Ca Form 593 2017

What is the Ca Form 593

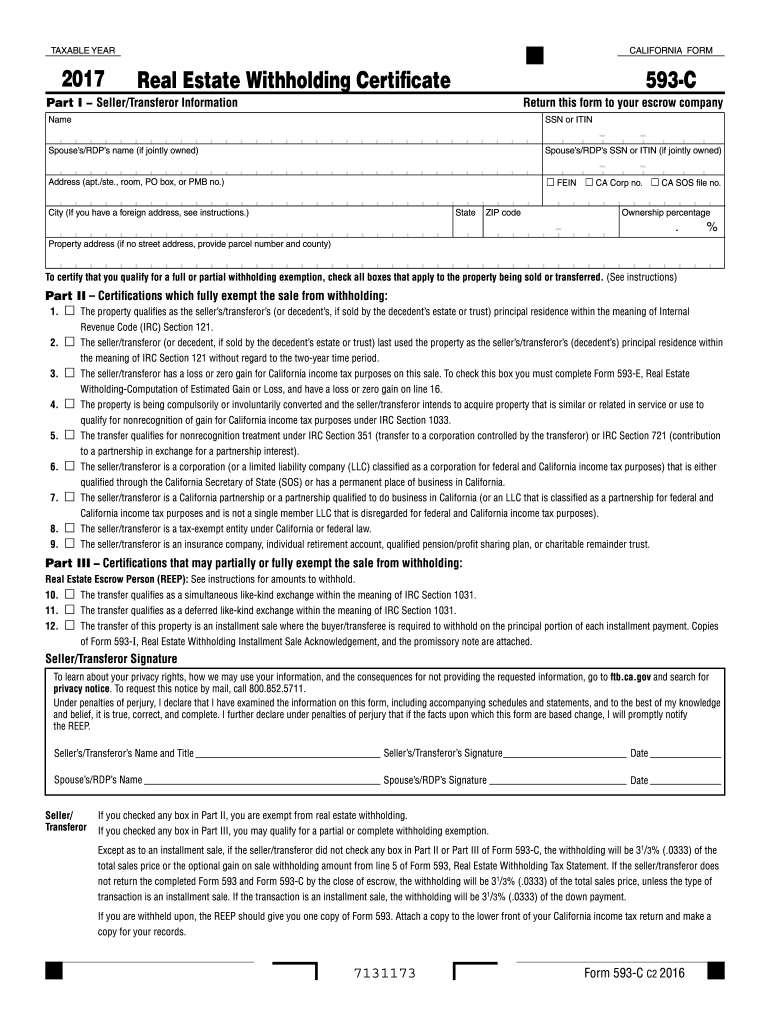

The Ca Form 593 is a tax form used in California for reporting withholding on payments made to non-residents. This form is essential for businesses and individuals who make payments to non-residents, as it ensures compliance with state tax regulations. The form collects information about the payer, the payee, and the amount withheld, allowing the California Franchise Tax Board to track and manage tax obligations effectively.

How to use the Ca Form 593

To use the Ca Form 593, you must first determine if you are required to withhold taxes on payments made to non-residents. If applicable, complete the form by providing necessary details such as the names and addresses of both parties, the type of payment, and the amount withheld. After filling out the form, you must submit it to the California Franchise Tax Board along with the payment of the withheld taxes. Ensure that you keep a copy of the completed form for your records.

Steps to complete the Ca Form 593

Completing the Ca Form 593 involves several key steps:

- Gather necessary information, including payer and payee details.

- Identify the type of payment being made to the non-resident.

- Calculate the amount to be withheld based on the applicable tax rate.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors before submission.

- Submit the form and payment to the California Franchise Tax Board.

Legal use of the Ca Form 593

The Ca Form 593 is legally mandated for use when making payments to non-residents that are subject to withholding in California. Failure to use this form correctly can result in penalties and interest on unpaid taxes. It is crucial to adhere to state guidelines and ensure that all information provided on the form is accurate and complete to avoid legal complications.

Key elements of the Ca Form 593

Key elements of the Ca Form 593 include:

- Payer Information: Name, address, and taxpayer identification number of the payer.

