSignature for the Corporations May File Missouri Mo 1120 Corporation Income Tax Returns Electronically In Conjunction With The Irs Through on iOS devices

How to make an electronic signature for the Corporations May File Missouri Mo 1120 Corporation Income Tax Returns Electronically In Conjunction With The Irs Through on Android

People also ask

-

What is the benefit of eFiling Missouri MO 1120 Corporation Income Tax Returns?

eFiling Missouri MO 1120 Corporation Income Tax Returns offers businesses a streamlined and efficient process. Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni, which helps in reducing the risk of errors and ensuring faster processing times.

-

How can I start eFiling my Missouri MO 1120 Corporation Income Tax Returns?

To start eFiling your Missouri MO 1120 Corporation Income Tax Returns, you simply need to sign up for airSlate SignNow. Once registered, Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni with just a few clicks, making the process hassle-free.

-

What features does airSlate SignNow offer for MO 1120 eFiling?

airSlate SignNow provides intuitive features for MO 1120 eFiling, such as document templates, electronic signature capabilities, and secure cloud storage. By ensuring that Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni, you can streamline your tax filing process and improve compliance.

-

Is there technical support available for using airSlate SignNow?

Yes, airSlate SignNow offers robust technical support for all users. If you have questions about how Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni, our support team is readily available to assist you.

-

What is the pricing model for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to various business needs. By utilizing airSlate SignNow, Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni are more cost-effective than traditional filing methods, ensuring businesses receive maximum value.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow integrates seamlessly with multiple software solutions such as CRMs and accounting platforms. This flexibility allows Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni while keeping your workflows connected and efficient.

-

What advantages does electronic filing provide over traditional methods?

Electronic filing provides numerous advantages, including quicker processing times and reduced paperwork. By ensuring that Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni, businesses can avoid delays and simplify their overall tax management.

Get more for Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni

Find out other Corporations May File Missouri MO 1120 Corporation Income Tax Returns Electronically In Conjunction With The IRS Through Moderni

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe