Dr418 Form

What is the Dr418 Form

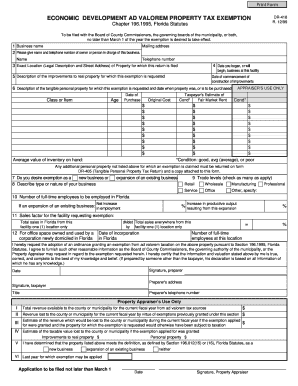

The Dr418 form, also known as the Economic Development Ad Valorem Tax Exemption Application, is a crucial document used by businesses in Florida to apply for property tax exemptions related to economic development. This form allows eligible companies to seek exemptions on ad valorem property taxes, which can significantly reduce their financial burden and encourage investment in local economies. The application is designed to assess whether a business meets the criteria set forth by the state for economic development initiatives.

Steps to Complete the Dr418 Form

Completing the Dr418 form requires careful attention to detail to ensure compliance with state regulations. Here are the essential steps involved:

- Gather necessary documentation, including financial statements and proof of business operations.

- Fill out the form with accurate information regarding the business's ownership, location, and the nature of the economic development project.

- Provide details about the anticipated benefits of the project, such as job creation and capital investment.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the appropriate local property appraiser's office by the specified deadline.

Eligibility Criteria

To qualify for the economic development property tax exemption using the Dr418 form, businesses must meet specific eligibility criteria. These may include:

- Establishing a physical presence in Florida.

- Demonstrating a commitment to job creation and capital investment.

- Operating within a designated economic development zone or area.

- Meeting any additional local requirements set by the county or municipality.

Legal Use of the Dr418 Form

The legal use of the Dr418 form is governed by Florida statutes and regulations regarding property tax exemptions. It is essential for applicants to understand that incomplete or inaccurate submissions can lead to denial of the exemption. The form must be used in accordance with the guidelines provided by the Florida Department of Revenue and local property appraisers to ensure that the application is processed correctly and legally.

Form Submission Methods

Businesses can submit the Dr418 form through various methods to accommodate different preferences. These methods include:

- Online submission via the local property appraiser's website, if available.

- Mailing the completed form to the appropriate property appraiser's office.

- In-person submission at designated local offices for direct assistance.

Who Issues the Form

The Dr418 form is issued by the Florida Department of Revenue, which provides guidelines and resources for businesses seeking economic development property tax exemptions. Local county property appraisers are responsible for processing the applications and determining eligibility based on the submitted information.

Quick guide on how to complete dr418 form

Effortlessly prepare Dr418 Form on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Dr418 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Dr418 Form with ease

- Find Dr418 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools specifically supplied by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Edit and electronically sign Dr418 Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr418 form

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is economic development property tax?

Economic development property tax refers to tax incentives offered to encourage businesses to invest in a specific area. These incentives can signNowly lower the tax burden for companies, promoting growth and job creation. Understanding these benefits is crucial for businesses looking to maximize their investments.

-

How can airSlate SignNow help with economic development property tax documentation?

AirSlate SignNow simplifies the documentation process required for economic development property tax incentives. With easy-to-use eSigning capabilities, businesses can efficiently submit applications and agreements online. This streamlines the overall process, ensuring that companies meet deadlines and requirements.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers several pricing plans designed to accommodate businesses of all sizes. The costs are competitive and provide excellent value, especially for organizations seeking to capitalize on economic development property tax opportunities. Each plan includes essential features to support your document signing needs.

-

Are there any features specifically supporting economic development property tax applications?

Yes, airSlate SignNow includes features tailored to support economic development property tax applications, such as document templates that streamline the submission process. Additionally, real-time tracking and reminders help ensure that deadlines are met, boosting compliance. These features make managing paperwork more efficient and accurate.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow enhances productivity by allowing businesses to eSign documents quickly and securely. The platform also helps organizations leverage economic development property tax incentives effectively, reducing costs and fostering growth. By saving time and money, businesses can focus more on their core objectives.

-

Can airSlate SignNow integrate with other business tools?

Absolutely! AirSlate SignNow offers integration options with various business tools and applications, facilitating seamless workflows. This includes tools that track economic development property tax incentives, enhancing your ability to manage relevant documents efficiently. Integrations help you create a comprehensive system tailored to your operational needs.

-

Is it secure to use airSlate SignNow for sensitive documents related to economic development property tax?

Yes, airSlate SignNow prioritizes security and compliance, making it safe to use for sensitive documents related to economic development property tax. The platform employs advanced encryption and authentication measures to protect your data. You can confidently handle important transactions and agreements without compromising security.

Get more for Dr418 Form

- Metlifebd info my policy form

- Digi sim card replacement form

- Tsw028 form

- Application for declaratory bon form

- City school past papers form

- Restraining order after hearing order of protection ltfite form

- Tr 300 agreement to pay and forfeit bail in installments form

- Cocodoc comcatalogequipment finance agreement18 equipment finance agreement to edit download form

Find out other Dr418 Form

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now