Missouri Form 1041 2019

What is the Missouri Form 1041

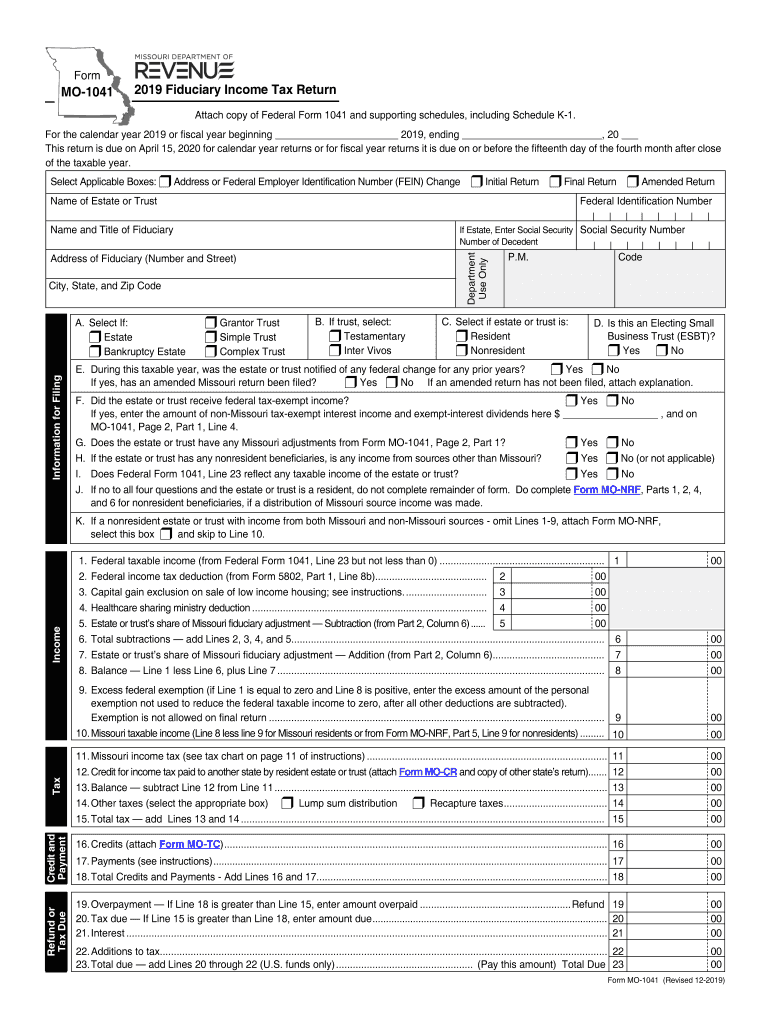

The Missouri Form 1041 is a state income tax return specifically designed for fiduciary entities, such as estates and trusts, operating within Missouri. This form is utilized to report income, deductions, and credits associated with the trust or estate. It is essential for fiduciaries to accurately complete this form to ensure compliance with state tax regulations and to facilitate the proper distribution of income to beneficiaries.

How to obtain the Missouri Form 1041

The Missouri Form 1041 can be obtained through the Missouri Department of Revenue website. Taxpayers may download a printable version of the form or access an electronic version for online completion. Additionally, physical copies of the form can be requested from local tax offices or obtained at public libraries. It is important to ensure that you are using the correct version of the form for the applicable tax year.

Steps to complete the Missouri Form 1041

Completing the Missouri Form 1041 involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including income statements, deduction records, and information about beneficiaries.

- Fill out the form: Enter the required information in the appropriate sections, ensuring accuracy in reporting income and deductions.

- Calculate tax liability: Use the provided instructions to determine the tax owed or any refund due.

- Review and sign: Carefully review the completed form for errors before signing it. Ensure that the fiduciary's signature is included.

Legal use of the Missouri Form 1041

The Missouri Form 1041 is legally binding when completed and submitted in accordance with state tax laws. To ensure its legal validity, the form must be signed by the fiduciary and submitted by the designated filing deadline. Electronic signatures are accepted, provided they comply with the state's eSignature laws. Proper completion and timely submission help avoid penalties and ensure that the fiduciary meets their legal obligations.

Filing Deadlines / Important Dates

The filing deadline for the Missouri Form 1041 typically aligns with the federal tax return deadlines. For most fiduciaries, this means the form is due on the fifteenth day of the fourth month following the close of the tax year. If the fiduciary entity operates on a calendar year basis, the deadline will be April 15. It is advisable to check for any updates or changes to deadlines annually, as they may vary.

Required Documents

To complete the Missouri Form 1041, several documents are essential:

- Income statements from all sources related to the estate or trust.

- Records of deductions, including expenses related to the administration of the trust or estate.

- Information regarding beneficiaries, including their share of income distributions.

Having these documents ready will facilitate a smoother and more accurate filing process.

Quick guide on how to complete what is a schedule k 1 form 1041 estates and trusts

Effortlessly Prepare Missouri Form 1041 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to generate, modify, and eSign your documents quickly and without delays. Handle Missouri Form 1041 on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign Missouri Form 1041 with Ease

- Obtain Missouri Form 1041 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that task.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to finalize your edits.

- Choose how you wish to share your form—via email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign Missouri Form 1041 while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is a schedule k 1 form 1041 estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the what is a schedule k 1 form 1041 estates and trusts

How to generate an eSignature for the What Is A Schedule K 1 Form 1041 Estates And Trusts in the online mode

How to create an electronic signature for the What Is A Schedule K 1 Form 1041 Estates And Trusts in Chrome

How to generate an eSignature for signing the What Is A Schedule K 1 Form 1041 Estates And Trusts in Gmail

How to make an eSignature for the What Is A Schedule K 1 Form 1041 Estates And Trusts from your mobile device

How to make an eSignature for the What Is A Schedule K 1 Form 1041 Estates And Trusts on iOS devices

How to create an eSignature for the What Is A Schedule K 1 Form 1041 Estates And Trusts on Android devices

People also ask

-

What is the 1041 form for Missouri?

The 1041 form for Missouri is used for reporting income, deductions, and taxes for estates and trusts. It's essential for ensuring compliance with Missouri state tax laws when dealing with such entities. If you're asking, 'is there a 1041 form for Missouri,' the answer is yes, and it must be filed by fiduciaries.

-

How can I access the 1041 form for Missouri?

You can download the 1041 form for Missouri from the official Missouri Department of Revenue website. It's easily accessible and provides all the necessary instructions for filling it out. If you're looking to see if 'is there a 1041 form for Missouri,' it’s available online and in various tax offices.

-

What are the features of airSlate SignNow for eSigning documents?

airSlate SignNow offers robust features for eSigning documents, including customizable templates, real-time tracking, and secure cloud storage. These features streamline your document management process. For those wondering, 'is there a 1041 form for Missouri,' SignNow can help you manage and sign these complex forms effortlessly.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers several pricing plans that cater to different business needs, including free trials and scalable options. This flexibility ensures that businesses seeking to eSign documents, including forms like the 1041 for Missouri, can find a suitable plan. Whether small or large, there's an option for everyone.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow allows integration with various third-party applications such as Google Drive, Salesforce, and more. This seamless integration helps in enhancing your workflow and document management. For those looking to manage tax forms like the 1041 for Missouri, these integrations can be very beneficial.

-

What benefits does airSlate SignNow provide for businesses?

airSlate SignNow empowers businesses by streamlining the eSigning process, thereby saving time and reducing paperwork. It enhances efficiency by providing a user-friendly interface and quick access to essential forms like the 1041 for Missouri. This can lead to better client satisfaction and faster transaction times.

-

How secure is airSlate SignNow for signing sensitive documents?

Security is a top priority for airSlate SignNow, which uses advanced encryption techniques to protect your sensitive documents. User privacy and data security measures are implemented to ensure that your information remains confidential. This is particularly important when dealing with forms like the 1041 for Missouri.

Get more for Missouri Form 1041

- Form eme 2621

- Color of water unit plan bruguier form

- Seven day prior log form hoovestol inc

- Anderson county activity amp event acceptance bformb university of bb

- Pro se visitation forms south carolina

- Opra request form

- Apostille or certificate of authentication request form washington sos wa

- Architectural modification application date palm aire form

Find out other Missouri Form 1041

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document