Form 593 C 2019

What is the Form 593 C

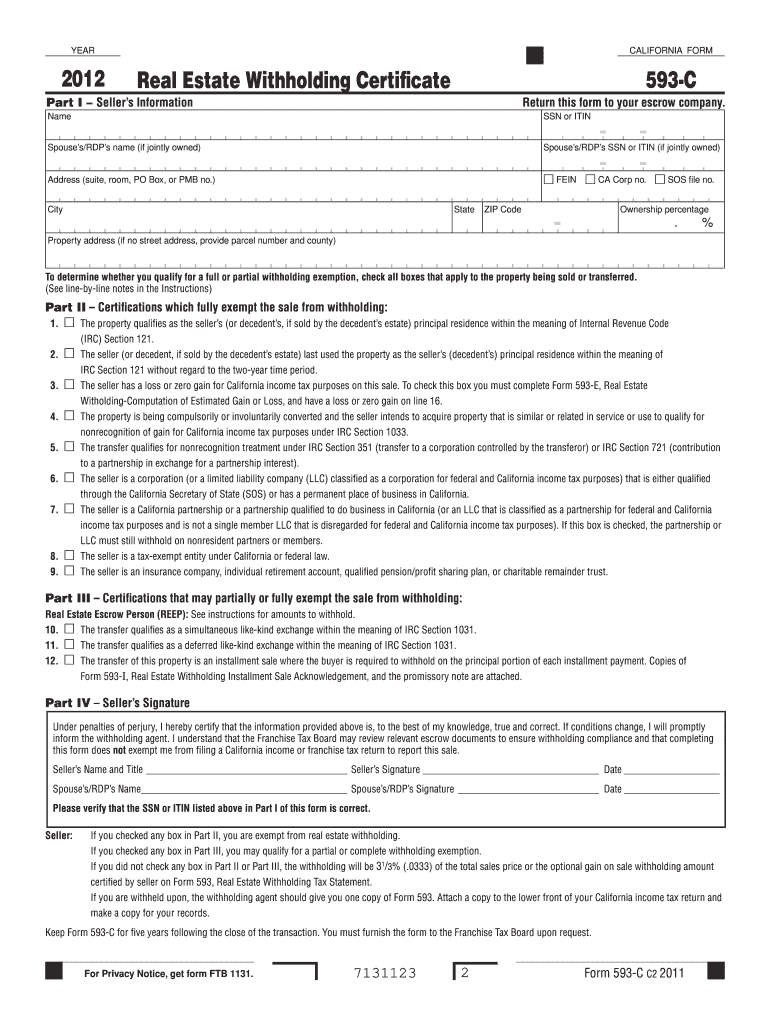

The Form 593 C is a tax form used in the United States, specifically for reporting the sale or transfer of real estate. It is essential for individuals and entities involved in real estate transactions to ensure compliance with state tax regulations. This form helps the California Franchise Tax Board track the withholding of taxes for non-residents who sell real property in California. By providing necessary information about the transaction, the Form 593 C assists in determining any tax liabilities that may arise from the sale.

How to use the Form 593 C

Using the Form 593 C involves several steps to ensure accurate reporting of real estate transactions. First, the seller must complete the form by providing details about the property sold, including the address, sale price, and the buyer's information. It is crucial to include the seller's tax identification number and any relevant withholding amounts. Once filled out, the form must be submitted to the California Franchise Tax Board along with the appropriate payment for any taxes owed. This ensures that all parties involved are compliant with state tax laws.

Steps to complete the Form 593 C

Completing the Form 593 C requires careful attention to detail. Follow these steps:

- Gather necessary information, including the property address, sale price, and buyer's details.

- Fill in the seller's tax identification number and the withholding amount, if applicable.

- Review the form for accuracy, ensuring all required fields are completed.

- Sign and date the form to validate the information provided.

- Submit the completed form to the California Franchise Tax Board, either online or by mail.

Legal use of the Form 593 C

The legal use of the Form 593 C is governed by California tax laws, which require that any sale or transfer of real estate by non-residents must be reported using this form. Failure to submit the form can result in penalties and interest on unpaid taxes. The form serves as a legal document that ensures compliance with state regulations and protects both the buyer and seller in real estate transactions. Properly completing and submitting the Form 593 C is essential for avoiding legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form 593 C are critical for compliance. Typically, the form must be submitted by the due date of the tax return for the year in which the sale occurred. For most taxpayers, this means filing by April 15 of the following year. However, if the seller is a non-resident, they may need to file earlier to ensure that withholding requirements are met. It is important to check the California Franchise Tax Board's guidelines for any updates or changes to these deadlines.

Required Documents

To complete the Form 593 C, several documents may be required. These include:

- Proof of sale, such as a purchase agreement or closing statement.

- Identification documents, including the seller's tax identification number.

- Any prior tax returns that may affect the withholding amount.

- Documentation of any exemptions or deductions that may apply to the transaction.

Who Issues the Form

The Form 593 C is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering California's tax laws and ensuring compliance among taxpayers. They provide guidance on how to fill out the form and the necessary steps for submission. Additionally, the FTB offers resources and support for individuals and businesses navigating real estate transactions and tax obligations in California.

Quick guide on how to complete 2012 form 593 c

Accomplish Form 593 C seamlessly on any device

Virtual document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow offers all the resources you need to create, edit, and eSign your documents quickly without issues. Manage Form 593 C on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form 593 C effortlessly

- Find Form 593 C and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your delivery method for your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 593 C and ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 593 c

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 593 c

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is Form 593 C?

Form 593 C is a document used for California real estate withholding. It provides necessary information to the Franchise Tax Board when a buyer purchases property from a seller who is a non-resident. Using airSlate SignNow, you can streamline the process of completing and eSigning Form 593 C efficiently.

-

How does airSlate SignNow facilitate the use of Form 593 C?

airSlate SignNow allows users to easily prepare, send, and eSign Form 593 C online. Its intuitive interface simplifies document management, ensuring that users can quickly complete required fields and securely share the form with relevant parties. This enhances the efficiency of handling real estate transactions.

-

What are the pricing options for using airSlate SignNow with Form 593 C?

airSlate SignNow offers flexible pricing plans to suit different business needs, including options for individual users and teams. Each plan includes features that enhance the use of Form 593 C, such as unlimited document signing and templates. Visit our pricing page to find a plan that fits your requirements.

-

Can I save templates for Form 593 C in airSlate SignNow?

Yes, airSlate SignNow allows you to save templates for Form 593 C. This feature enables you to reuse the form without having to fill it out from scratch each time, making document management much more efficient. You can customize templates according to your specific needs.

-

Is airSlate SignNow secure for eSigning Form 593 C?

Absolutely! airSlate SignNow prioritizes security and complies with industry regulations to ensure that your eSigned Form 593 C is protected. We utilize encryption and secure storage solutions to safeguard your data, giving you peace of mind while handling sensitive documents.

-

What integrations does airSlate SignNow offer for Form 593 C?

airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and Microsoft Office. This allows you to import or export Form 593 C effortlessly, enhancing your workflow and making it easier to manage your real estate documents alongside other tools you use.

-

How can airSlate SignNow help in tracking Form 593 C status?

With airSlate SignNow, you can track the status of your Form 593 C in real-time. You'll receive notifications when the document is viewed, signed, or if any actions are required, ensuring that you stay informed throughout the process. This helps you manage deadlines effectively.

Get more for Form 593 C

Find out other Form 593 C

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template