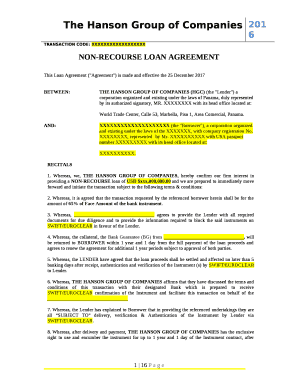

Non Recourse Loan Agreement Sample 2016-2026

What is the non recourse loan agreement sample

A non recourse loan agreement is a financial contract that limits the lender's ability to claim repayment beyond the collateral specified in the agreement. In this type of loan, if the borrower defaults, the lender can seize the collateral but cannot pursue the borrower's other assets. This agreement is particularly useful for borrowers who want to minimize their financial risk. A non recourse loan example typically includes terms outlining the collateral, interest rates, repayment schedules, and the specific circumstances under which the lender can claim the collateral.

Key elements of the non recourse loan agreement sample

Understanding the key elements of a non recourse loan agreement is essential for both borrowers and lenders. Important components include:

- Collateral Description: Clearly defines the asset being used as collateral.

- Loan Amount: Specifies the total amount borrowed.

- Interest Rate: Outlines the rate applied to the loan amount.

- Repayment Terms: Details the schedule and method of repayment.

- Default Clauses: Describes the actions taken if the borrower defaults.

These elements ensure that both parties understand their rights and obligations under the agreement.

Steps to complete the non recourse loan agreement sample

Completing a non recourse loan agreement involves several steps to ensure accuracy and legality:

- Gather Necessary Information: Collect all relevant details about the loan, including borrower and lender information.

- Define Collateral: Clearly identify the asset that will serve as collateral for the loan.

- Outline Terms: Specify the loan amount, interest rate, and repayment schedule.

- Review Default Clauses: Ensure both parties understand the consequences of defaulting on the loan.

- Sign the Agreement: Both parties should sign the document, ideally in the presence of a witness or notary.

Following these steps can help facilitate a smooth agreement process.

Legal use of the non recourse loan agreement sample

The legal validity of a non recourse loan agreement hinges on compliance with state and federal laws. Such agreements must be clear, concise, and include all necessary terms to be enforceable in a court of law. It is advisable for both parties to consult with legal professionals to ensure the agreement meets all legal requirements. Additionally, electronic signatures can be used to execute the agreement, provided they comply with the ESIGN and UETA acts, which recognize the validity of electronic contracts.

Examples of using the non recourse loan agreement sample

Non recourse loans are commonly used in various scenarios, including:

- Real Estate Investments: Investors may use non recourse loans to finance property purchases while protecting their other assets.

- Business Financing: Companies may secure funding with non recourse loans to limit liability in case of business failure.

- Project Financing: Large projects often utilize non recourse loans, where lenders rely solely on project revenue for repayment.

These examples illustrate how non recourse loans can be strategically used to manage risk while securing necessary funding.

Quick guide on how to complete non recourse loan agreement sample

Prepare Non Recourse Loan Agreement Sample effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Non Recourse Loan Agreement Sample on any device using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Non Recourse Loan Agreement Sample with ease

- Locate Non Recourse Loan Agreement Sample and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Non Recourse Loan Agreement Sample and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the non recourse loan agreement sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a non recourse loan agreement?

A non recourse loan agreement is a type of loan where the lender's only remedy in the event of default is to take back the collateral. This means that borrowers are not personally liable beyond the collateral itself. Understanding this agreement is crucial for businesses securing funding without risking personal assets.

-

What are the benefits of a non recourse loan agreement?

The primary benefit of a non recourse loan agreement is the protection it offers borrowers. Since the lender cannot pursue personal assets, businesses can take calculated risks without signNow personal liability. This encourages entrepreneurship and investment in business projects.

-

How does airSlate SignNow facilitate the creation of non recourse loan agreements?

AirSlate SignNow simplifies the process of creating a non recourse loan agreement with customizable templates and an intuitive interface. Users can easily modify loan terms and conditions to fit their specific needs, ensuring that all relevant details are accurately captured. This saves time and reduces the risk of errors.

-

Can I integrate airSlate SignNow with other applications for managing non recourse loan agreements?

Yes, airSlate SignNow offers seamless integration with various applications such as CRM tools and document management systems. This allows users to manage their non recourse loan agreements alongside other business processes efficiently. Integrations enhance workflow and ensure all related documents are accessible in one place.

-

What features does airSlate SignNow provide for non recourse loan agreements?

AirSlate SignNow provides robust features including electronic signatures, document tracking, and customizable templates for non recourse loan agreements. These features streamline the process, improve security, and ensure compliance with legal standards. Users can manage their contracts effectively with these tools.

-

Is airSlate SignNow a cost-effective solution for creating non recourse loan agreements?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With flexible pricing plans, users can choose the option that best fits their budget while accessing essential features for managing non recourse loan agreements. This affordability helps businesses manage their contracts without breaking the bank.

-

How secure is the signing process for non recourse loan agreements with airSlate SignNow?

AirSlate SignNow prioritizes security, using advanced encryption and authentication methods to protect all documents, including non recourse loan agreements. The platform is compliant with international security standards, ensuring that sensitive information remains confidential. This provides peace of mind for businesses and their clients.

Get more for Non Recourse Loan Agreement Sample

Find out other Non Recourse Loan Agreement Sample

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed