Form 199 Instructions 2010

What is the Form 199 Instructions

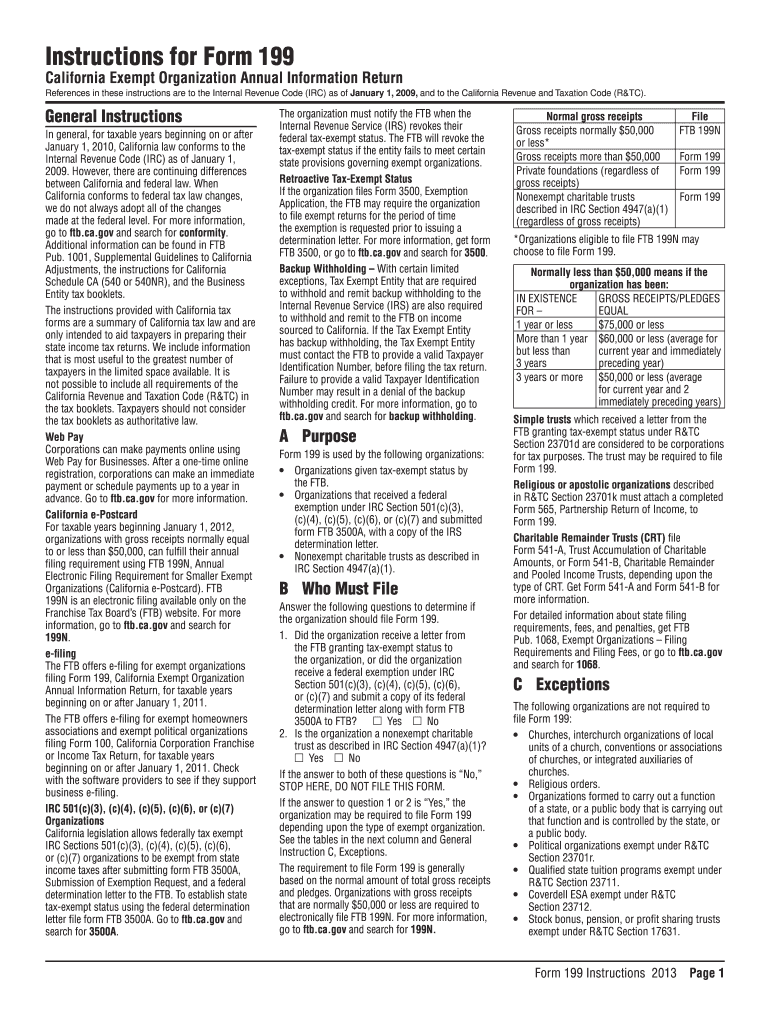

The Form 199 Instructions provide detailed guidance on how to complete and submit Form 199, which is typically used for reporting certain tax information for businesses in the United States. This form is essential for entities that need to report specific financial data to the IRS, ensuring compliance with federal tax regulations. Understanding these instructions is crucial for accurate reporting and avoiding potential penalties.

Steps to complete the Form 199 Instructions

Completing the Form 199 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets. Next, carefully read through the Form 199 Instructions to understand the requirements for each section of the form. Fill out the form methodically, ensuring all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form by the specified deadline to avoid late penalties.

Legal use of the Form 199 Instructions

The legal use of the Form 199 Instructions is governed by federal tax laws. Proper adherence to these instructions ensures that the submitted form is considered valid and binding. Electronic signatures can be used if they comply with the ESIGN Act and UETA, providing the same legal standing as traditional signatures. It is essential to use a reliable eSignature solution that meets these legal requirements, ensuring the integrity of the document.

Filing Deadlines / Important Dates

Filing deadlines for Form 199 can vary depending on the type of entity and fiscal year. Generally, the form must be submitted by the 15th day of the third month following the end of the tax year. For entities operating on a calendar year, this typically means a deadline of March 15 for the previous year’s data. It is important to mark these dates on your calendar to ensure timely submission and avoid any penalties associated with late filings.

