Form MO 1041 Fiduciary Income Tax Return 2020

What is the Form MO 1041 Fiduciary Income Tax Return

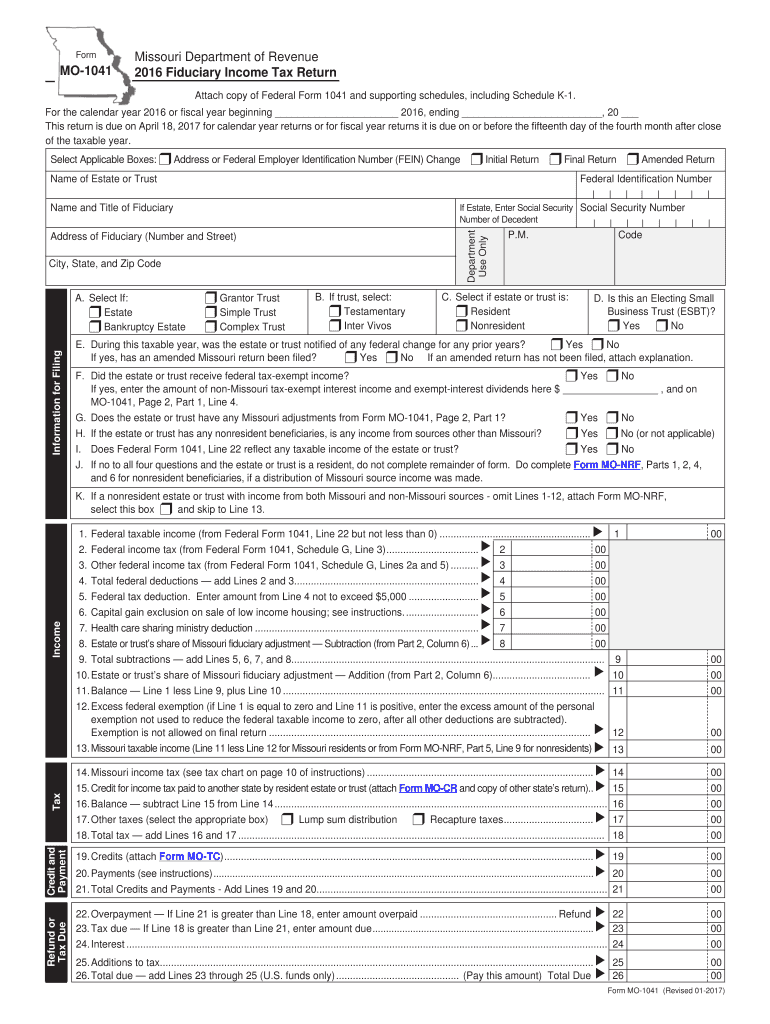

The Form MO 1041 Fiduciary Income Tax Return is a tax document used by fiduciaries in Missouri to report income, deductions, and credits for estates and trusts. This form is essential for ensuring compliance with state tax laws and for accurately calculating the tax liability of the estate or trust. Fiduciaries, who manage the assets of an estate or trust, are responsible for filing this return on behalf of the entity they represent. Understanding the purpose and requirements of the Form MO 1041 is crucial for effective tax management.

Steps to complete the Form MO 1041 Fiduciary Income Tax Return

Completing the Form MO 1041 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the estate or trust, including income statements, expense receipts, and prior tax returns. Next, fill out the form by providing detailed information about the income earned, deductions claimed, and credits available. It is important to double-check all entries for accuracy to avoid potential errors. After completing the form, review it thoroughly before submitting it to the appropriate tax authority.

How to obtain the Form MO 1041 Fiduciary Income Tax Return

The Form MO 1041 can be obtained through various means. It is available for download from the Missouri Department of Revenue website. Additionally, physical copies can often be requested from local tax offices or libraries. Ensuring you have the correct and most current version of the form is vital for proper filing. Always check for any updates or changes to the form before completing it.

Filing Deadlines / Important Dates

Filing deadlines for the Form MO 1041 are critical to avoid penalties and interest. Generally, the return is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this typically means April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to keep track of these dates to ensure timely submission.

