Al8453 Form

What is the AL8453?

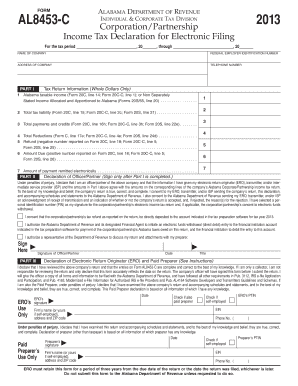

The AL8453 is a partnership declaration form used in Alabama. It is essential for partnerships to report their income, deductions, and credits to the state. This form is crucial for compliance with state tax regulations and helps ensure that partnerships fulfill their tax obligations correctly. By submitting the AL8453, partnerships can accurately disclose their financial information to the Alabama Department of Revenue.

Steps to Complete the AL8453

Completing the AL8453 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense records. Next, fill out the form with the partnership's identifying information, including the name, address, and federal employer identification number (EIN). Carefully report all income, deductions, and credits, ensuring that each entry is accurate and supported by documentation. Once completed, review the form for any errors before submitting it to the appropriate state authority.

Legal Use of the AL8453

The AL8453 serves as a legally binding document when filled out and submitted correctly. It must be signed by an authorized partner to validate the information provided. Compliance with Alabama's tax laws is crucial, as failure to submit the AL8453 can result in penalties or fines. The form is designed to meet the legal requirements set forth by the state, ensuring that partnerships can operate within the law while fulfilling their tax responsibilities.

How to Obtain the AL8453

The AL8453 can be obtained from the Alabama Department of Revenue's official website or through authorized tax professionals. It is available in a printable format, allowing partnerships to fill it out by hand or electronically. For those who prefer digital solutions, the form can also be completed using eSignature platforms, which streamline the process and enhance security. Ensure that you have the most current version of the form to avoid any compliance issues.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines for the AL8453 to ensure timely submission. Typically, the form is due on the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. It is important to mark these dates on your calendar to avoid late fees and penalties associated with non-compliance.

Required Documents

To complete the AL8453 accurately, partnerships should gather several key documents. These include financial statements, previous tax returns, and any supporting documentation for income and deductions claimed. Having these documents readily available will facilitate a smoother completion process and help ensure that all information reported is accurate and verifiable.

Quick guide on how to complete al8453

Effortlessly prepare Al8453 on any device

The management of documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you require to swiftly create, modify, and eSign your documents without any delays. Manage Al8453 on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and eSign Al8453 effortlessly

- Obtain Al8453 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your updates.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the al8453

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the AL8453 print feature in airSlate SignNow?

The AL8453 print feature in airSlate SignNow allows users to easily print signed documents directly from the platform. This ensures that you can keep physical records of all your important agreements without any hassle. The feature is designed to be user-friendly, streamlining your document management process.

-

How does pricing work for the AL8453 print option?

Pricing for the AL8453 print feature is included in the overall subscription plans for airSlate SignNow. These plans are competitively priced, providing excellent value for features offered. To ensure you find the best fit for your business needs, we recommend reviewing the different subscription options available.

-

What are the benefits of using airSlate SignNow's AL8453 print feature?

Using the AL8453 print feature offers several benefits including seamless integration with your existing workflows and the ability to maintain physical copies of eSigned documents. Additionally, it enhances your document security since you can print only completed agreements. This makes your business processes more efficient and organized.

-

Can I integrate the AL8453 print feature with other software?

Yes, the AL8453 print feature can be easily integrated with a variety of other applications. airSlate SignNow supports integrations with popular tools such as Google Drive, Dropbox, and various CRM systems. This versatility allows for a more customized document management experience.

-

Is there a mobile option for the AL8453 print function?

Absolutely! The AL8453 print feature in airSlate SignNow is accessible through mobile devices. This flexibility allows users to handle their documents on-the-go and print them whenever needed, making it a convenient choice for busy professionals.

-

How secure is the AL8453 print option in airSlate SignNow?

The AL8453 print feature prioritizes security by employing industry-standard encryption to protect your documents. This ensures that only authorized users can access and print sensitive information. airSlate SignNow takes document security seriously, providing peace of mind for your business.

-

What types of documents can I print using the AL8453 print feature?

You can print a variety of document types using the AL8453 print feature in airSlate SignNow, including contracts, agreements, and other important forms. The platform supports various file formats, ensuring you can easily print whatever you need. The process is straightforward, minimizing time spent on document preparation.

Get more for Al8453

- Doh 5198 form

- Combustion reactions chem worksheet 10 5 answer key form

- Michigan pistol purchase form

- Dhs 9042 form

- All star segment 2 contract form

- Confluence preview of pdf files shows error please wait if form

- Cr 170 notification of decision whether tochallenge recommendation pen code2972 1 form

- H m treasury help to buy isa scheme rules tisa form

Find out other Al8453

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney