Wi 212 Form 2020

What is the Wi 212 Form

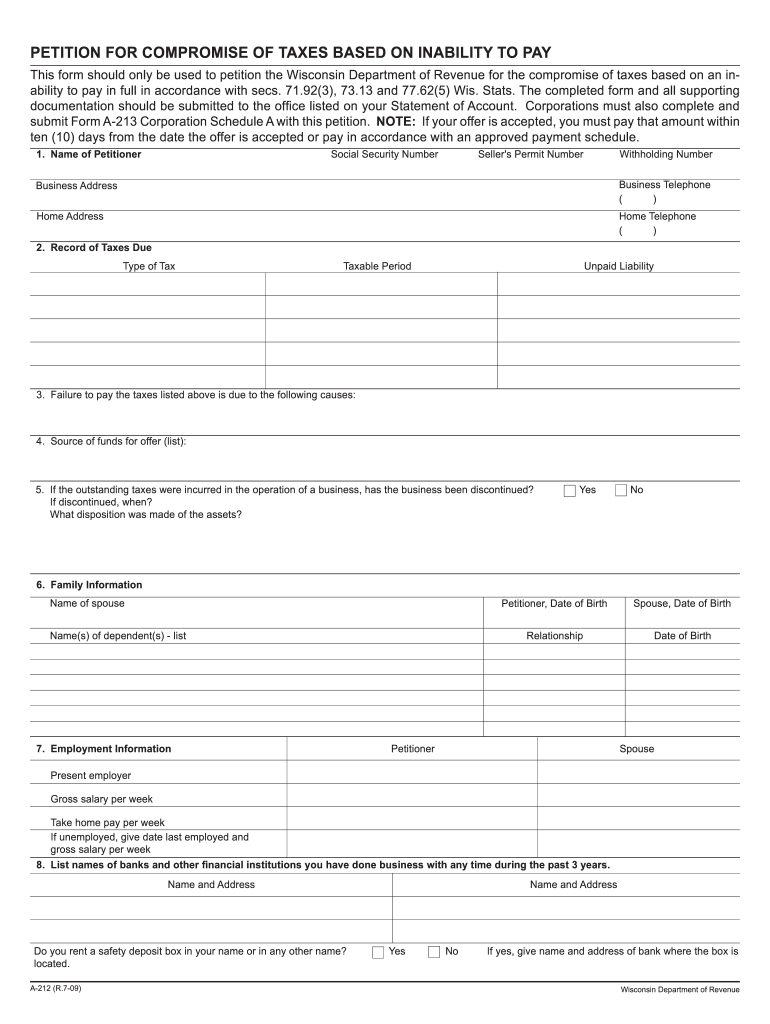

The Wi 212 Form is a specific document used in the state of Wisconsin, primarily related to tax reporting. This form is essential for individuals and businesses to report their income accurately and comply with state tax regulations. It serves as a declaration of income and is a critical component in the overall tax filing process for residents and entities operating within Wisconsin.

How to use the Wi 212 Form

To use the Wi 212 Form effectively, individuals must first ensure they have the correct version of the form, which can typically be obtained from the Wisconsin Department of Revenue's website. Once in possession of the form, users should carefully read the instructions provided to understand the information required. It is important to fill out all sections accurately, providing necessary details such as income sources, deductions, and any applicable credits. After completing the form, it should be submitted according to the guidelines specified by the state.

Steps to complete the Wi 212 Form

Completing the Wi 212 Form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Download or print the Wi 212 Form from the Wisconsin Department of Revenue's website.

- Follow the instructions on the form to fill out your personal information, including your name, address, and Social Security number.

- Report your total income accurately, ensuring that all sources are included.

- Calculate any deductions or credits you may be eligible for, as these can significantly impact your tax liability.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Wi 212 Form

The legal use of the Wi 212 Form is governed by state tax laws and regulations. It is essential for individuals and businesses to understand that submitting this form accurately is not only a matter of compliance but also a legal obligation. Failure to complete and submit the form correctly can result in penalties, including fines and interest on unpaid taxes. Therefore, ensuring that the form is filled out in accordance with the law is crucial for maintaining good standing with the Wisconsin Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Wi 212 Form are critical for taxpayers to observe. Typically, the form must be submitted by April 15th of the following year for individual filers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable for taxpayers to mark their calendars and prepare their documents in advance to avoid any last-minute issues.

Form Submission Methods (Online / Mail / In-Person)

The Wi 212 Form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file online through the Wisconsin Department of Revenue's e-filing system, which is often the quickest method. Alternatively, the form can be mailed to the appropriate address provided in the instructions. For those who prefer in-person submissions, visiting a local Department of Revenue office may also be an option, although this is less common. Each method has its own processing times and requirements, so it is essential to choose the one that best fits your needs.

Quick guide on how to complete wi 212 2009 form

Effortlessly Prepare Wi 212 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Wi 212 Form on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Modify and eSign Wi 212 Form with Ease

- Locate Wi 212 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Wi 212 Form to ensure efficient communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wi 212 2009 form

Create this form in 5 minutes!

How to create an eSignature for the wi 212 2009 form

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Wi 212 Form and how is it used?

The Wi 212 Form is a tax form used by businesses in Wisconsin for reporting income and expenses. It is essential for accurate tax filing and helps ensure compliance with state regulations. Understanding the Wi 212 Form is crucial for any business operating in Wisconsin.

-

How can airSlate SignNow assist with the Wi 212 Form?

airSlate SignNow allows businesses to easily send, eSign, and manage their Wi 212 Form digitally. With our user-friendly platform, you can streamline the signing process, ensuring that your documents are processed efficiently. This reduces paperwork and speeds up your filing process.

-

What features does airSlate SignNow offer for the Wi 212 Form?

airSlate SignNow offers features such as document templates, eSignature authentication, and secure file sharing specifically for forms like the Wi 212 Form. You can customize your templates to match your business needs, making the filing process straightforward and efficient. These features enhance document management and ensure accuracy.

-

Is airSlate SignNow cost-effective for handling the Wi 212 Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the Wi 212 Form. Our pricing plans are designed to cater to businesses of all sizes, allowing you to save on printing and mailing costs while benefiting from a robust e-signature platform. Try our service and see how it can streamline your tax documentation.

-

Can I integrate airSlate SignNow with other software for the Wi 212 Form?

Absolutely! airSlate SignNow offers integrations with various popular software platforms, making it easy to manage your Wi 212 Form alongside your other tools. Whether you use accounting software or CRM systems, you can connect seamlessly and enhance your workflow.

-

What are the benefits of using airSlate SignNow for the Wi 212 Form?

Using airSlate SignNow for the Wi 212 Form provides numerous benefits, including enhanced security, improved efficiency, and easier document tracking. Our platform ensures that your sensitive information is protected while allowing for quick access and storage of essential tax documents. You'll save time and reduce errors in your filings.

-

Is there customer support available for questions about the Wi 212 Form?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions regarding the Wi 212 Form. Our knowledgeable team is available to help guide you through the process, ensuring you have the information you need to complete your form correctly. signNow out anytime for assistance.

Get more for Wi 212 Form

Find out other Wi 212 Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document