Required Documents

To complete the Form 199, several documents are required to provide the necessary financial data. These typically include:

- Income statements

- Balance sheets

- Previous tax returns

- Any supporting documentation for deductions and credits

Having these documents ready will streamline the completion process and help ensure that all information reported is accurate and comprehensive.

Form Submission Methods (Online / Mail / In-Person)

Form 199 can be submitted through various methods, providing flexibility for users. The most common submission methods include:

- Online: Many entities choose to file electronically through approved e-filing systems, which can expedite processing times.

- Mail: Forms can be printed and mailed to the appropriate IRS address, ensuring that the correct postage is applied.

- In-Person: Some individuals may opt to deliver their forms in person at designated IRS offices, which can provide immediate confirmation of receipt.

Choosing the right submission method depends on personal preference and the urgency of processing.

Eligibility Criteria

To use the Form 199, entities must meet specific eligibility criteria. Generally, it is designed for certain types of businesses, including corporations and partnerships, that are required to report their financial activities to the IRS. Understanding these criteria is essential to determine whether your entity qualifies to use this form and to ensure compliance with IRS regulations.

Quick guide on how to complete form 199 instructions 2013

Effortlessly Prepare Form 199 Instructions on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Handle Form 199 Instructions on any platform with the airSlate SignNow applications for Android or iOS and simplify any document-related workflow today.

How to Modify and eSign Form 199 Instructions with Ease

- Locate Form 199 Instructions and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tiresome form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign Form 199 Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 199 instructions 2013

Create this form in 5 minutes!

How to create an eSignature for the form 199 instructions 2013

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What are the key features of airSlate SignNow for managing Form 199 Instructions?

airSlate SignNow offers a user-friendly interface that simplifies the process of managing Form 199 Instructions. Users can easily upload, edit, and send documents for eSignature, streamlining the entire workflow. The platform also includes templates and automated reminders to ensure timely submissions.

-

How can I access Form 199 Instructions through airSlate SignNow?

To access Form 199 Instructions via airSlate SignNow, simply create an account and navigate to the document upload section. You can upload your Form 199 and start utilizing the eSigning features right away. The platform provides clear guidelines to ensure that you can fill out and send the instructions efficiently.

-

What pricing plans does airSlate SignNow offer for users needing Form 199 Instructions?

airSlate SignNow offers various pricing plans that cater to both individual users and businesses needing to manage Form 199 Instructions. There are affordable options to match different needs, and each plan provides access to essential features for document management, including eSigning capabilities. A free trial is also available for new users.

-

Can I integrate airSlate SignNow with other tools for managing Form 199 Instructions?

Yes, airSlate SignNow allows seamless integrations with various third-party applications, enhancing the overall management of Form 199 Instructions. This includes integration with cloud storage services and CRM systems. These integrations simplify data transfer and improve workflow efficiency, making task management easier.

-

What benefits does airSlate SignNow provide for handling Form 199 Instructions?

With airSlate SignNow, users benefit from a streamlined process for handling Form 199 Instructions. The platform enhances productivity by reducing paperwork and accelerating turnaround times for document signing. Additionally, its security features ensure that sensitive documents are protected during the eSigning process.

-

Is it easy to track the status of Form 199 Instructions in airSlate SignNow?

Absolutely! airSlate SignNow features real-time tracking for Form 199 Instructions, allowing users to monitor document status at any stage. You will receive notifications when the document is viewed, signed, or completed, which helps keep your workflow organized and transparent.

-

How does airSlate SignNow ensure the security of my Form 199 Instructions?

airSlate SignNow prioritizes security with advanced encryption protocols to safeguard your Form 199 Instructions. The platform is compliant with industry standards, including GDPR and eIDAS, ensuring that your sensitive information is protected throughout the signing process. Users can confidently manage their documents knowing that security is a top priority.

Get more for Form 199 Instructions

- Golf course budget spreadsheet form

- Calorimetry lab gizmo answers form

- Disability tax form

- Nyc doe forms

- Special support program application form

- 534 e for your protection and privacy please press form

- Xcel energy solarrewards final electrical inspection form

- Architectural control committee submission form lascolinas org

Find out other Form 199 Instructions

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word