- Payee Information: Name, address, and taxpayer identification number of the non-resident payee.

- Payment Details: Type of payment and amount subject to withholding.

- Withholding Amount: Total amount withheld from the payment, calculated according to state tax rates.

Form Submission Methods

The Ca Form 593 can be submitted through various methods, including:

- Online Submission: Many users opt for electronic filing through the California Franchise Tax Board's online portal.

- Mail: The completed form can be mailed to the appropriate address provided by the California Franchise Tax Board.

- In-Person: Some may choose to deliver the form in person at designated tax office locations.

Quick guide on how to complete ca form 593 2017

Your assistance manual on how to prepare your Ca Form 593

If you're curious about how to generate and submit your Ca Form 593, here are some brief guidelines on how to simplify tax declaration.

To begin, you only have to set up your airSlate SignNow profile to change your approach to online documentation. airSlate SignNow is an extremely user-friendly and robust document solution that allows you to adjust, draft, and finalize your tax papers effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to modify responses as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to finalize your Ca Form 593 in just a few minutes:

- Establish your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Obtain form to launch your Ca Form 593 within our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Use the Sign Tool to append your legally-recognized eSignature (if needed).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Be aware that filing physically can increase errors in returns and postpone refunds. And of course, before electronically filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ca form 593 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the ca form 593 2017

How to create an eSignature for your Ca Form 593 2017 in the online mode

How to generate an eSignature for the Ca Form 593 2017 in Chrome

How to generate an eSignature for putting it on the Ca Form 593 2017 in Gmail

How to create an eSignature for the Ca Form 593 2017 from your smart phone

How to make an electronic signature for the Ca Form 593 2017 on iOS

How to make an eSignature for the Ca Form 593 2017 on Android OS

People also ask

-

What is Ca Form 593 and why is it important?

Ca Form 593 is a crucial tax form used by the state of California for withholding on real estate transactions. Understanding how to properly complete and file Ca Form 593 is essential for real estate professionals to ensure compliance and avoid penalties. Using airSlate SignNow can simplify this process by allowing you to eSign and manage documents efficiently.

-

How can airSlate SignNow help with Ca Form 593?

airSlate SignNow provides a user-friendly platform for filling out and eSigning Ca Form 593. Our solution allows you to easily upload the form, fill in the necessary details, and send it for signatures—all in one integrated process. This streamlines the handling of important tax documents, ensuring you stay organized and compliant.

-

Is airSlate SignNow cost-effective for managing Ca Form 593?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling Ca Form 593 and other documents. With flexible pricing plans, you can choose a package that fits your business needs without overspending. Our platform helps reduce printing and mailing costs associated with traditional document processes.

-

What features does airSlate SignNow offer for handling Ca Form 593?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and secure storage specifically for managing Ca Form 593. You can also track document status in real-time, ensuring that all parties are kept up to date. These features enhance efficiency in handling tax documents.

-

Can I integrate airSlate SignNow with other tools for processing Ca Form 593?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to incorporate tools you already use into your workflow for Ca Form 593. This integration helps streamline your processes, making it easier to manage documents and share data across platforms.

-

What are the benefits of using airSlate SignNow for Ca Form 593?

Using airSlate SignNow for Ca Form 593 offers numerous benefits, including time savings, increased accuracy, and enhanced compliance. Our platform eliminates the need for physical paperwork, reducing errors and ensuring that your forms are filed correctly and on time. This helps you focus on your core business activities.

-

Is airSlate SignNow secure for handling sensitive documents like Ca Form 593?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Ca Form 593 and other sensitive documents are protected. Our platform uses advanced encryption and secure cloud storage, so you can rest assured that your data is safe from unauthorized access. Compliance with industry standards is a top priority.

Get more for Ca Form 593

- Wwwbstaterhcorgb american registry of radiologic form

- Fpl claim form

- Reno livestock events center bvisitrenotahoecomb form

- Trunk or treat registration form littleton massachusetts littletonma

- Enrollment verification request saba university school of medicine saba form

- Official transcript request kalamazoo valley community college kvcc form

- Barring notice oag oag dc form

- Credit card authorization form marriott aft aft

Find out other Ca Form 593

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast