Instructions 199 Form 2010

What is the Instructions 199 Form

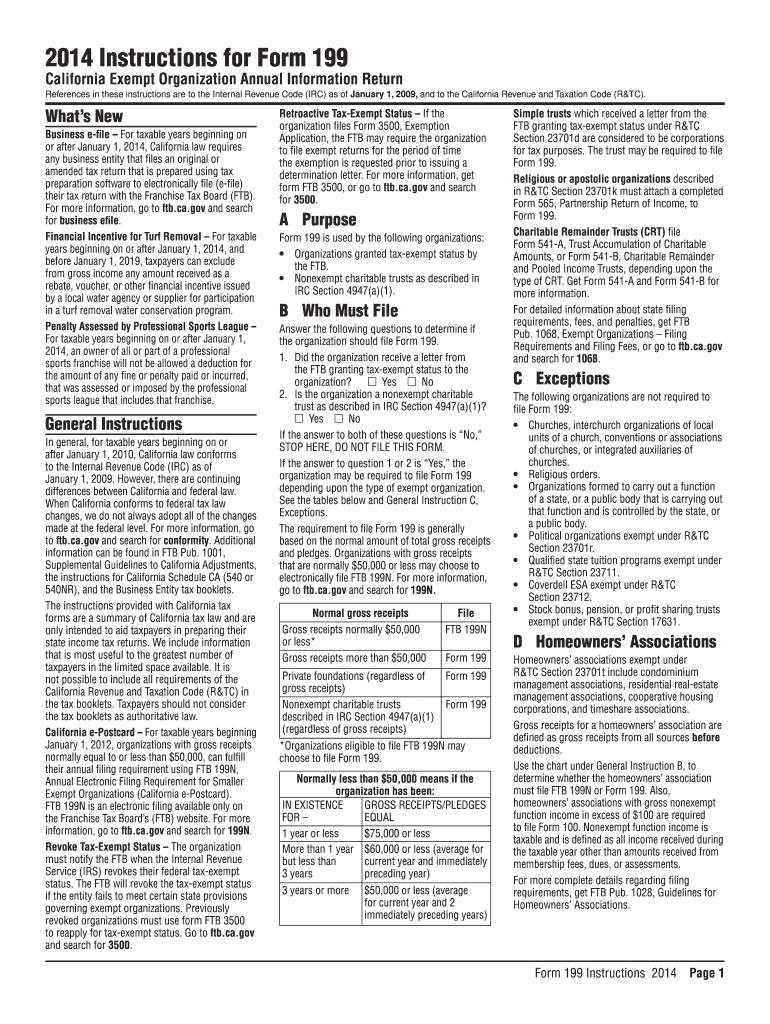

The Instructions 199 Form is a document provided by the Internal Revenue Service (IRS) that outlines the guidelines for completing and submitting Form 199. This form is primarily used by certain tax-exempt organizations to report their financial activities and ensure compliance with federal tax regulations. Understanding the purpose and requirements of the Instructions 199 Form is essential for organizations aiming to maintain their tax-exempt status while fulfilling their reporting obligations.

How to use the Instructions 199 Form

Using the Instructions 199 Form involves several key steps to ensure accurate completion. First, organizations should carefully read through the instructions provided to understand the specific requirements for their financial reporting. Next, gather all necessary financial documents and data that will be needed to fill out the form accurately. Once the data is compiled, follow the step-by-step guidance in the instructions to complete the form, ensuring that all information is correct and complete before submission.

Steps to complete the Instructions 199 Form

Completing the Instructions 199 Form requires a systematic approach. Here are the essential steps:

- Review the eligibility criteria to confirm that your organization needs to file.

- Gather relevant financial statements, including income statements and balance sheets.

- Fill out each section of the form according to the provided guidelines, ensuring all figures are accurate.

- Double-check all entries for correctness and completeness.

- Submit the completed form by the designated deadline.

Legal use of the Instructions 199 Form

The legal use of the Instructions 199 Form is crucial for maintaining compliance with IRS regulations. Organizations must ensure that they follow the guidelines outlined in the instructions to avoid penalties or issues with their tax-exempt status. Proper use of the form helps demonstrate transparency and accountability in financial reporting, which is essential for organizations operating under tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions 199 Form are critical for organizations to adhere to in order to avoid penalties. Typically, the form must be submitted annually, with the deadline falling on the fifteenth day of the fifth month after the end of the organization's fiscal year. Organizations should mark this date on their calendars and ensure that all necessary documentation is prepared in advance to meet this deadline.

Required Documents

To complete the Instructions 199 Form, organizations must gather several required documents. These typically include:

- Financial statements, such as income statements and balance sheets.

- Details of contributions and grants received during the reporting period.

- Records of expenditures and disbursements made by the organization.

- Any additional documentation that supports the figures reported on the form.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting the Instructions 199 Form. The form can typically be submitted online through the IRS e-filing system, which is often the fastest method. Alternatively, organizations may choose to mail a paper copy of the form to the appropriate IRS address. In-person submission may be possible in certain circumstances, but it is generally less common. Organizations should select the method that best suits their needs while ensuring compliance with IRS submission guidelines.

Quick guide on how to complete 2014 instructions 199 form

Complete Instructions 199 Form effortlessly on any device

Digital document management is gaining traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, alter, and eSign your documents swiftly without any delays. Handle Instructions 199 Form on any device using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest method to modify and eSign Instructions 199 Form without hassle

- Find Instructions 199 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or redact sensitive information with the tools available from airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Modify and eSign Instructions 199 Form and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 instructions 199 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 instructions 199 form

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Instructions 199 Form?

The Instructions 199 Form is a specific document used for various legal and business purposes. It provides guidance on filling out the form correctly to ensure compliance and facilitates smooth transactions. Understanding its structure and requirements is vital for anyone dealing with legal documentation.

-

How can airSlate SignNow help with the Instructions 199 Form?

airSlate SignNow offers a streamlined platform to eSign the Instructions 199 Form quickly and securely. Our solution ensures that all fields are correctly filled, reducing the chances of errors and ensuring compliance with legal standards. With intuitive features, completing this form becomes hassle-free.

-

Is there a cost associated with using airSlate SignNow for the Instructions 199 Form?

Yes, airSlate SignNow provides various pricing plans to cater to different business needs. Our pricing is competitive, especially considering the efficiency and time-saving features we offer for tasks such as handling the Instructions 199 Form. Check our website for detailed pricing information.

-

Are there any integrations available for the Instructions 199 Form?

airSlate SignNow seamlessly integrates with various applications and software that businesses already use, making it easier to manage the Instructions 199 Form. Our platform connects with tools like Google Drive, Dropbox, and more, enhancing document management and collaboration. Explore our integrations to see how we can fit into your existing workflow.

-

What are the benefits of using airSlate SignNow for the Instructions 199 Form?

Using airSlate SignNow for the Instructions 199 Form offers numerous benefits, including faster processing times, enhanced security, and easier tracking of document status. Our solution promotes efficiency, allowing businesses to focus on more important tasks while ensuring all documentation is handled correctly. Enjoy the peace of mind that comes with our reliable eSigning capabilities.

-

Can I save templates for the Instructions 199 Form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and save templates for the Instructions 199 Form. This feature enables quick access and consistent use of the form, eliminating the need to start from scratch each time. Save time and enhance productivity by utilizing our template functionality.

-

Is customer support available for issues related to the Instructions 199 Form?

Yes, airSlate SignNow provides comprehensive customer support for any queries about the Instructions 199 Form. Our team is available via multiple channels to assist you with any questions or issues you may encounter. We're dedicated to ensuring you have a smooth experience with our platform.

Get more for Instructions 199 Form

- The art of persuasion aristotles rhetoric for everybody pdf form

- Cellular respiration crossword puzzle answer key pdf form

- Village of lombard contractor registration form

- Ihss pay stub example 100383466 form

- Form 14 ica sample

- Accessdata ace exam answers form

- Affidavit of unemployment 26350600 form

- Hpd online 11928819 form

Find out other Instructions 199 Form

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy