Missouri Instructions 2018

What is the Missouri Instructions

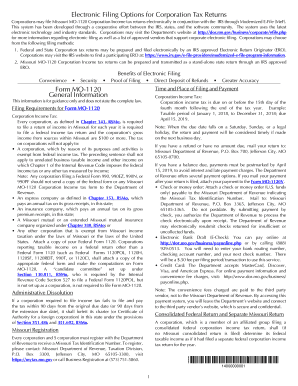

The Missouri 2018 Form MO 1120 instructions provide guidance for corporations filing their state tax returns. This form is essential for businesses operating in Missouri, as it outlines the necessary steps and requirements for accurate completion. The instructions cover various aspects, including tax rates, allowable deductions, and credits specific to Missouri corporations. Understanding these instructions is crucial for ensuring compliance with state tax laws and avoiding potential penalties.

Steps to complete the Missouri Instructions

Completing the Missouri 2018 Form MO 1120 requires careful attention to detail. Here are the key steps involved:

- Gather necessary documents: Collect all financial records, including income statements, balance sheets, and any relevant tax documents.

- Review the instructions: Familiarize yourself with the Missouri instructions to understand the requirements and sections of the form.

- Fill out the form: Complete the form accurately, ensuring that all calculations are correct and all required fields are filled.

- Double-check your work: Review the completed form for any errors or omissions before submission.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, as outlined in the instructions.

Legal use of the Missouri Instructions

The Missouri 2018 Form MO 1120 instructions are legally binding when completed and submitted according to state regulations. To ensure that your submission is valid, it is important to comply with specific eSignature laws, which govern the electronic signing of documents. Using a reliable digital tool that adheres to these regulations can enhance the legal standing of your completed form.

Filing Deadlines / Important Dates

Timely filing of the Missouri 2018 Form MO 1120 is essential to avoid penalties. The standard deadline for submitting this form is typically the 15th day of the fourth month following the end of your corporation's tax year. For corporations operating on a calendar year basis, this means the due date is April 15. If additional time is needed, corporations may request an extension, but it is important to understand that this does not extend the time for payment of any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the Missouri 2018 Form MO 1120. These include:

- Online Submission: Many businesses opt to file electronically through the Missouri Department of Revenue's online portal, which allows for quicker processing.

- Mail: Corporations can also print the completed form and send it via postal mail to the appropriate address provided in the instructions.

- In-Person: Some may choose to deliver the form in person at local Department of Revenue offices, which can be beneficial for immediate confirmation of receipt.

Key elements of the Missouri Instructions

The Missouri 2018 Form MO 1120 instructions include several key elements that are critical for successful completion. These elements encompass:

- Filing requirements: Detailed information on who must file and under what circumstances.

- Tax rates: Current tax rates applicable to corporations in Missouri.

- Deductions and credits: A list of allowable deductions and tax credits that can reduce taxable income.

- Signature requirements: Guidelines on who must sign the form and any necessary supporting documentation.

Quick guide on how to complete information to complete mo 1120

Complete Missouri Instructions effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any holdups. Handle Missouri Instructions on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to alter and electronically sign Missouri Instructions with ease

- Obtain Missouri Instructions and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and bears the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Alter and electronically sign Missouri Instructions and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct information to complete mo 1120

Create this form in 5 minutes!

How to create an eSignature for the information to complete mo 1120

How to create an electronic signature for the Information To Complete Mo 1120 in the online mode

How to generate an electronic signature for your Information To Complete Mo 1120 in Chrome

How to generate an eSignature for putting it on the Information To Complete Mo 1120 in Gmail

How to generate an eSignature for the Information To Complete Mo 1120 right from your smartphone

How to create an eSignature for the Information To Complete Mo 1120 on iOS devices

How to make an electronic signature for the Information To Complete Mo 1120 on Android OS

People also ask

-

What are the Missouri 2018 Form MO 1120 instructions?

The Missouri 2018 Form MO 1120 instructions provide detailed guidance on how to correctly file corporate income tax in the state. It outlines the necessary forms, schedules, and calculations you will need to complete to ensure compliance with state laws.

-

How can airSlate SignNow help me file the Missouri 2018 Form MO 1120?

airSlate SignNow simplifies the process of filing the Missouri 2018 Form MO 1120 by allowing you to electronically sign and send documents securely. With its intuitive interface, you can ensure all forms are completed accurately, helping you avoid potential filing errors.

-

Is there a cost associated with using airSlate SignNow for the Missouri 2018 Form MO 1120?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. You can choose from different plans based on your needs, ensuring that you only pay for what you use while efficiently managing your Missouri 2018 Form MO 1120.

-

What features does airSlate SignNow offer for handling the Missouri 2018 Form MO 1120?

airSlate SignNow offers a range of features including document templates, cloud storage, and electronic signatures. These capabilities make it easier to manage the Missouri 2018 Form MO 1120, streamlining the filing process and enhancing productivity.

-

Can I automate reminders for filing the Missouri 2018 Form MO 1120 with airSlate SignNow?

Absolutely! airSlate SignNow allows you to set automated reminders for important filing dates related to the Missouri 2018 Form MO 1120. This feature helps you stay on track and ensures that you never miss a filing deadline.

-

What integrations does airSlate SignNow offer for filing the Missouri 2018 Form MO 1120?

airSlate SignNow integrates seamlessly with various platforms, including CRM systems and accounting software. This compatibility makes it easier to manage all aspects of your operations while handling the Missouri 2018 Form MO 1120 efficiently.

-

How does airSlate SignNow ensure the security of my Missouri 2018 Form MO 1120 documents?

Security is a top priority for airSlate SignNow. With advanced encryption and authentication measures, your Missouri 2018 Form MO 1120 documents are protected throughout the entire signing process, ensuring that your sensitive information remains confidential.

Get more for Missouri Instructions

Find out other Missouri Instructions

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online