Form D 410P Application for Extension for Filing Partnership, Estate 2014

What is the Form D 410P Application For Extension For Filing Partnership, Estate

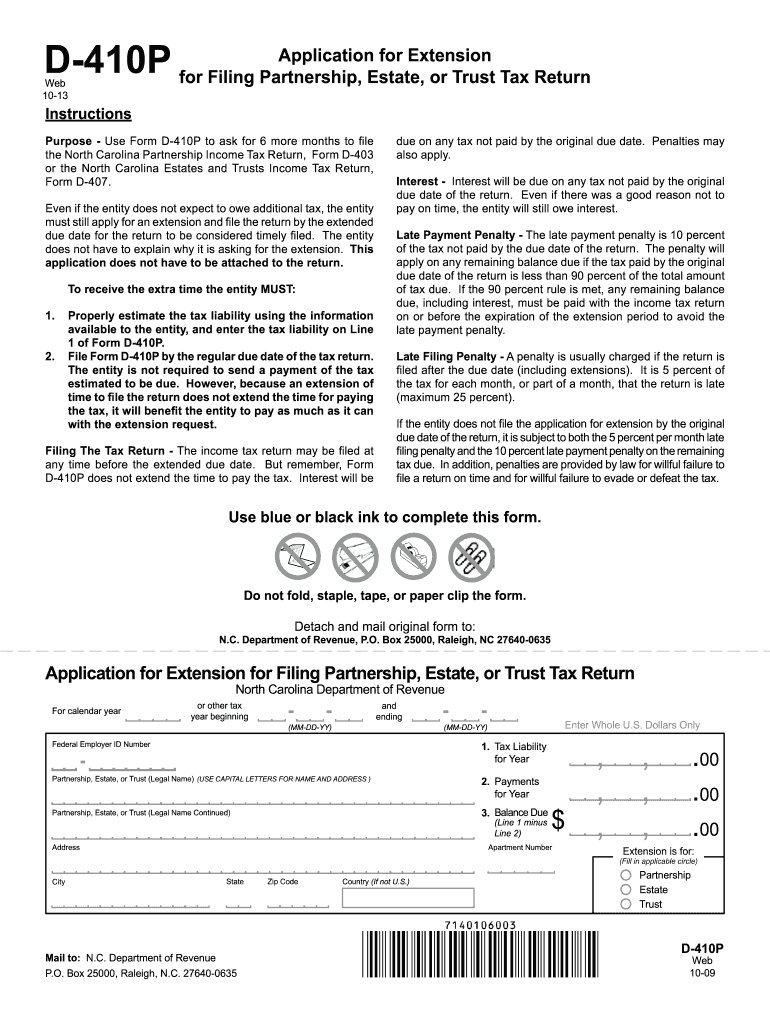

The Form D 410P Application For Extension For Filing Partnership, Estate is a crucial document used by partnerships and estates in the United States to request an extension for filing their tax returns. This form allows entities to extend their filing deadlines, ensuring compliance with tax regulations while providing additional time to prepare accurate returns. It is essential for partnerships and estates to understand the implications of this form, as it can impact their financial reporting and tax obligations.

Steps to complete the Form D 410P Application For Extension For Filing Partnership, Estate

Completing the Form D 410P requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the partnership or estate name, address, and Employer Identification Number (EIN).

- Determine the reason for the extension request, as this may need to be indicated on the form.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Form D 410P Application For Extension For Filing Partnership, Estate

The legal use of the Form D 410P is governed by IRS regulations. When properly completed and submitted, this form provides a legitimate means for partnerships and estates to extend their tax filing deadlines. It is important to note that the extension granted does not extend the time for payment of any taxes owed. Therefore, understanding the legal implications and responsibilities associated with this form is vital for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form D 410P are critical to avoid penalties. Typically, the form must be submitted by the original due date of the partnership or estate tax return. Extensions are generally granted for six months, but it is essential to check specific deadlines for the current tax year, as they may vary. Keeping track of these dates ensures that partnerships and estates remain compliant with tax regulations.

Required Documents

To successfully complete the Form D 410P, certain documents may be required. These include:

- Partnership or estate tax identification information.

- Previous year’s tax returns for reference.

- Any supporting documentation that justifies the need for an extension.

Having these documents ready can streamline the process and help ensure accuracy when filling out the form.

Form Submission Methods (Online / Mail / In-Person)

The Form D 410P can be submitted through various methods, including online filing, mailing, or in-person submission. Online submission is often the most efficient method, allowing for immediate processing. However, partnerships and estates should ensure they follow the appropriate procedures for their chosen submission method to ensure compliance with IRS requirements.

Quick guide on how to complete form d 410p application for extension for filing partnership estate

Effortlessly Create Form D 410P Application For Extension For Filing Partnership, Estate on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to find the needed form and securely store it online. airSlate SignNow provides you with all the tools necessary to design, edit, and electronically sign your documents quickly and efficiently. Handle Form D 410P Application For Extension For Filing Partnership, Estate on any platform with airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Form D 410P Application For Extension For Filing Partnership, Estate with Ease

- Obtain Form D 410P Application For Extension For Filing Partnership, Estate and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in a few clicks from your preferred device. Edit and electronically sign Form D 410P Application For Extension For Filing Partnership, Estate to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form d 410p application for extension for filing partnership estate

Create this form in 5 minutes!

How to create an eSignature for the form d 410p application for extension for filing partnership estate

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the Form D 410P Application For Extension For Filing Partnership, Estate?

The Form D 410P Application For Extension For Filing Partnership, Estate is a document that allows partnerships and estates to request an extension for filing their tax returns. This form is crucial for ensuring compliance and avoiding late penalties while providing extra time for accurate filing.

-

How does airSlate SignNow facilitate the completion of the Form D 410P Application For Extension For Filing Partnership, Estate?

airSlate SignNow simplifies the process of completing the Form D 410P Application For Extension For Filing Partnership, Estate by offering an intuitive interface for filling out the necessary fields. Users can easily save, edit, and eSign the document, streamlining the submission process to the pertinent authorities.

-

Is there a cost associated with using airSlate SignNow for the Form D 410P Application For Extension For Filing Partnership, Estate?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Users can choose a plan that fits their budget while gaining access to features that assist in the efficient completion of the Form D 410P Application For Extension For Filing Partnership, Estate.

-

What are the main benefits of using airSlate SignNow for my Form D 410P Application For Extension For Filing Partnership, Estate?

The primary benefits include the ability to eSign documents electronically, which saves time, and the assurance of security and compliance with legal standards. Additionally, airSlate SignNow's easy-to-use features enhance productivity by allowing you to focus on your business rather than paperwork.

-

Can airSlate SignNow integrate with other software for managing the Form D 410P Application For Extension For Filing Partnership, Estate?

Absolutely! airSlate SignNow offers integrations with various third-party applications, such as cloud storage and accounting software. This ensures that you can efficiently manage your Form D 410P Application For Extension For Filing Partnership, Estate alongside other critical business processes.

-

Is there customer support available when completing the Form D 410P Application For Extension For Filing Partnership, Estate on airSlate SignNow?

Yes, airSlate SignNow provides robust customer support to assist with any inquiries related to completing the Form D 410P Application For Extension For Filing Partnership, Estate. Users can access help via chat, email, or phone to ensure a seamless experience.

-

What features make airSlate SignNow a better choice for the Form D 410P Application For Extension For Filing Partnership, Estate compared to other solutions?

airSlate SignNow stands out with its user-friendly interface, advanced security measures, and comprehensive eSignature features. These tools are designed to enhance the user experience, making the Form D 410P Application For Extension For Filing Partnership, Estate both easy to complete and securely managed.

Get more for Form D 410P Application For Extension For Filing Partnership, Estate

- Paramedical examiner certification online form

- Imo maritime declaration of health form excel

- Geometry proofs examples and answers pdf form

- United welsh housing application form

- Tai chi 37 form yang style pdf

- Conditional waiver and release on progress payment form

- Form xxviii list of holidays

- Clinical reference medsource travelers form

Find out other Form D 410P Application For Extension For Filing Partnership, Estate

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online