Form or 41, Oregon Fiduciary Income Tax Return, 2023

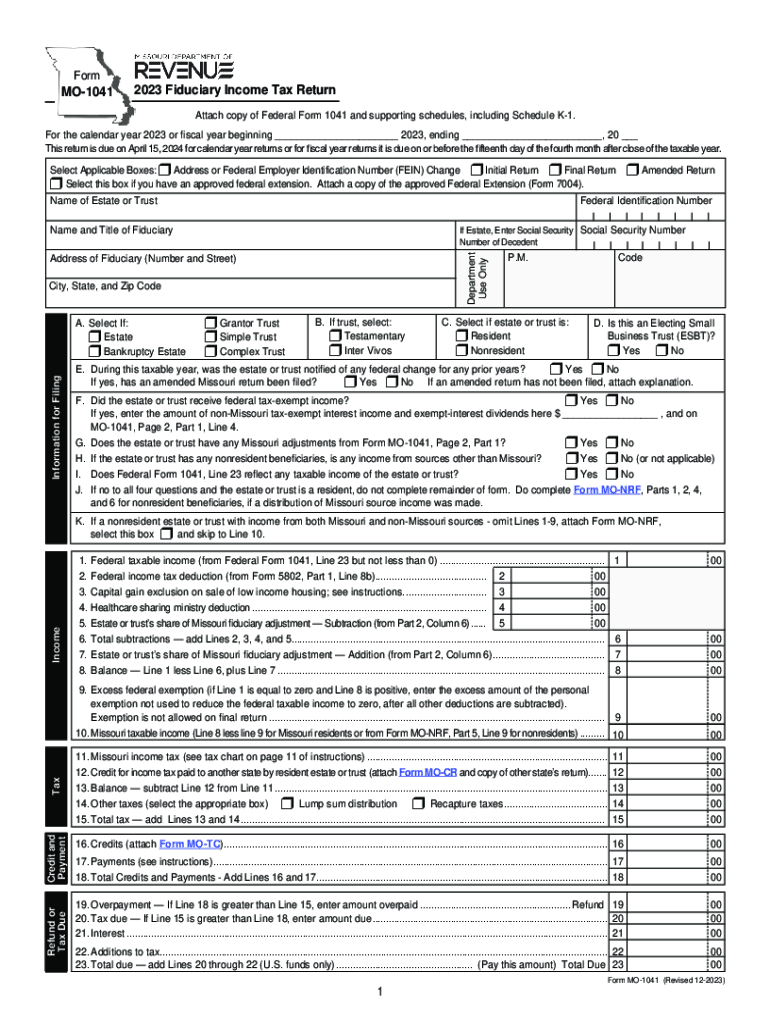

What is the 2024 Form OR 41?

The 2024 Form OR 41 is the Oregon Fiduciary Income Tax Return, designed for estates and trusts that generate income. This form is essential for reporting income, deductions, and credits associated with the fiduciary entity. It ensures compliance with Oregon state tax laws and helps in the proper calculation of tax liabilities for the estate or trust.

Key elements of the 2024 Form OR 41

Understanding the key components of the 2024 Form OR 41 is crucial for accurate completion. The form includes sections for reporting income from various sources, such as dividends, interest, and rental income. Additionally, it requires details about deductions, including administrative expenses and distributions to beneficiaries. Properly filling out these sections ensures that the fiduciary entity meets its tax obligations while maximizing allowable deductions.

Steps to complete the 2024 Form OR 41

Completing the 2024 Form OR 41 involves several important steps. First, gather all necessary financial documents related to the estate or trust, including income statements and expense receipts. Next, accurately fill in the income and deduction sections of the form. It is essential to ensure that all figures are correct and supported by documentation. After completing the form, review it thoroughly for any errors before submitting it to the Oregon Department of Revenue.

Filing Deadlines / Important Dates

Timely filing of the 2024 Form OR 41 is critical to avoid penalties. The due date for filing is typically the fifteenth day of the fourth month following the end of the tax year. For most fiduciaries, this means the form is due on April 15. However, if the fiduciary entity operates on a fiscal year, the deadline may differ. It is advisable to check the Oregon Department of Revenue’s website for any updates or changes to filing deadlines.

Legal use of the 2024 Form OR 41

The legal use of the 2024 Form OR 41 is governed by Oregon tax law. This form must be used for reporting income generated by estates and trusts to ensure compliance with state tax regulations. Failure to use the correct form or to report income accurately can lead to penalties and interest charges. Understanding the legal implications of filing this form is essential for fiduciaries to protect themselves and the beneficiaries.

How to obtain the 2024 Form OR 41

The 2024 Form OR 41 can be obtained through the Oregon Department of Revenue’s official website. The form is available for download in a printable format, allowing fiduciaries to fill it out manually. Alternatively, many tax preparation software programs include the form, enabling electronic completion and submission. It is important to ensure that you are using the correct version of the form for the tax year in question.

Quick guide on how to complete form or 41 oregon fiduciary income tax return

Effortlessly Prepare Form OR 41, Oregon Fiduciary Income Tax Return, on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Manage Form OR 41, Oregon Fiduciary Income Tax Return, on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related procedure today.

How to Modify and Electronically Sign Form OR 41, Oregon Fiduciary Income Tax Return, with Ease

- Find Form OR 41, Oregon Fiduciary Income Tax Return, and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with specialized tools offered by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Form OR 41, Oregon Fiduciary Income Tax Return, to maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form or 41 oregon fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the form or 41 oregon fiduciary income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Form 41 and how is it used?

The Oregon Form 41 is a taxation document used for reporting corporate income. Businesses in Oregon must correctly complete this form to avoid penalties and ensure compliance with state tax regulations. airSlate SignNow simplifies the eSigning process for this vital document, making submission easy and efficient.

-

How does airSlate SignNow support the completion of Oregon Form 41?

airSlate SignNow allows you to easily upload and fill out the Oregon Form 41, streamlining the process. With intuitive forms and eSignature features, users can ensure the document is completed accurately and promptly. This improves efficiency and helps businesses meet tax deadlines without hassle.

-

Are there any costs associated with using airSlate SignNow for Oregon Form 41?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for businesses of all sizes. You can choose from various subscription models to find the best fit for your needs while efficiently managing documents like the Oregon Form 41. This investment provides value through time savings and enhanced productivity.

-

Can I integrate airSlate SignNow with other software for filing Oregon Form 41?

Yes, airSlate SignNow supports integrations with various software solutions, enhancing the workflow for filing the Oregon Form 41. By connecting with tools you already use, you can streamline your document management and eSignature processes. This integration capability allows for seamless data transfer and better organization.

-

What are the benefits of using airSlate SignNow for Oregon Form 41?

Using airSlate SignNow for your Oregon Form 41 provides several benefits, including a user-friendly interface, secure eSigning, and faster turnaround times. The solution signNowly reduces paperwork and manual entry errors, which are common in traditional filing methods. By digitizing this process, businesses can save valuable time and focus on their core operations.

-

Is the eSignature on Oregon Form 41 legally binding with airSlate SignNow?

Yes, eSignatures created with airSlate SignNow are legally binding and compliant with federal and state regulations, including for documents like the Oregon Form 41. This ensures that your signed forms are valid and enforceable, providing peace of mind for your business transactions. You can trust airSlate SignNow to securely handle your eSignature needs.

-

How can I track the status of my Oregon Form 41 with airSlate SignNow?

airSlate SignNow offers tracking features that allow you to monitor the progress of your Oregon Form 41. You can easily see who has signed the document and when it was completed, ensuring transparency throughout the process. This helps in maintaining proper oversight and accountability for your filing tasks.

Get more for Form OR 41, Oregon Fiduciary Income Tax Return,

- Brookdale externship form

- Cigna memphis form

- Aplar eular school of rheumatology esor form

- Cigna voluntary term life insurance enrollment form

- Soar consent for release of information

- American academy of pediatrics section aaporg form

- Pharmacy progress note follow up dosing per collaborative practice form

- Cssare pain log form

Find out other Form OR 41, Oregon Fiduciary Income Tax Return,

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed