February a 212 Petition for Compromise of Taxes Based on Inability to Pay 2020-2026

Understanding the A 212 Petition for Compromise of Taxes

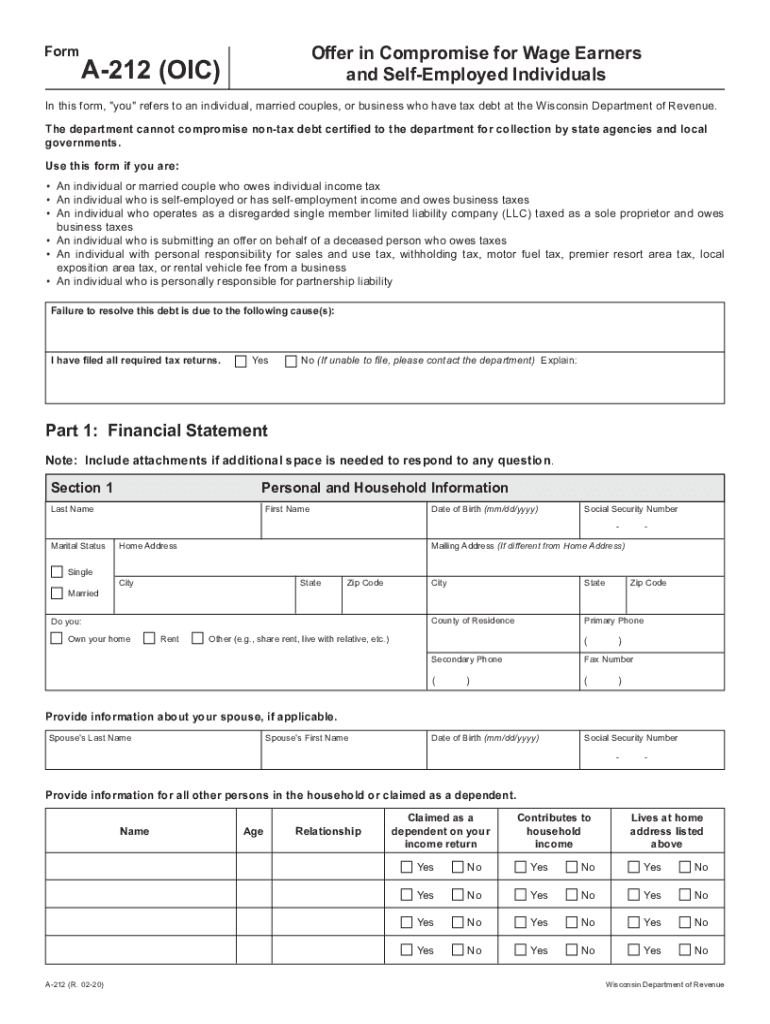

The A 212 Petition for Compromise of Taxes is a legal document used by taxpayers in Wisconsin who are experiencing financial hardship and are unable to pay their tax liabilities. This petition allows individuals to request a reduction of their tax debt based on their inability to pay. It is essential to understand the specific criteria and requirements that must be met for the petition to be considered valid and effective.

Steps to Complete the A 212 Petition for Compromise of Taxes

Completing the A 212 Petition involves several steps to ensure accuracy and compliance with state regulations. First, gather all necessary financial documents that demonstrate your inability to pay, such as income statements, bank statements, and any relevant expense documentation. Next, fill out the A 212 form carefully, providing detailed information about your financial situation. It is crucial to be honest and thorough, as any discrepancies may lead to rejection of the petition. Finally, review the form for completeness and accuracy before submission.

Eligibility Criteria for the A 212 Petition

To be eligible for the A 212 Petition for Compromise of Taxes, taxpayers must demonstrate a genuine inability to pay their tax obligations. This typically includes showing that their income is insufficient to cover basic living expenses while also meeting tax liabilities. Additionally, the petition may require proof of any significant financial hardships, such as medical expenses, job loss, or other unforeseen circumstances that impact financial stability.