Legal use of the Form MO 1041 Fiduciary Income Tax Return

The legal use of the Form MO 1041 is governed by state tax regulations. This form must be filed to report the income of estates and trusts accurately. Failure to file or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. It is essential for fiduciaries to understand their legal obligations and ensure compliance with all relevant tax laws to protect themselves and the beneficiaries of the estate or trust.

Key elements of the Form MO 1041 Fiduciary Income Tax Return

The Form MO 1041 includes several key elements that must be completed accurately. These elements typically include identifying information about the estate or trust, such as its name, address, and federal identification number. Additionally, the form requires detailed reporting of income sources, allowable deductions, and any applicable credits. Accurate completion of these sections is vital for determining the correct tax liability.

Quick guide on how to complete form mo 1041 2016 fiduciary income tax return

Effortlessly Complete Form MO 1041 Fiduciary Income Tax Return on Any Device

Internet-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Form MO 1041 Fiduciary Income Tax Return on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to Alter and Electronically Sign Form MO 1041 Fiduciary Income Tax Return with Ease

- Obtain Form MO 1041 Fiduciary Income Tax Return, then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize crucial parts of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information thoroughly and click the Done button to save your modifications.

- Choose your preferred method to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form MO 1041 Fiduciary Income Tax Return to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1041 2016 fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the form mo 1041 2016 fiduciary income tax return

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Form MO 1041 Fiduciary Income Tax Return?

Form MO 1041 Fiduciary Income Tax Return is a tax form used by estates and trusts to report their income, deductions, and tax credits in Missouri. This form is crucial for ensuring compliance with state tax laws. Understanding this form helps trustees and executors manage their fiduciary duties effectively.

-

How can airSlate SignNow help with Form MO 1041 Fiduciary Income Tax Return?

AirSlate SignNow simplifies the process of preparing and submitting Form MO 1041 Fiduciary Income Tax Return by allowing users to electronically sign and send documents securely. Our platform ensures that sensitive information is protected while streamlining the workflow for tax professionals and fiduciaries. This enhances efficiency and reduces errors in tax filing.

-

What features does airSlate SignNow offer for completing Form MO 1041 Fiduciary Income Tax Return?

AirSlate SignNow offers features such as customizable templates, document tracking, and secure eSigning, specifically designed to assist with Form MO 1041 Fiduciary Income Tax Return. These tools facilitate greater accuracy in filling out tax forms, promote collaboration among users, and simplify communication between parties involved. This ensures a smoother process for handling fiduciary responsibilities.

-

Is there a cost associated with using airSlate SignNow for Form MO 1041 Fiduciary Income Tax Return?

Yes, airSlate SignNow provides a cost-effective solution for all your document signing needs, including Form MO 1041 Fiduciary Income Tax Return. We offer various pricing plans to accommodate different user requirements, ensuring access to essential features at a competitive rate. This makes it an affordable choice for both individuals and businesses managing fiduciary tax responsibilities.

-

Can I integrate airSlate SignNow with other applications for managing Form MO 1041 Fiduciary Income Tax Return?

Absolutely! AirSlate SignNow seamlessly integrates with various applications to enhance your workflow while managing Form MO 1041 Fiduciary Income Tax Return. This includes integration with popular accounting and document management software, allowing for smoother data transfer and reduced duplication of efforts. These integrations help streamline your tax preparation processes and promote efficiency.

-

What are the benefits of eSigning Form MO 1041 Fiduciary Income Tax Return with airSlate SignNow?

Using airSlate SignNow to eSign Form MO 1041 Fiduciary Income Tax Return offers numerous benefits, including increased security, reduced turnaround time, and enhanced convenience. Electronic signatures are legally binding and can be completed from any device, facilitating faster processing of tax documents. Moreover, this digital solution minimizes the need for paper, making it an environmentally friendly choice.

-

What support does airSlate SignNow offer for users dealing with Form MO 1041 Fiduciary Income Tax Return?

AirSlate SignNow provides extensive support for users managing Form MO 1041 Fiduciary Income Tax Return through dedicated customer service and a comprehensive help center. Our knowledgeable team is ready to assist you with any queries or technical issues that may arise. Additionally, accessible resources and tutorials are available to ensure users can efficiently utilize our platform.

Get more for Form MO 1041 Fiduciary Income Tax Return

Find out other Form MO 1041 Fiduciary Income Tax Return

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF