Self Employment Income Report Form 2019-2026

What is the Self Employment Income Report Form

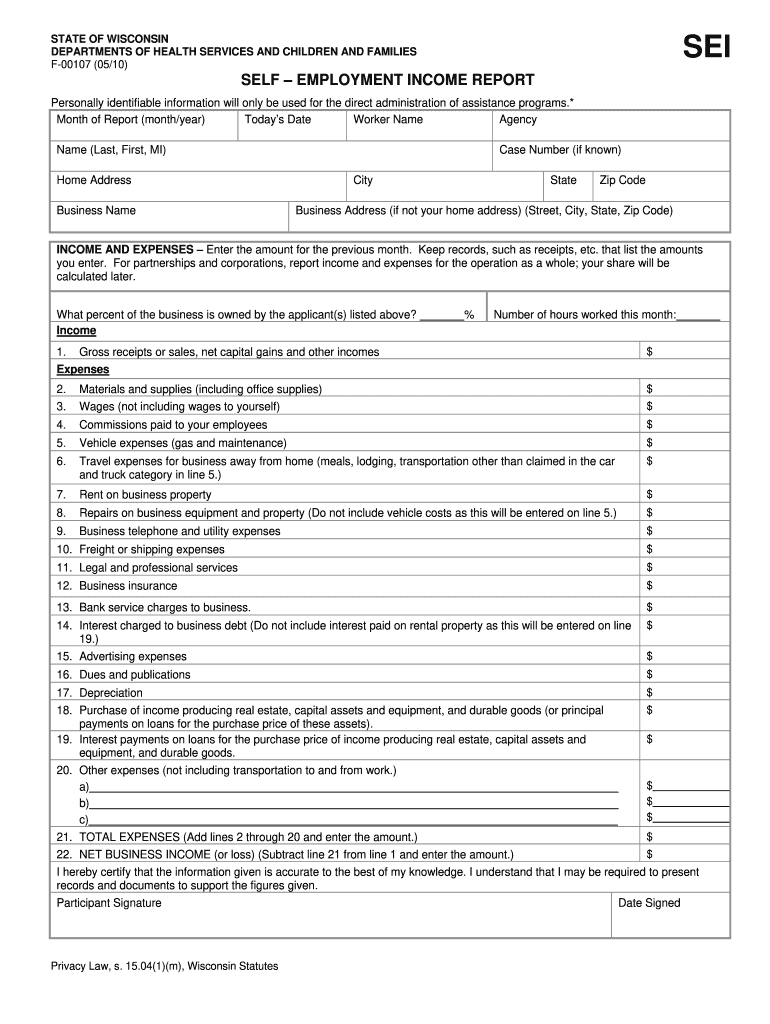

The Self Employment Income Report Form, commonly referred to as Form F-00107, is a crucial document for individuals who are self-employed in the United States. This form is used to report income earned from self-employment activities, ensuring that individuals accurately disclose their earnings for tax purposes. It is particularly relevant for freelancers, independent contractors, and small business owners who do not receive a traditional paycheck. Completing this form helps in calculating the appropriate taxes owed and maintaining compliance with IRS regulations.

Steps to complete the Self Employment Income Report Form

Filling out the Self Employment Income Report Form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial documents, including records of income and expenses related to your self-employment activities. Next, follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- List all sources of self-employment income for the reporting period, ensuring to include all earnings.

- Detail any business expenses that can be deducted, such as supplies, travel, and utilities.

- Calculate your net income by subtracting total expenses from total income.

- Review the form for accuracy, ensuring all information is complete and correct.

Legal use of the Self Employment Income Report Form

The Self Employment Income Report Form is legally binding when completed accurately and submitted according to IRS guidelines. It is essential to understand that providing false information can lead to penalties, including fines and legal repercussions. Using a reliable platform for electronic signatures, such as signNow, can enhance the legal standing of your eDocument, ensuring compliance with laws such as the ESIGN Act and UETA. This compliance is vital for the form to be considered valid in a legal context.

Who Issues the Form

The Self Employment Income Report Form is issued by the state tax authority in Wisconsin, specifically for residents who need to report their self-employment income. This form is designed to align with state tax regulations and is essential for those who operate their own businesses or work as independent contractors. It is important to ensure that you are using the most current version of the form, as regulations and requirements may change over time.

Filing Deadlines / Important Dates

Filing deadlines for the Self Employment Income Report Form are crucial to avoid penalties. Typically, the form must be submitted by April 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, individuals may need to consider estimated tax payment deadlines throughout the year, which are generally due on April 15, June 15, September 15, and January 15 of the following year.

Required Documents

To accurately complete the Self Employment Income Report Form, certain documents are necessary. These may include:

- Records of all income received from self-employment.

- Receipts and invoices for business expenses.

- Bank statements that reflect income deposits.

- Previous tax returns, if applicable, for reference.

Having these documents organized will facilitate a smoother completion process and help ensure compliance with tax regulations.

Quick guide on how to complete self employment income report form 2010

Complete Self Employment Income Report Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Self Employment Income Report Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Self Employment Income Report Form with ease

- Find Self Employment Income Report Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document needs in just a few clicks from any device you choose. Edit and eSign Self Employment Income Report Form and ensure effective communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct self employment income report form 2010

Create this form in 5 minutes!

How to create an eSignature for the self employment income report form 2010

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is a self employment income report form?

A self employment income report form is a document used by individuals who are self-employed to report their income and expenses for tax purposes. It helps in accurately assessing the net income earned, essential for tax filing. Utilizing airSlate SignNow makes it easy to create and send this form securely.

-

How can airSlate SignNow help in creating a self employment income report form?

airSlate SignNow provides templates and tools that streamline the process of creating a self employment income report form. You can customize the form to fit your specific business needs and include necessary details. The easy-to-use interface allows users to get started quickly and efficiently.

-

Is it secure to use airSlate SignNow for submitting a self employment income report form?

Yes, using airSlate SignNow is secure for submitting your self employment income report form. The platform employs advanced encryption and secure cloud storage to protect your sensitive data. You can confidently send and sign documents, knowing they are safeguarded.

-

Are there any costs associated with using airSlate SignNow for self employment income report forms?

airSlate SignNow offers various pricing plans tailored to suit different business needs. Whether you're a freelancer or a larger business, there are options available that provide access to features for creating self employment income report forms at a cost-effective rate. You can choose a plan that fits your budget.

-

Can I integrate airSlate SignNow with other software for my self employment income report form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications to help manage your self employment income report form more effectively. Whether you need to sync with accounting software or project management tools, airSlate SignNow makes it simple to connect.

-

What features does airSlate SignNow offer for self employment income report forms?

airSlate SignNow includes features such as templates, eSigning, and document tracking, all tailored for self employment income report forms. You can automate workflows, send reminders, and monitor the status of your forms. These features enhance efficiency and streamline the documentation process.

-

How does using airSlate SignNow benefit self-employed individuals?

Using airSlate SignNow benefits self-employed individuals by providing an organized, digital solution for managing self employment income report forms. It saves time, reduces paperwork, and minimizes errors associated with outdated methods. Overall, it enhances productivity and simplifies tax filing.

Get more for Self Employment Income Report Form

Find out other Self Employment Income Report Form

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document