Required Documents for the A 212 Petition

When submitting the A 212 Petition, certain documents are required to support your claim of financial hardship. These may include:

- Proof of income, such as pay stubs or tax returns

- Bank statements for the past few months

- Documentation of monthly expenses, including rent, utilities, and medical bills

- Any other relevant financial records that illustrate your current financial situation

Having these documents ready will facilitate the review process and improve the chances of a favorable outcome.

Filing Methods for the A 212 Petition

The A 212 Petition can be submitted through various methods, depending on the preferences of the taxpayer. Options typically include:

- Online submission through the appropriate state tax portal

- Mailing the completed form to the designated tax office

- In-person submission at local tax offices, if applicable

Choosing the right submission method can impact the processing time, so it is advisable to consider the most efficient option based on individual circumstances.

Legal Use of the A 212 Petition

The A 212 Petition for Compromise of Taxes is legally binding once approved. It serves as a formal request to the state tax authority to reconsider the amount owed based on the taxpayer's financial situation. Understanding the legal implications of submitting this petition is crucial, as it may affect future tax obligations and the taxpayer's financial standing. It is recommended to consult with a tax professional if there are uncertainties regarding the legal aspects of the petition.

Quick guide on how to complete february 2016 a 212 petition for compromise of taxes based on inability to pay

Effortlessly Prepare February A 212 Petition For Compromise Of Taxes Based On Inability To Pay on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents promptly without any holdups. Handle February A 212 Petition For Compromise Of Taxes Based On Inability To Pay on any device with the airSlate SignNow applications for Android or iOS and streamline any document-based process today.

How to Edit and eSign February A 212 Petition For Compromise Of Taxes Based On Inability To Pay with Ease

- Obtain February A 212 Petition For Compromise Of Taxes Based On Inability To Pay and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign February A 212 Petition For Compromise Of Taxes Based On Inability To Pay and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct february 2016 a 212 petition for compromise of taxes based on inability to pay

Create this form in 5 minutes!

How to create an eSignature for the february 2016 a 212 petition for compromise of taxes based on inability to pay

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is a 212 pdf and why do I need it?

A 212 pdf is a type of document often used for specific forms and legal purposes. Businesses may need a 212 pdf for compliance or record-keeping. By utilizing airSlate SignNow, users can easily create, edit, and sign a 212 pdf, streamlining their workflow.

-

How can I create a 212 pdf using airSlate SignNow?

Creating a 212 pdf with airSlate SignNow is simple. You can upload an existing document or start from scratch using our intuitive interface. The platform allows you to customize your 212 pdf to meet your specific needs for signing and sharing.

-

Is airSlate SignNow a cost-effective solution for handling a 212 pdf?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. With features designed for efficiency, using our platform to manage a 212 pdf can save costs compared to traditional document handling methods.

-

What features does airSlate SignNow offer for managing a 212 pdf?

airSlate SignNow provides multiple features for effectively managing a 212 pdf, including electronic signatures, document editing, and secure sharing options. These tools make it easier to collaborate and ensure that your documents are legally binding.

-

Can I integrate airSlate SignNow with other applications for handling a 212 pdf?

Yes, airSlate SignNow has seamless integration capabilities with various applications. This includes popular platforms such as Google Drive and Microsoft Office, which makes managing a 212 pdf even more streamlined within your business processes.

-

What benefits can I expect from using airSlate SignNow for a 212 pdf?

Using airSlate SignNow to manage a 212 pdf provides numerous benefits, including enhanced efficiency, reduced turnaround times for document signing, and improved accuracy. With our platform, businesses can focus on core tasks without being bogged down by paperwork.

-

Is it safe to eSign a 212 pdf using airSlate SignNow?

Yes, signing a 212 pdf with airSlate SignNow is completely secure. We employ advanced encryption and security protocols to ensure that your documents and signatures are protected from unauthorized access.

Get more for February A 212 Petition For Compromise Of Taxes Based On Inability To Pay

- Transfer superior court form

- Wpf uh 080200 order transferring case and setting hearing ortr washington form

- Deferred prosecution agreement form

- Notice to real property lender corporation or llc washington form

- Washington disclaimer form

- Washington conditional form

- Quitclaim deed wife form

- Warranty deed from husband and wife to corporation washington form

Find out other February A 212 Petition For Compromise Of Taxes Based On Inability To Pay

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking